Facebook libra: Could regulators crush Mark Zuckerberg’s dream cryptocurrency?

Mark Zuckerberg’s decision this summer to launch a digital currency – Facebook libra – sparked the interest and concern of regulators around the world.

Watchdogs have warned that without tight regulations libra could be used for money laundering and financing terrorism. They have also raised concerns over the potential risks it poses to data protection and cyber resilience.

Read more: Why privacy regulators are so concerned about Facebook’s libra

Regulators have come down hard on libra, stressing that the new currency must face strict rules to ensure the stability of the global financial system.

But Facebook is clearly dedicated to making it work.

Just today Facebook launched a bug bounty programme to boost security for the crypto contender. Coders who discover flaws in the software underpinning it can earn up to $10,000 (£8,140).

Given Facebook’s questionable record on privacy, it still faces a battle to win regulatory approval however.

Here we sum up where the major watchdogs stand on Facebook libra – but first we need to understand how it works.

So what is libra, exactly?

Libra is a “global currency and financial infrastructure” powered by Facebook’s version of blockchain – the technology that underpins bitcoin.

The social media giant describes it as a so-called stablecoin, which means it is tied to a fixed asset in order to reduce the kind of volatility seen with bitcoin’s huge fluctuations in value.

While some stablecoins are tied to a single currency, libra is pegged to a group of “low-volatility assets, including bank deposits and government securities” in various currencies.

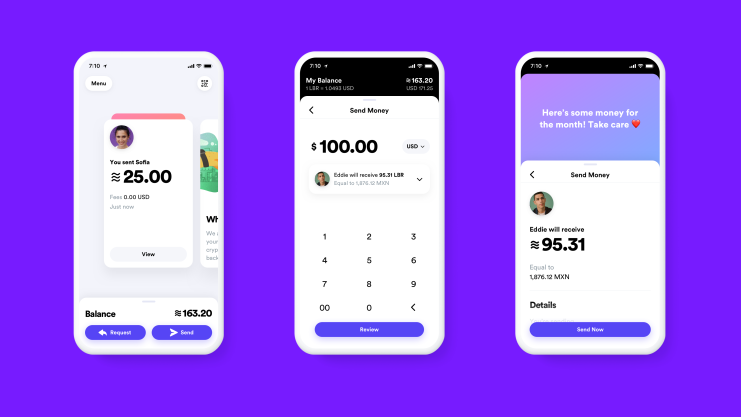

When the currency launches, which is expected to be in 2020, users will be able to download Facebook’s digital wallet app, Calibra, to send libra to other smartphones.

Facebook’s currency will be overseen by the Libra Association – a group of companies that have invested a minimum of $10m into the scheme. This coterie includes other tech and finance giants such as Paypal, Mastercard, Spotify and Uber.

Zuckerberg’s social network said it has created libra to access the millions of “unbanked” people around the world.

However, critics say Facebook is simply looking to tap a new market for monetising its platform and collecting data.

What do global regulators have to say about Facebook libra?

Bank of England

Bank of England governor Mark Carney has said he will keep an “open mind” over the digital currency, but warned that it would face strict regulation if it goes ahead.

“Anything that works in this world will become instantly systemic and will have to be subject to the highest standards of regulations,” he said.

Carney said regulators would look at the “operational resilience” of digital currencies and their anti-money laundering and counter-terrorist financing procedures.

Financial Stability Board

Randal Quarles, the chairman of the Financial Stability Board, said in a briefing to G20 leaders in June that new types of crypto-assets for retail payment purposes “would warrant close scrutiny by authorities to ensure that they are subject to high standards of regulation.”

G7

The G7 group of finance ministers and central bankers said libra and other digital currencies must be regulated as tightly as possible so they do not upset the world’s financial system.

A taskforce led by European Central Bank board member Benoit Coeure reported that stablecoins can effectively bring down the cost of remittances and forms of payment, helping poor people.

However, Coeure said they must be held to the “highest regulatory standards and be subject to prudent supervision and oversight”.

US Congress

David Marcus, the chief executive of libra, was grilled by US policymakers when he appeared in front of the US Financial Services Committee (FSC) and Senate Banking Committee in July.

Maxine Waters, chair of the FSC , said she had “serious concerns” over the proposals.

Other senators raised Facebook’s dubious record on privacy issues as cause for it to reconsider its plans for libra.

“Facebook has demonstrated through scandal after scandal that it doesn’t deserve our trust,” Democratic senator Sherrod Brown said in his opening remarks. “We’d be crazy to give them a chance to let them experiment with people’s bank accounts.”

Marcus, the former president of Paypal, has pledged not to begin issuing libra until all regulatory concerns had been satisfied. “We will take the time to get this right,” he said.

Financial Conduct Authority

Financial Conduct Authority (FCA) chief executive Andrew Bailey has told the Treasury Committee that Facebook “will not walk through authorisation” without deep engagement with regulators.

He added that Facebook and the FCA have already entered discussions on the matter.

“We have already engaged with Facebook and there will be many more engagements. We are waiting to see how the responsibility will divide between Facebook and the other organisation,” Bailey said.

Is Facebook libra actually a cryptocurrency?

There has been some dispute over whether libra is a true cryptocurrency. As mentioned, Facebook’s libra is a stablecoin in order to reduce price volatility.

It is backed up by the Libra Reserve, a mix of various liquid assets to support its value.

Cryptocurrencies like bitcoin were created to avoid reliance on a central bank, so libra’s reliance on these underlying assets and the Libra Association’s control of the currency means it is tied to a cental authority of sorts.

“Is this good for cryptocurrencies as a whole? With regards to international exposure, it’s a positive but that may be where the positives end,” said Temtum founder Richard Dennis.

“With Facebook one of the biggest hoarders of personal data on the planet, there’s a complete contradiction of what cryptocurrencies are meant to be – no one entity should hold the power, the data or most importantly control user funds.”

However, bitcoin surged to its highest level since January 2018 after the announcement sparked a renewed interest in cryptocurrency.

Could privacy concerns derail Facebook libra?

Facebook has weathered a number of privacy breach scandals in recent years, causing critics to question whether the tech giant should be trusted with financial information.

“For Facebook there is the question of trust, or rather the lack of it,” Interactive Investor’s McFarlane said.

Read more: Does Facebook’s libra cryptocurrency pose a global currency threat?

Saga Foundation president Ido Sadeh Man added: “Based on its past endeavours, there is no doubt in Facebook’s ability to engage in such large-scale projects and provide an impeccable user experience.

“However, we are already experiencing the shortcomings of centralized control over data when there is not a representative body to answer to.

“Extending this to users’ money and life savings is adventurous, to put it mildly.”