FCA orders Wirecard to cease all regulated activities

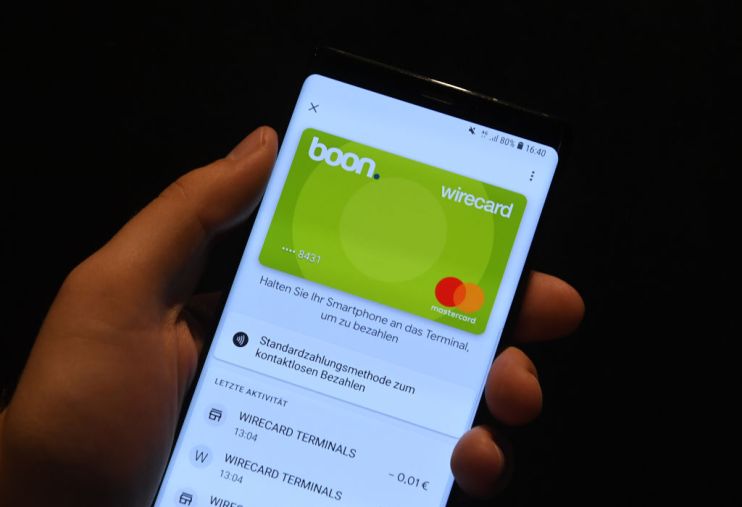

The Financial Conduct Authority has ordered Wirecard to cease all regulated activities after the firm disclosed a €1.9bn financial hole in its accounts.

The watchdog said Wirecard should not dispose of any assets or funds or carry out any regulated activities.

After news of a missing €1.9bn in the company’s accounts, the FCA said it immediately placed requirements on Wirecard’s UK business. This meant it could not pay out or reduce any money it holds for its customers unless they were instructed to do so.

It has now taken the step to instruct the firm to stop all regulated activities and customers money cannot now be accessed.

In a statement the FCA said: “We have been working closely with Wirecard UK and other authorities over the past few days to take action that protects consumers. We are continuing to do this and on 26 June, we took additional measures to require the firm to cease all regulated activities in order to further protect customer money. This now means customers money cannot be accessed.”

It has been a turbulent week for Wirecard after its Frankfurt-listed shares were frozen ahead of management’s decision to file for insolvency.

The firm’s longstanding chief executive Markus Braun resigned last week and was arrested on Monday and released on €5m bail.

He is accused of misrepresenting Wirecard’s accounts and of market manipulation by falsifying income from transactions with so-called third-party acquirers.

This morning, the Financial Times reported that Brussels is calling for a probe into whether Germany’s banking regulator, BaFin, failed in its handling of the firm.

Valdis Dombrovskis, the EU’s executive vice-president in charge of financial services policy, told the FT that he was writing to Europe’s markets supervisor to assess BaFin’s supervision of Wirecard.

He said the bloc should prepare to investigate the regulator for “breach of union law” if the preliminary investigation by the European Securities and Markets Authority discovered faults in BaFin’s approach.