UK tech special: The rocky but unstoppable rise in startup valuations

The accelerated growth of startup valuations has sparked debate around the world, particularly in the markets where this has been reflected in the most significant raises and the speediest unicorns.

Despite ongoing pandemic uncertainty, a quarter of the UK’s 116 unicorn tech companies became unicorns during 2021.

Investment climbed significantly, up to £26bn in 2021 from £11.5bn in 2020, and leading VC funds like Balderton Capital, Eight Road Ventures and Index Ventures also had record years for fundraising.

The easy explanation for this is that startup sectors like fintech, especially BNPL, or rapid delivery have built incredible hype.

Ballooning valuations at later stages have created an investor-frenzy to get in on the action, leading to more generous offers and expedited negotiations.

A slightly more sophisticated answer might also reference that there simply aren’t many other asset classes performing quite so well.

Crypto seems to be stagnating, bonds are unattractive, real estate prices are inflated and post-Brexit some companies may struggle, but startup investments still appear strong. Another part of the picture.

The bigger picture, in data

Looking at the data behind 7,000 UK early-stage startup valuations, going back six years, reveals an underlying trend that is more powerful, and more optimistic, than either of the above: entrepreneurs are simply more ambitious, better prepared for success, and empowered by technology.

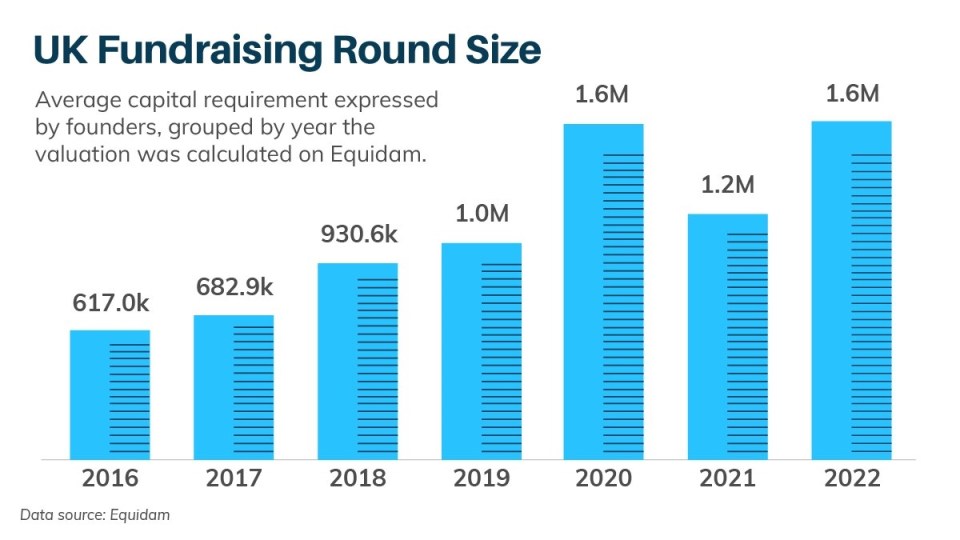

The first finding is the steady increase in capital that founders have been looking to raise.

It also shows that while 2021 was a fantastic year for the headline grabbing later stage rounds, perhaps pre-seed and seed stage founders did feel a bit of a squeeze from Covid.

