Fair regulation would prove to be a bullish thing for cryptocurrency

Whether inside or outside the Metaverse, when you steal from the rich and give to the poor, the economy collapses.

Such flawed economic ideas have had disastrous consequences over the centuries. History is littered with such countries such as Venezuela, Argentina, et al.

When you steal from the poor and give to the rich by printing money, it always ends in revolution, war, or a totalitarian state if history is any guide. There are no exceptions.

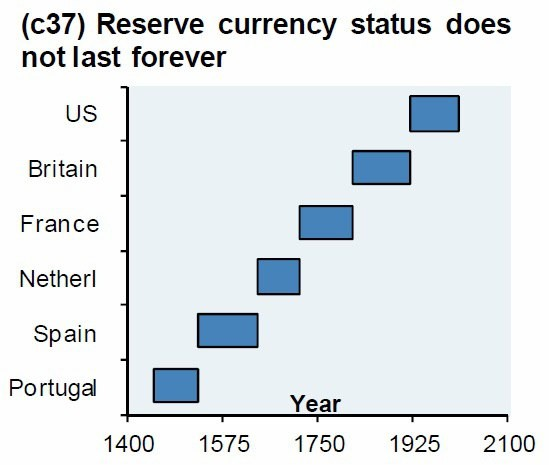

This is why reserve fiat currencies have a limited lifespan. Fortunately, blockchain prevents this from happening within the Metaverse as such colossally “crap” ideals quickly flame out.

In 2008, governments were on the brink of bailing out banks that failed us. Today they are creating central bank digital currencies (CBDCs) to take direct control into every aspect of the economy.

CBDCs are the ultimate fusing of fiscal and monetary policy. So when a government mismanages its fiscal budget, as it always does, it has the monetary power to steal money from its people via an inflationary tax to continue as if there are no consequences.

Imagine seeing your bank account’s rate of interest drop because your credit score or ESG rating falls, maybe because you bought Bitcoin. In China, it is also about social scores. A negative rate of interest would show your bank account losing money each day. Bitcoin is the antidote. Fate it seems is not without its irony.

Bitcoin is decentralised gold

It has been said that Bitcoin is digital gold. Disagree. Gold and the gold standard failed because debts exceeded gold supply for the US government among others. The most recent occurrence was in 1971.

Gold’s failure led to the unilateral cancellation of the direct international convertibility of the US dollar to gold. Fiat then ruled the day because fiat is centralised. Bitcoin meanwhile is decentralized gold. It removes gold’s failures.

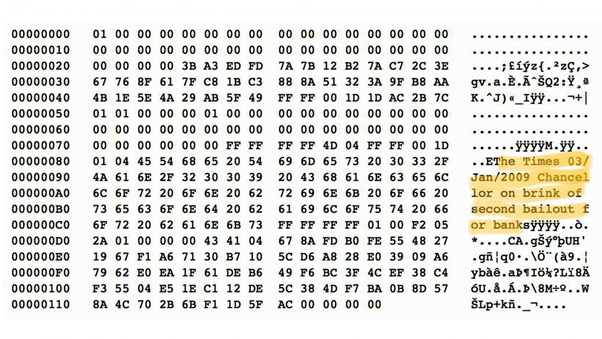

At its inception in 2009, an encoded message in Bitcoin’s code read: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Bitcoin is more relevant today than ever.

2021 is not 2018

While many are saying we will go lower as the bear market is well underway, bringing up 2014 and 2018 as the two prime examples, this negates the metrics which are 180 degrees opposite what they were in both of those years when Bitcoin lost 84% and 87% respectively over about a 12 month period, while alt coins lost between 95% and 100%.

2018 was also riddled with crap coins with deficient business models, much akin to the dot-com bust from 2000-2002. Bear markets drive out the junk while the few gems emerge.

