Exclusive: The West must accept climate trade-offs in green metal push

The West should be honest about the environmental effects of mining for vital green metals, argued Eldur Olafsson, founder and chief executive of Amaroq Minerals (Amaroq), and the trade-offs involved in pushing for climate friendly technology.

Olafsson told City A.M. that mining will always have “an effect” and that companies had to treat sites as a resource partner, looking to offset any damage with re-wilding such as tree planting and ensuring mining happens at sites with sufficient sustainable resources.

He said: “What we need to do is look at this as effectively a resource partner. So, rather than thinking about going in and exploiting it, we need to say ‘For the short term, we need those metals to electrify the world. However, we need to be careful what we leave behind’.”

The Amaroq boss also believed supply security was essential – with China and Russia dominating the green metals and rare earth minerals markets.

He suggested friendly countries should band together to procure metals from sites outside the influence of potentially hostile actors – such as Greenland, where Amaroq’s operations are based.

This would ensure the supply independence of countries as they push for electrification and decarbonisation with green power, electric cars, low carbon infrastructure and green energy projects.

Olaffson said: “These metals they cannot be coming solely from China, Russia and these countries, they need to come from jurisdiction where we can trust the supply and we can trust how they are taken out of the ground.”

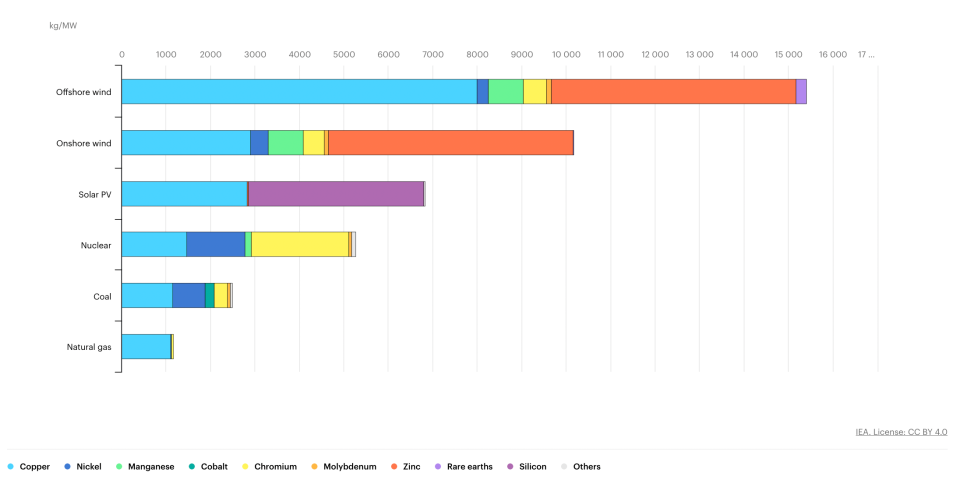

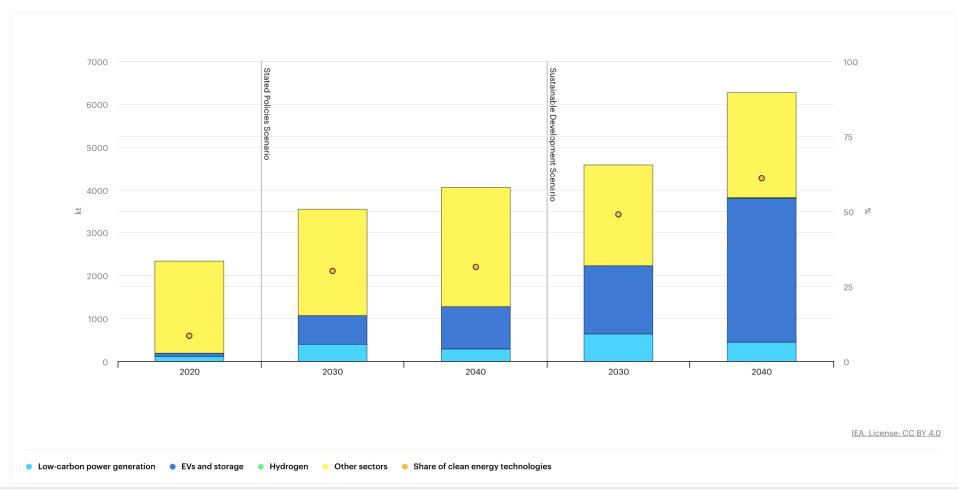

The International Energy Agency has forecast that the world is currently on track for a doubling of overall mineral requirements for clean energy technologies by 2040 – including a 20-25 times increase in demand for nickel.

Meanwhile, the UK has established its own critical minerals strategy, which it launched in July, where it targets plans to boost domestic production and team up with international partners.

Amaroq raises funds to power green ambitions

Amaroq is a mining specialist listed on the FTSE AIM All-Share, operating in Southern Greenland, that was founded by Olafsson in 2017 under the name AEX Gold.

It is the largest acreage holder in Southern Greenland with a land package of gold and strategic mineral assets including copper and nickel, covering 7,866.85 km squared.

While gold remains valuable as a precious metal and flight to safety asset, copper and nickel are both considered essential for electric vehicle batteries – which have broken into the mainstream in recent years.

The company’s land remains in the quantification stage – meaning Amaroq is drilling and calculating available assets from its sites including Nalunaq, its key project.

This is necessary for the project to be granted permission for full-scale drilling – with development and cash flow planned for 2024/25.

Olafsson was so far encouraged by the data, revealing many of the metals are extractable from surface level.

Alongside meeting Western needs for a green future, he also wanted to ensure his projects had an impact for “the greater good” of Greenland including boosting its economic growth and enable them to “live off the sites for the long term.”

Earlier this month, the company raised £30m in London at a price of 35p per share – a 2.78 per cent discount to the previous day’s closing price.

The funds raised will go towards progressing Nalunaq, which will enter the bulkhead sampling stage next year.

It has confirmed a listing in Iceland on First North, where it will debut tomorrow.