Exclusive: Rival firm urges Octopus and Ovo to ringfence Bulb’s customers

A rival supplier has slammed the two reported bids for fallen firm Bulb Energy (Bulb), labelling them a “significant risk to all energy bill payers.”

It has told City A.M. it wants both Octopus Energy (Octopus) and Ovo Energy (Ovo) to commit to ringfencing the customer credit balances of Bulb’s 1.6m customers.

A source at the supplier warned that, without ringfencing, the takeover deal could jeopardise its own customers and the taxpayer.

It also questioned why any deal for Bulb needed “state aid” in the form of £1bn hedging support in the prevailing economic environment.

| Supplier | Customer Numbers |

| Bulb Energy | 1.6m |

| Avro Energy | 580,000 |

| Green Network | 360,000 |

| People’s Energy | 350,000 |

| Green Supplier | 255,000 |

The costs involved in keeping Bulb on life support have ballooned to £4bn since it fell into special administration last November – propped up by regular transfusions of public funds.

The Government and Octopus have been closing in on a deal for Bulb, City A.M. understands.

The agreement includes a nine-figure lump sum and a profit share agreement with its customers, in exchange for £1bn in public funds to establish a hedging strategy – which Octopus would pay back over time.

However, Ovo has made an eleventh-hour play for the de-factionalised firm, writing a letter of interest to administrator Teneo earlier this month, as first reported by Sky News.

Octopus, Ofgem, Ovo, Teneo, and the Government all declined to comment when approached by City A.M.

Bulb bid reignites industry ringfencing debate

Ringfencing refers to requirements proposed by Ofgem for energy firms to hold the credit balance of customers in a different account to their day-to-day operations – and for the money to be spent only on procuring energy for consumers.

The proposal has been backed by some of the UK’s biggest suppliers including British Gas owner Centrica, EON UK, and Utilita Energy.

However, other suppliers including both bidders Octopus and Ovo are concerned ringfencing requirements will force suppliers to charge customers more for their energy bills.

Ofgem has yet to impose any ringfencing commitments as part of its sweep up of the energy sector.

The watchdog has brought in fit and proper person rules, quarterly price caps, and financial stress tests since 30 suppliers collapsed over the past 15 months – directly affecting over four million customers.

It has quizzed the industry on a potential transition period starting at 30 per cent ringfencing, and plans to publish the next stage of its consultation later this year.

Scottish Power has also raised concerns over the Bulb deal – writing to former Business Secretary Jacob Rees-Mogg earlier this year that the deal should not include public funds and the auction should be reopened.

Falling spot prices ease costs for supplier

Bulb is currently benefitting from a vast drop in spot prices for gas, which have plummeted courtesy of warm winter weather and European Union’s supply scramble – with the bloc topping of supplies to 90 per cent storage capacity.

Unlike other suppliers, Bulb has not been allowed to hedge to meet its energy needs, meaning it has had to buy gas on a daily basis at spot prices rather than in the typically cheaper futures market.

This means it has been able to purchase gas in recent days at prices as low as £1.70 per therm, below the rate other suppliers reliant on futures and season ahead contracts are paying to meet their customer’s energy needs.

Currently, the Energy Price Guarantee sets prices for households at a maximum of 34p per kWh for electricity and 10.3p per kWh for gas – which works out at £2,500 per year for average households.

However, the costs invoked from buying at spot prices have chiefly driven up the costs of its administration, drawing criticism from the BEIS Select Committee in its latest report on the market.

City A.M. understands from industry sources the currently lower spot prices are unlikely to drive down the cost of taking on Bulb.

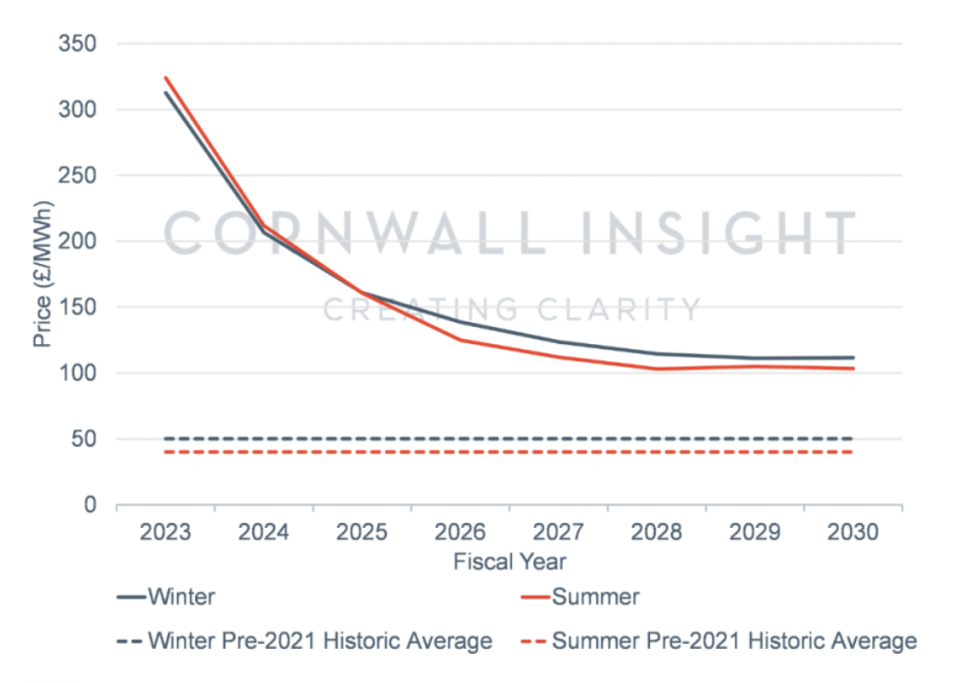

Energy specialists Cornwall Insight and Auxilione are both forecasting energy bills over £4,000 per year from April next year – when the support packages for households are expected to end.

This is sixty per cent above current record levels, while futures contracts for November and December are at £3.28 and £3.63 per therm respectively.