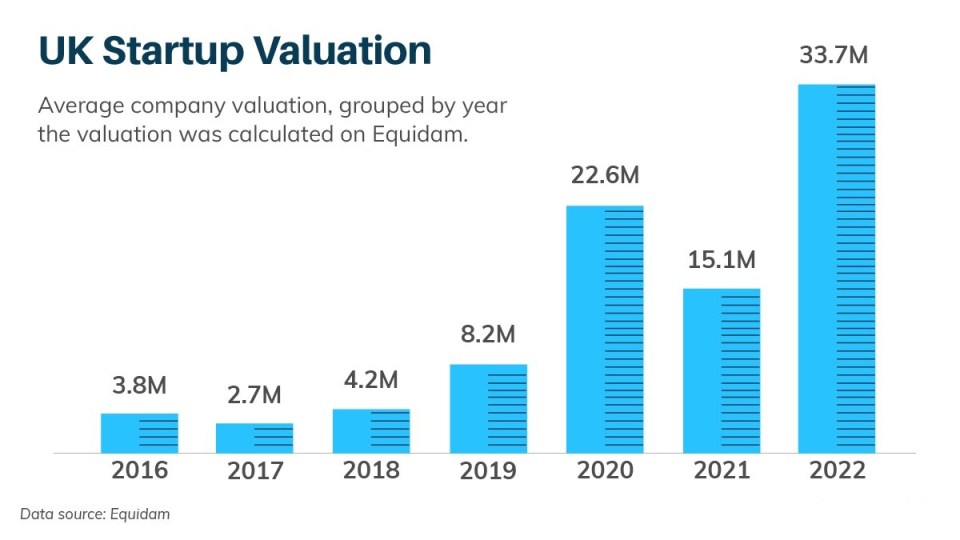

Valuations have understandably increased alongside this. If founders are looking to raise more money, to fuel more ambitious growth goals, it’s only logical that this be reflected in increasing valuations.

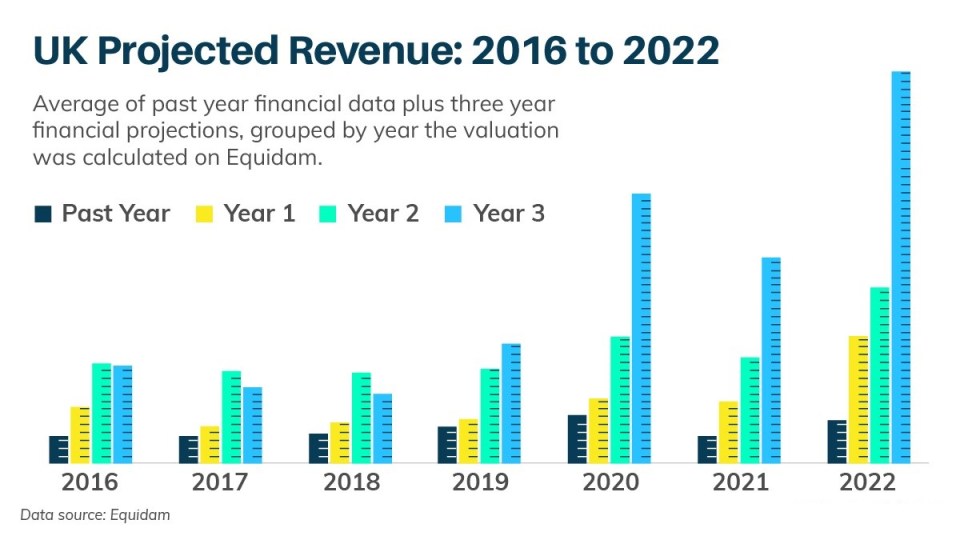

The final graph is where we find the final piece in the valuation puzzle: the revenue projections from the startups behind the increased ask and higher valuations.

From 2020 onward there has been quite a remarkable progression towards more aggressive ‘hockey stick’ like projections.

There’s a number of theories as to why, but one overarching trend is obvious: digitalisation, which rapidly accelerated during the Covid pandemic, has moved everything online, remote, and digital.

That means customer acquisition through digital channels is now much more effective, scalable and accessible.

It’s also certainly true, in the era of no-code and integrations for everything, that it’s cheaper than ever to build the ‘tech’ component of a company, whether that’s commerce or consultancy. The material to learn how to do so is widely available, as is the advice on how to grow your business.

Conservative year

The data makes clear why 2021 was a more conservative year for a lot of startups.

Covid uncertainty did have an impact on revenue: past year revenue totals, looking back to 2020, were the lowest since 2015.

This was enough to knock the confidence of founders in their ability to perform as their peers had a year earlier, especially with the Delta and Omicron variants emerging, creating more conservative projections for the three years ahead.

It’s safe to say, from looking at the preliminary 2022 data, that this trend has corrected and founders are as bullish as ever about their chances.