Falling mortgage rates to provide support for house prices in 2024

Mortgage rates are set to fall in 2024, providing some support to house prices, as traders bet on the Bank of England would cut interest rates further and faster than expected next year.

Interest rates are expected to fall in the first half of next year after new figures showed that inflation dropped to 3.9 per cent in November, down sharply from 4.6 per cent the month before.

November’s figures came in comfortably below City expectations. Markets now expect the benchmark Bank Rate to fall to four per cent by the end of next year.

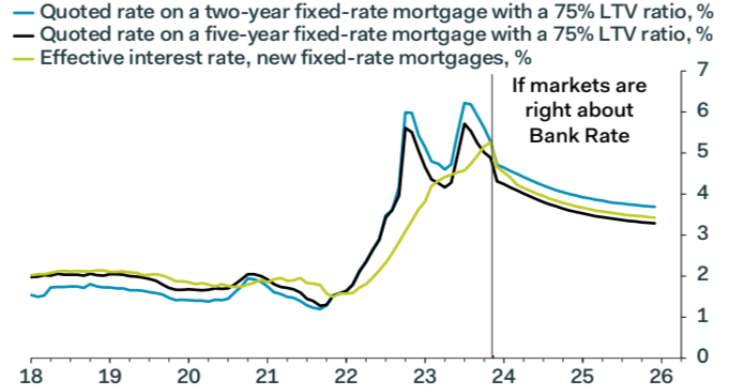

This will have a knock on effect to mortgage holders looking to refinance in the new year. Mortgage rates are influenced by SONIA swap rates – the main interest rate benchmark in sterling markets.

In the last week swap rates on a five year have come down by just over 0.5 per cent. Responding to SWAP rates, the first sub four per cent deals on five-year deals have come onto the market.

Generation Home released a 3.94 per cent five-year fixed deal on Wednesday. Although most lenders have not reduced rates due to the quiet Christmas period, they are expected to dip sharply in the new year.

Taking into account the fall in markets’ expectations for Bank Rate, the average quoted rate for a two-year fixed-rate mortgage with a 75 per cent LTV ratio will drop to about 4.50 per cent by March—the lowest level since September 2022.

“Things are looking incredibly positive at the moment rate wise,” Chris Sykes, technical director at Private Finance said.

This will benefit millions of mortgage holders. Around 1.5m households will roll onto new deals next year, according to AJ Bell.

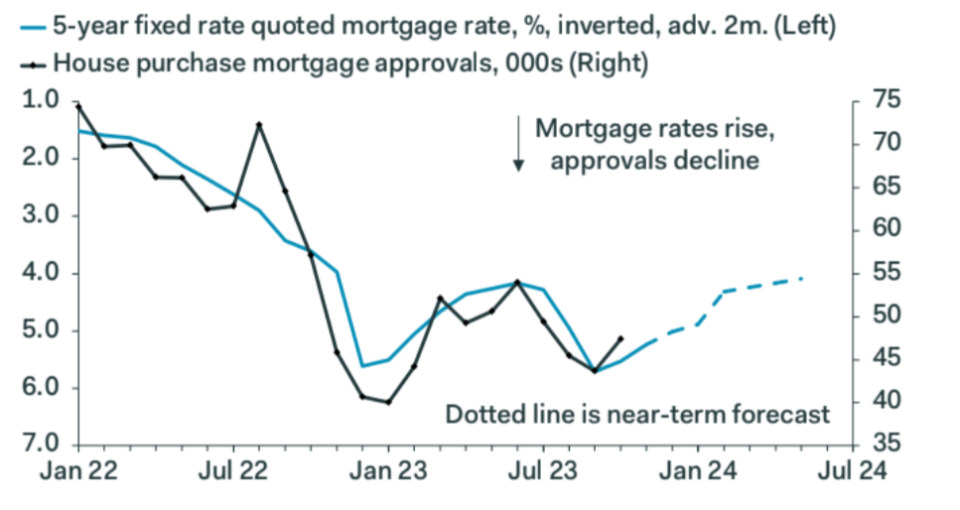

The likely fall in mortgage rates is also likely to offer some support to house prices. According to figures out this week, house prices fell by 1.2 per cent in October, widening from the 0.6 per cent fall recorded in the prior month.

Although analysts at Pantheon Macroeconomics expect house prices to continue falling in the first quarter of next year, easing mortgage rates will then provide a healthy tailwind for the housing market.

“We still expect prices to rise by over five per cent over the final three quarters of 2024, such that they return to their nominal peak at the end of the year,” they said.