Next winter’s energy crisis will be even worse, warns forecaster

Next winter’s energy crisis will be even worse than this year’s escalating supply difficulties, unless the West makes fresh efforts to tame demand, warned Stifel.

The US investment group also argued that the energy crisis will not ease before spring 2024, meaning plans for shoring up supplies had to be sustained over the next two years rather than just this winter.

Chris Wheaton, managing director, suggested that European Union (EU) gas cuts are insufficient to balance the market, and that the troubled continent will have to compete with Asian economy for an increasingly limited supply of liquefied natural gas (LNG) next year.

Member states from the energy-starved bloc have pledged voluntary 15 per cent cuts to gas usage over the winter, however Wheaton believes a 20-25 per cent cut would be necessary to prevent supply shortages and spikes in wholesale costs.

He told City A.M.: “Our forecasts show that a 15 per cent demand cut is insufficient to balance the market with the result that gas storage levels will exit 2022 lower than normal and stay lower than normal through 2023 and into 2024. It is this imbalance that means the EU will continue to have to compete for a limited pool of LNG with Asia, which will keep prices high.”

If more stringent cuts weren’t made, he warned there could “be unplanned gas shortages and price ‘super-spikes'” which could rise to “potentially multiples of the extremely high prices gas consumers are already experiencing currently.”

This comes as gas prices surged to massive highs earlier this week, with Dutch TTF Futures benchmark rallying more than 10 per cent to a peak of €290 per megawatt hour.

In the UK, gas prices for next-day delivery surged as much as 33 per cent to £4.80 per therm.

In its industry update, UK Energy and Power Stifel suggested there is “light at the end of the tunnel”, in the form of new LNG projects from both Qatar and the US, however these would not come on stream until 2025.

The EU is racing to top up supplies ahead of winter, with the bloc’s biggest economy Germany securing 75 per cent capacity ahead of September.

Nevertheless, multiple German cities including Berlin, Munich and Hanover have brought in rationing measures including turning off public streetlights at night and limiting air conditioning and heating in Government buildings.

Meanwhile, there are expectations of further pressure on European supplies, with Gazprom confirming the closure of Nord Stream 1 later this month for maintenance.

The pipeline has already been reduced to 20 per cent outflows amid a dispute with Germany and the EU over a turbine.

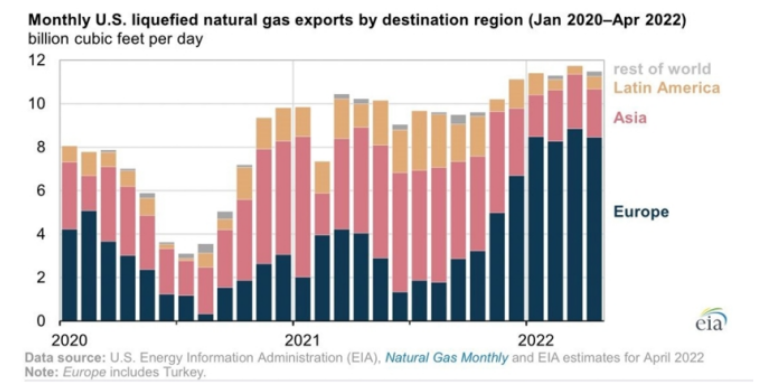

This has exacerbated the bloc’s reliance on LNG, with shipments from the US helping to stave off blackouts last Christmas.

Stifel noted that a shift in LNG flows away from Asia to Europe can already be seen in data from the US, where deliveries have shifted from 35-40-25 to Europe, Asia and Latin America in 2021, to 70-20-10 this year.

