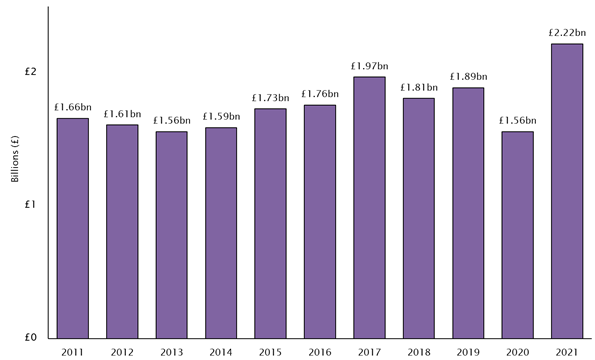

Exclusive: UK customs duties shoot up by 42 per cent to record £2.2bn since Brexit

UK businesses and consumers have paid 42 per cent more in customs duties on goods since Brexit came into force on 1 January of this year, according to new data shared with City A.M. this afternoon.

The jump to £2.2billion in customs duties – paid in the year from 1 January to July 31 of this year – is a new record and is up from £1.6bn in the same period last year, according to research from accountancy firm UHY Hacker Young.

The increased costs are due to new tariffs which have arisen as a result of leaving the EU, the firm explained in an email.

The main increase in customs costs comes from the “rule of origin” tariff, which applies to goods imported from the EU which were originally made, or contain components made, outside of the EU.

The increased cost of customs duties places further burden on UK businesses who have already been hit hard by the pandemic and increased staffing costs caused by the change in Brexit immigration rules, UHY Hacker Young added.

Complicated and time-consuming

Importing goods from the EU has also become far more complicated and time-consuming for UK businesses due to the bureaucracy involved.

In some cases, hauliers have needed to supply documentation of up to 700 pages long at borders, causing significant delays.

“UK Businesses weren’t given enough time or help to prepare for the cost of Brexit or the masses of paperwork,” explained Michelle Dale, senior manager at UHY Hacker Young.

“The result is that the cost of tariffs and extra paperwork is now causing serious difficulties for many businesses who are already struggling to stay profitable in the face of mounting pandemic-induced costs,” Dale told City A.M.

Businesses are set to face further issues from 1 October, when a new import ban on EU products of animal origin is being implemented for goods such as chilled mincemeat.

This new ban will likely cause longer queues at borders, leaving businesses with increased disruption and costs.