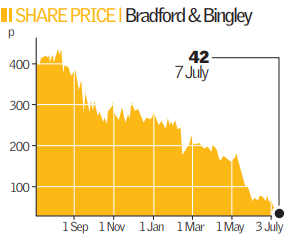

Fears mount for Bradford & Bingley as shares flop

Bradford & Bingley’s stock plunged to an all-time low of 42p yesterday – well below its rights issue price of 55p – as concerns over the troubled lender’s future intensified.

Fears also increased that the lender would issue another profit warning, due to the deepening crisis in the housing market, when it releases the prospectus for its £400m rights issue later this week. Shares in the bank dropped 16 per cent to close at 42p – making it the biggest loser in the FTSE 250 yesterday.

The falls follow B&B’s decision to increase its planned rights issue to £400m after American private equity firm TPG Capital pulled out of buying a 23 per cent stake due to credit rating agency Moody’s downgrading of the bank.

B&B received a further blow when entrepreneur Clive Cowdery made it clear his investment company Resolution was unlikely to attempt to come to the lender’s rescue again.

Resolution had put forward a rival rescue plan, but walked away 10 days ago after B&B refused access to its books.

B&B’s executive chairman Rod Kent has been severely criticised for telling shareholders that the TPG agreement offered a “certainty”, when in fact there was a high probability that a ratings downgrade would allow the private equity firm to pull out.

Analysts at Fox-Pitt, Kelton cut their target price for the stock to 43p, saying the developments were “unequivocal negatives”.

“Our price target assumes that the rights issue does actually complete at the 55p subscription price and that the UK’s Financial Services Authority and the Bank of England ensure the bank does not fail.

“However, we cannot rule out the possibility of an effective failure, with shareholders receiving little or nothing for their shares.” Bruce Packard, an analyst at Pali International, last week reduced his target price for the bank to zero.