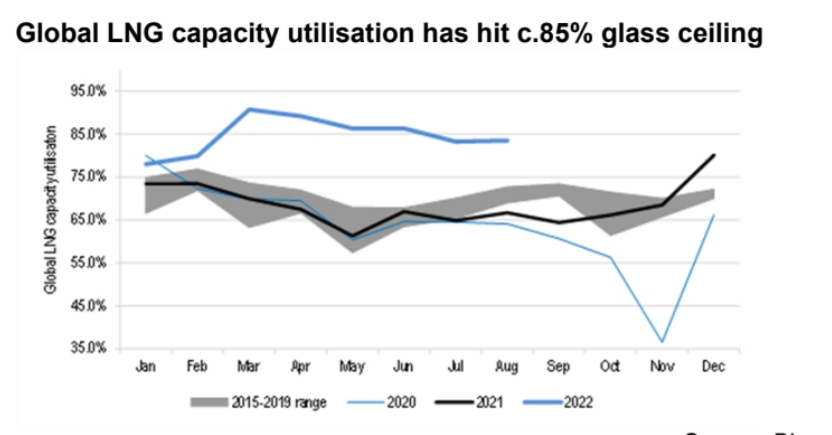

However, it suggested that the global LNG industry capacity utilisation appears to have hit a glass ceiling of 85 per cent – meaning there isn’t much more LNG to squeeze out to ease European supply worries.

It highlighted a gradual downward trend in utilisation since the uptick immediately post the Ukraine invasion in March, indicating to that the LNG industry can’t run at high levels of utilisation indefinitely.

UK vulnerable to winter price spike amid storage shortages

Alongside the EU’s struggles, Stifel suggested the UK is at particular risk of a spike in gas prices this winter.

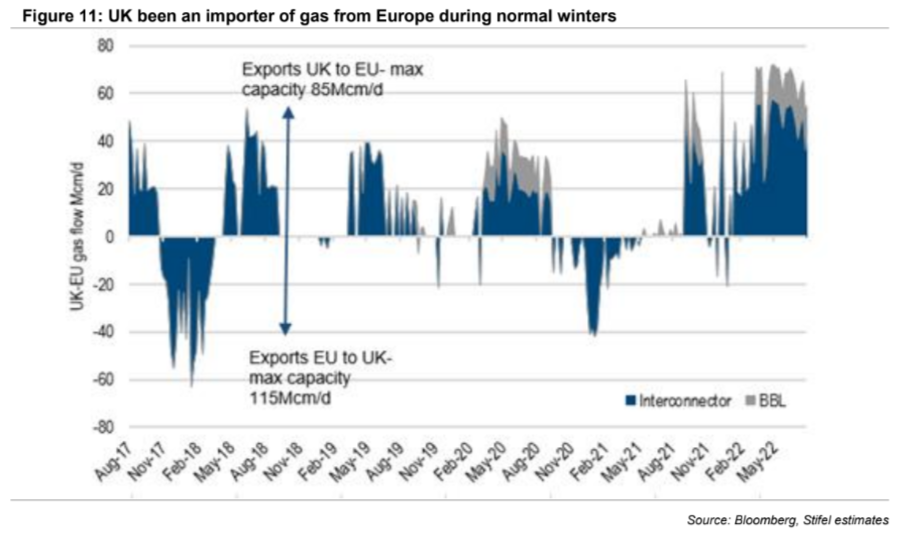

With limited gas storage capacity versus demand, it argued the UK will need to have gas prices high enough to pull in additional gas from Europe in order to balance supply and demand or attract more LNG, when there is very limited potential additional supply from Norway.

Centrica is pushing to put the Rough storage site back online this winter ahead of expected Government approval, but it is unlikely to be operating at full capacity until next winter.

At its peak, it can provide 10 days of gas storage, but was shut down in 2017 amid financial concerns.

It also highlighted that in the last two “normal” winters (excluding the abnormally warm winters of 2018/19 and 2019/20), the UK has had to import gas from Europe, which has required UK gas prices to be at a premium to European gas prices.

Stifel suggests there is a risk that European gas imports into Europe are not available to the UK at any

price, as Dutch regulators might not permit exports of gas if they thought it could compromise their

security of supply.

This is despite the National Grid’s electricity system operator predicting there would be sufficient overseas supplies available to meet demand in case of domestic difficulties.

In the note, Stifel highlight a precedent in the French electricity market, when during the very cold weather of February 2018, the French electricity market regulator refused to permit additional exports of electricity from France to the UK.

This is because it would have breached their margin of safety of spare generation capacity.

The UK is currently exporting significant – up to five per cent of total UK power demand – amounts

of electricity to France, to compensate for their loss of nuclear generation capacity due to metal fatigue issues.