Exclusive: North Sea body backs hydrogen hub to power 20m homes

A vast offshore hydrogen project could help power 20m homes and businesses with low carbon energy, according to a new report from the North Sea Transition Authority (NSTA).

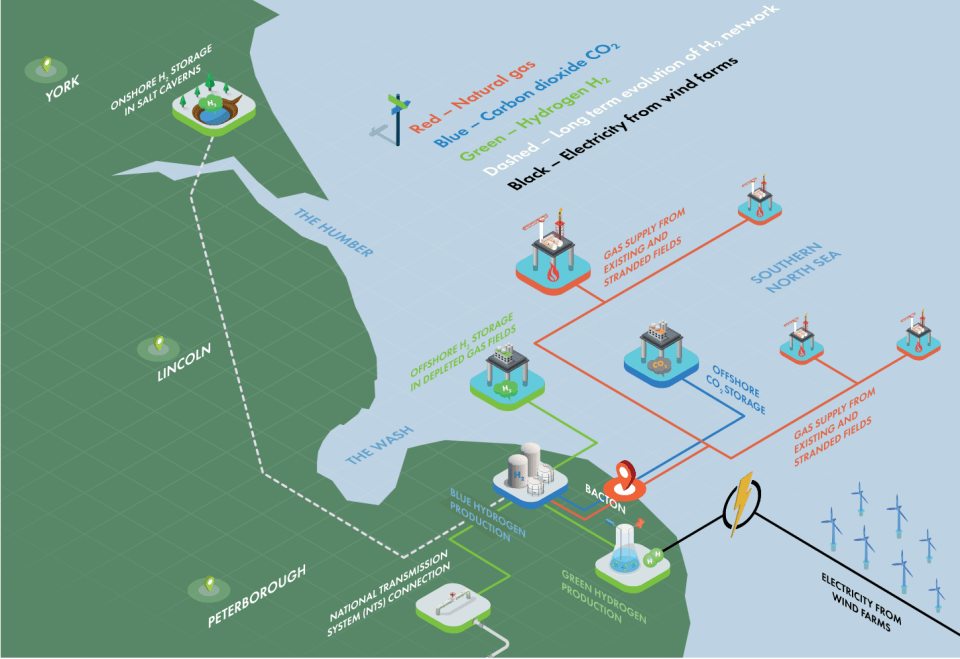

The NSTA argues that the Bacton Energy Hub, which is located off the coast of Norfolk, could both contribute to the UK’s energy security and significantly reduce the country’s greenhouse gas emissions.

The site is a hydrogen project with carbon capture and storage (CCS) capabilities, set for further development over the coming decade.

NSTA predicts the core site – referring to the hydrogen and offshore gas facilities- will cost £500m, and can be delivered by 2030 if a final investment decision is made by the third quarter of 2025.

It believes future hydrogen produced at Bacton could be blended into the UK’s network of gas pipelines.

The development was launched by the NSTA and has been supported by a consortium of companies including the Energy Transition Authority, Petrofac, Progressive Energy Limited, Sumitomo Corporation, Turner and Townsend, and Xodus.

Currently the National Transmission System (NTS) supplying gas to homes and businesses in London and South East of England is 100 per cent methane.

Blending 20 per cent of hydrogen into the NTS displaces the same quantity of methane, which in turn, creates the potential to reduce 1.5m tonnes per year of CO2 by the end of the decade, rising to 17m tonnes by 2050.

CCS-enabled (blue) hydrogen, produced from natural gas, would form the early supply until the early 2040s.

After this, electrolytic (green) hydrogen – produced through a process of splitting water into hydrogen and oxygen called electrolysis – would take over.

Blue hydrogen creates CO2 as a by-product, but Bacton could provide potential carbon storage fields – supported by the NSTA’s carbon storage licensing round to meet those needs.

The NSTA calculates there are underdeveloped gas reserves of up to 2tn cubic feet at Bacton, which could be used as feedstock for the production of blue hydrogen.

The hub will also include 15GW of offshore wind, contributing 30 per cent of the energy generation for the UK’s 50GW target.

The report was produced after work looking into supply chain issues, hydrogen demand, and infrastructure by

Alastair MacFarlane, NSTA Southern North Sea Area Manager, called on a consortiumto come together to back the development with further funding.

He said: “We are resolutely focused on the twin goals of ensuring energy security and reaching net zero. This project can play a transformative role in both.”

Experts raise concerns over blue hydrogen role

The NSTA’s 33rd licensing round was launched in October earlier this year and included four priority clusters in the Southern North Sea.

These are areas with known hydrocarbons with the potential to be developed quickly – so the necessary gas resource is readily available.

The NSTA’s report also suggests UK’s interconnectors to Europe could unlock could see Bacton develop into a CO2 import hub, storing gas transported from western Europe and importing feedstock for hydrogen production.

The Government is targeting 10GW of blue and green hydrogen generation by the end of the decade, as part of its energy security strategy.

The latest developments were welcomed by Hydrogen One, the country’s first London-listed hydrogen fund.

Managing partner Richard Hulf called the Bacton Energy Hub a “great example” of the UK repurposing fossil fuel infrastructure for the transition to zero-carbon energy sources.

He told City A.M.: “This is just the sort of project that will attract capital from funds like our own and we look forward to further project updates.”

However, the plans also drew scepticism from energy experts, including Adam Bell, head of policy at Stonehaven and ex-head of energy at BEIS.

He noted that the report attempts to make a link between the Climate Change Committee suggesting carbon storage can play an important role in scaling up the hydrogen industry and data showing that hydrogen boilers can save up to 85 per cent of emissions compared to natural gas usage in boilers.

Yet, CCC has not argued hydrogen should play a significant role in hydrogen-only domestic heating systems, even if its analysis does see a role for hydrogen in domestic hybrid devices – which Bell though was reasonable “on grid upgrade grounds.”

Bell was also uncertain the decade usage of blue hydrogen as a pathway to greener energy made sense amid historically elevated wholesale costs.

He said: “It’s challenging to see a medium-term role for blue hydrogen given both current gas prices and the continuous reduction in cost of electrolysers and power from renewable energy sources. Its scope to be a transition fuel may be limited to a few years at the end of the 2020s.”

Roz Bulleid, research director at Green Alliance, was more critical of the project – concerned it would be used to justify further fossil fuel development over the transition to a low carbon future.

She said: “This is a clear example of CCUS and hydrogen production being used to justify continued fossil fuel development. While there are roles for hydrogen and CCUS in a clean transition, we need to move away from fossil fuel extraction. The North Sea is an increasingly inefficient and expensive location for extraction.”