2021 has demonstrated a number of innovative applications of token economics and structure in this cycle so far. To name a few paradigm-shifting technologies, we have the megaton gorillas DeFi and NFTs, but we also have blockchain gaming in the metaverse with the likes of Axie Infinity whose weekly revenues are approaching $100 million and are looking to potentially exceed that of the most profitable traditional multiplayer online games.

As blockchain is the great equaliser, those in developing countries such as the Philippines, Vietnam, and others play Axie Infinity as a primary way to earn income with a number of people quitting their low paying full-time jobs.

Crypto enables a new business model in gaming called play to earn. It allows for an open economy within the game itself that provides financial benefits to the players who participate in the game. The tokens earned can be easily converted into Bitcoin.

We also see the grass roots bootstrapping of global wireless networks such as Helium with hotspot counts and utilisation growing rapidly. While security and privacy were concerns, the network has been built for such concerns. Helium-enabled LoRaWAN devices are hardware-secured to protect user traffic from the utilised spectrum. This means the security is built-in since devices using the network have AES private key encryption at the chip level.

And that’s not all…

DAOs are gaining traction. The number of DAOs have jumped 660% since 2019 but this is just the beginning.

As reported: ShapeShift, a cryptocurrency exchange based in Switzerland, has announced it started dissolving its corporate structure in order to evolve into a fully community-owned decentralised cryptocurrency exchange. The company emphasised in an announcement it is going to open its codebase and technology to the public in the coming months.

“These changes are designed to bring ShapeShift further in line with the true vision of immutable, decentralised finance,” the company added.

As part of the decentralisation process, ShapeShift has airdropped 340 million FOX tokens (out of 1,000,001,337 FOX) to its clients and decentralised finance (DeFi) community. Another 320 million FOX tokens will be airdropped to employees and shareholders. The remaining tokens will be distributed between the Foundation (7.5%), and retained by ShapeShift during decentralization process (1.3%). ShapeShift plans to be fully decentralised with no employees, nor bank accounts by July 2022.

DAOs are outside the control of government unless they shut down the entire internet. But then there are mesh networks which would counter such a move. Same for electrical grids where workaround technologies already exist in the unlikely event of an electrical shutdown.

Regulations?

When it comes to DAOs, regulations will not matter but in the short to intermediate term, there will be a clash as governments try to control the situation, much as the US government tried to do so with the internet back when they held hearings in 1995.

And of course, we all know what happened with Napster, Pirate’s Bay, and the like. The number of users continued to soar despite all the court ordered shut downs of such p2p file sharing sites.

LLCs were a necessary structure so those with innovative ideas could launch without fear of permanent ruin. Sure, one could lose all their assets in the LLC, but all debts would be erased, so one could start over. And, as Elon Musk infamously, said: “Launching a start-up is like staring into the abyss while chewing on broken glass and loving it.”

Within a decade, organisations will transform from the LLC to the DAO. DAOs make it far easier to own assets while participating in the growth of the DAO. With a platform such as Metamask, one can be a shareholder of DAOs such as Shapeshift. This is good for humanity, bad for centralised power structures.

Nevertheless, regulations outside of DAOs are useful as they will help the cryptospace mature for mass adoption by users, companies, and countries. One potential black swan on the horizon depends on how aggressive the US becomes under Yellen’s suggestion to regulate stablecoins. Fair regulations, should they prevail, would be a bullish event for crypto.

(͡:B ͜ʖ ͡:B)

Dr Chris Kacher, bestselling author/top 40 charted musician/PhD nuclear physics UC Berkeley/Record breaking audited accts: stocks+crypto/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr. Kacher bought his first bitcoin at just over $10 in January-2013 and participated in early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in bitcoin since 2011. He was up in 2018 vs the median performing crypto hedge fund at -46% (PwC) and is up quadruple digit percentages since 2019 as capital is force fed into the top performing alt coins while weaker ones are sold.

Virtue of Selfish Investing Crypto Reports

TriQuantum Technologies: Hanse Digital Access

https://twitter.com/VSInvesting/ & https://twitter.com/HanseCoin

https://www.linkedin.com/in/chriskacher/