Exclusive: Tax benefits turn luxury watches into investment asset as imports swell to £500m

A new audience of buyers of luxury watches is increasingly taking the market by storm as they view watches that contain precious metals as a stand-alone investment asset.

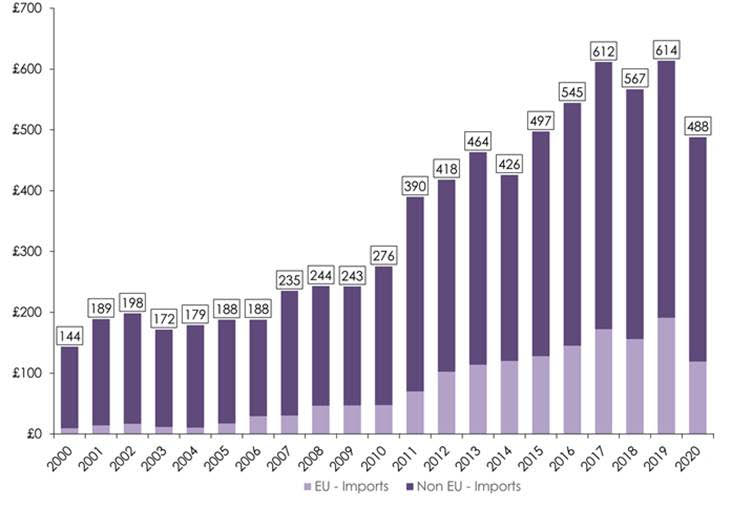

The value of premium luxury watches imported into the UK increased 43 per cent in the last decade, with £488m worth of imports last year alone, compared to just £276m in 2010, according to new research shared with City A.M. this afternoon.

The rise in the number of potential buyers, which has not been matched with increased production rates, has driven up prices in the market, according to Bowmore Wealth Group.

Rolex and Piguet

The continued scarcity of certain models, coupled with a rise in demand, has driven up the prices of particularly sought-after luxury watches. Luxury brands choose to keep production quantities low to ensure exclusivity of their products.

Rolex’s produces 800,000 watches a year whilst Audemars Piguet produce just 40,000 watches annually.

Investing in watches has particular tax benefits. In the UK any gifts, including watches, made more than seven years before death are not liable for inheritance tax.

Many choose to gift their children luxury watches as a way to pass down wealth, with some watches costing over £250,000, with the expectation that the value of the watch will continue to climb.

An example of a luxury watch that has seen a steep price increase is the Patek Philippe Nautilus 5711, with the blue dial, which can go for as much as £100,000 on the used market, with it being extremely difficult to buy new.

When the model was originally listed in 2006, it retailed at just £18,000, meaning most who purchase it today are doing so at 560 per cent of its original listed value.

Tax benefits

The UK Government exempts profits on most watch sales by individuals from capital gains tax, so those who are looking to buy luxury models may be able to sell them on without having to pay tax on the profit.

Despite multiple lockdowns stalling in person purchases, the UK luxury watch market has remained strong – with retailer Watches of Switzerland reporting luxury watch sales up 16 per cent in 2020/21 compared to the previous year.

“The value of luxury watches performed remarkably well during the global financial crisis – quickly recovering from only minor dips in value,” commented Mark Incledon, CEO at Bowmore Wealth Group.

“Similarly, luxury watches have continued to appreciate in value throughout the last year despite the global economic downturn,” Incledon told City A.M.

“The rise in demand for luxury watches reflect the growth in number of high net worth individuals across the globe. As more see their wealth increase, they are looking for new assets and investments,” Incledon explained.

“While those who have a fondness for luxury watches will understandably make high value purchases in the market, buyers must be careful not to be wholly dependent on the assumption that their value will increase,” he concluded.