FCA lifts ban on regulated activities of Wirecard UK

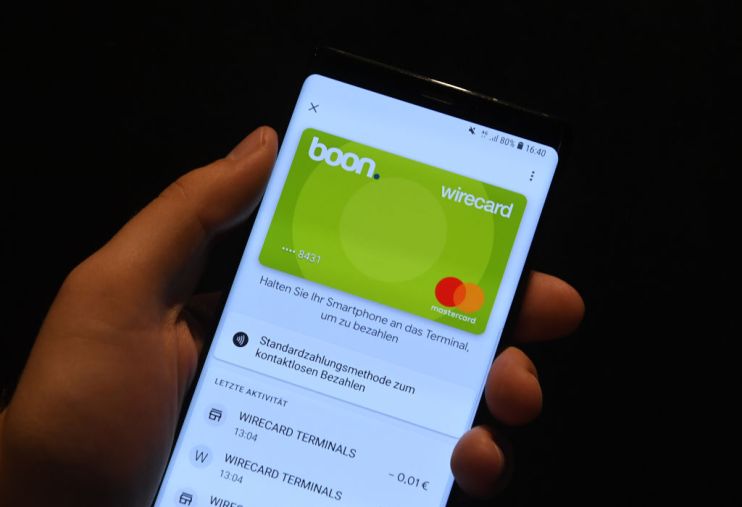

The financial watchdog has lifted a ban on the payment activities of Wirecard’s UK arm, restoring services for millions of customers who were temporarily locked out over the weekend.

In a statement released on Monday night, the FCA said Wirecard UK could resume activity from midnight, meaning customers can “use their cards as usual”.

Last week, the watchdog imposed a number of requirements on Wirecard, instructing the firm to stop all regulated activities, which froze thousands of customers out.

The bulk of Wirecard Solutions customers are based in the UK, via companies such as Pockit, Curve and Anna, which use Wirecard products as part of their digital payments services.

Yesterday the UK subsidiary appointed turnaround firm Alvarez & Marsal in a last-ditch rescue attempt, before the FCA’s announcement.

It came after a turbulent week for the German payment processor firm. Last week it filed for insolvency following the discovery of a €1.9m blackhole in its accounts by its auditors EY.

It triggered the arrest of former boss Markus Braun on suspicion of false accounting and market manipulation. He has now been released on €5m bail.

Dan Scholey, chief operating officer of Moneyhub, said: “The domino effect of the freeze shows that people do not have control over their own money when there is disruption from an external provider.”

“But solutions do exist to combat this risk. Initiation Services (PIS) are a core pillar of Open Banking, that allows people to initiate payments directly from any of their accounts to the right destination, be it another account, a merchant or a friend. Having bank cards as people’s only source of payment must be a thing of the past,” he added.

Get the news as it happens by following City A.M. on Twitter.