Exclusive: Ringfencing is the ‘least worst option’ for protecting customers, says Utilita Energy boss

Ringfencing is the ‘least worst option’ for protecting personal credit balances, argued Utilita Energy’s chief executive Bill Bullen.

The energy boss told City A.M. he “tended to be on Centrica’s side” in the industry debate over separating consumer balances from the commercial operations of suppliers.

Bullen said it was understandable businesses had set themselves up to function with minimal working capital and to rely on credit balances, as this was permissible within Ofgem’s existing rules.

However, with the watchdog imposing a raft of new measures from fit and proper person rules to financial stress tests, he also thought it was natural for Ofgem to pursue controls over credit balances to ensure households did not have to cough up so much money for future supplier failures.

He explained: “The problem comes when you have a company failure, and Ofgem has this rule where it wants to guarantee customers credit balances. So, those credit balances become a significant part of any supplier of last resort process – and that cost basically gets passed on to all other customers.

I do think on the issue of customer credit balances – they do need to be ringfenced if Ofgem is going to take the view that it is going to guarantee those customer credit balances in the event of failure.”

| Ringfencing – In Favour | Ringfencing – Opposed |

| Ofgem Centrica (British Gas) E.ON Utilita Energy | Octopus Energy So Energy Good Energy Ovo Energy (City A.M. understands) |

Ringfencing refers to requirements proposed by Ofgem for energy suppliers to hold the credit balances of customers in a different account to their day-to-day operations, and for the money spent by consumers to only be used on procuring energy.

This proposal has been supported by Centrica, which owns the UK’s largest energy firm British Gas – home to over nine million customers.

Centrica’s chief executive Chris O’Shea has argued it is vital customer’s money is protected by suppliers, and used only for the purchase of energy supplies – not to fund commercial ambitions at the company.

British Gas has been ringfencing customer credit balances as a matter of company policy since March earlier this year.

He criticised Ofgem for so far only bringing in requirements for 30 per cent of customer credit balances to be protected, instead of 100 per cent, with the regulator currently consulting energy firms on the concept.

E.ON has also lent its support to proposals to ringfence credit balances.

A more concrete decision on ringfencing is expected from Ofgem over the coming months.

Rival firms raise concerns over ringfencing

The prospect of ringfencing is contested by multiple other energy firms including Octopus Energy (Octopus),So Energy and Good Energy.

City A.M. understands Ovo Energy has also raised concerns over ringfencing requirements.

These firms believe that the requirement will force suppliers to charge customers more for their energy bills, and that it would stifle both innovation and new entrants to the market.

Octopus’ boss Greg Jackson warned last month that ringfencing runs the risk of “handing the market back to turgid incumbents” through over-burdening the energy sector with regulations.

He urged the regulator not to give in to “pressure from archaic companies, whose proposals will only drive up bills and supplier profits.”

In his view, poor management and insufficient hedging were the key drivers of the market crisis, which has seen 30 supplier collapse since last September.

Nevertheless, Bullen believed there was no other way to secure deposits in a way that wouldn’t put further costs on to consumers.

He recognised “everybody is going argue their corner” but that without ringfencing, the energy boss feared companies will have a “free option” of investing a capital “they’re not really paying for”.

He said: “The risk of this will just pass on to someone else if they fail, and clearly, that’s not right. I think the only sensible way of dealing with that issue to avoid everybody else having to pick up the cost of those failed companies is that a company has to ringfence.”

Utilita largely relies on pre-payment meters and would only need to ringfence around £5.7m from customers, a tiny fraction of its overall revenues.

Bullen explained: “We’re not using access to direct debits to fund the business, we never have done . It doesn’t really make an awful lot of difference to us one way or the other. Obviously, it does mean if we have to ring fence the £5.7m, there’s a little bit of financial strain on us, but it’s nothing that we’re not going to handle.”

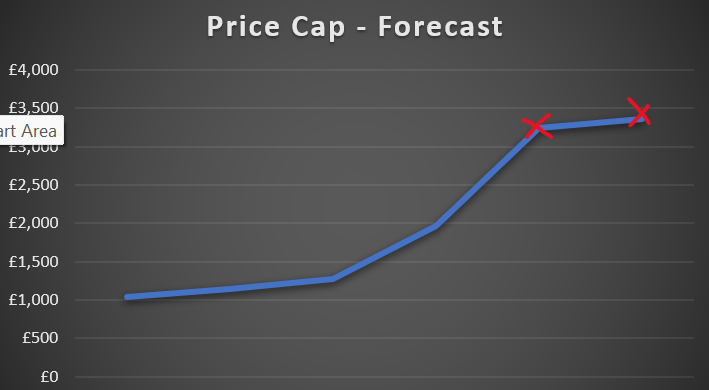

The industry dispute over ringfencing follows the consumer price cap spiking to nearly £2,000 per year this month, with analysts forecasting prices could exceed £3,000 per year in October and January when demand is at its peak in the coldest months of the year.

While this has been driven chiefly by soaring wholesale costs, energy users are also expected to foot a £2.7bn clean-up bill for the supplier of last resort process, which ferried over two million customers from fallen firms to surviving suppliers.

There is also an estimated £3bn taxpayer bill for the propping up of Bulb Energy, which fell into special administration last November.

City A.M. understands from industry sources that Octopus and Masdar Energy remain in the running to acquire Bulb – with a decision expected later this month.

Meanwhile, Bullen has raised concerns over the performance of Ofgem during the crisis, slamming the regulator for labelling his firm as having ‘moderate or severe’ issues handling direct debits.

He revealed he no longer has faith in Ofgem.