Exclusive: More than two firms remain interested in Bulb Energy’s customers

City A.M. understands at least one other energy firm remains interested in Bulb Energy (Bulb), but they are not yet prepared to commit to a full takeover bid.

Sources have told the newspaper the supplier would consider taking on some of Bulb’s 1.7m customers if they are eventually offloaded in segments, rather than altogether in one transaction.

British Gas owner Centrica and UAE-based energy firm Masdar were the only two companies to have put forward non-binding bids when the first round of the process closed earlier this month, as reported first in The Sunday Times.

However, it remains unclear if either bid will be accepted, with a decision not expected until June.

While Masdar is reportedly set to make a full offer for Bulb, Centrica only wants Bulb’s customers and has asked for taxpayer support to buy the power required to heat customer homes.

EDF Energy has consistently been linked with Bulb since it fell into special administration last November and Greg Jackson, chief executive of Octopus Energy Group (Octopus), did not rule out making a play for its customers when interviewed by the newspaper last month.

He told City A.M. it was critically important any deal got the best value for taxpayers, and that Bulb’s customers were well looked after.

Jackson said: “Octopus has probably done just about the best job of looking after customers through failures. So, in terms of looking after customers, it’s something we’d be highly committed to. But to get the best value for taxpayers, we need to make sure there’s a transparent process.”

| Energy Supplier | Onboarded domestic consumers (thousand) |

| Centrica (British Gas) | 717 |

| EDF Energy | 680 |

| Octopus Energy Group | 580 |

| Shell Energy | 536 |

| E.ON Energy UK | 239 |

Centrica declined to comment on the reports linking the firm to Bulb – but has scooped up nearly three-quarters of a million domestic consumers through the supplier of last resort process, making it the most active firm during the energy crisis.

Masdar also refused to confirm its was interested in buying Bulb – which it described as “market speculation” – but it did confirm the company was interested in boosting its investment footprint in the UK.

A spokesperson said: “Masdar continues to drive substantial growth across its global clean energy portfolio, which includes world-leading wind and battery storage projects in the UK. As a global clean energy powerhouse, we remain committed to growing our presence in the UK and elsewhere to help support the energy transition.”

Currently, Masdar is owned by three Abu Dhabi state-controlled companies, and is chaired by Sultan Ahmed Al Jaber, the chief executive of the Abu Dhabi National Oil Company.

Details of the size of either bid remain elusive, although both firms expressed interest in Bulb prior to its collapse in November, when US investment bank Lazard scrambled to secure buyers in a last ditch attempt last autumn.

Bulb drains taxpayer funds as market crisis deepens

Bulb is the UK’s seventh biggest energy supplier, and was the first firm to drop into de-facto nationalisation during the escalating energy crisis.

The supplier was placed on life support over the winter, propped up through regular transfusions of public money – which Sky News has estimated could reach £3bn, the biggest state bailout since RBS in 2008.

It is one of 29 suppliers that has collapsed since September amid market carnage across the domestic energy industry.

However, the other 28 failed suppliers exited the market – with over two million customers shifted to new firms through the supplier of last resort process.

Ofgem has alllocated £1.83bn in public funds to compensate suppliers for the cost of onboarding customers during the crisis – equating to a £68 fee for energy users.

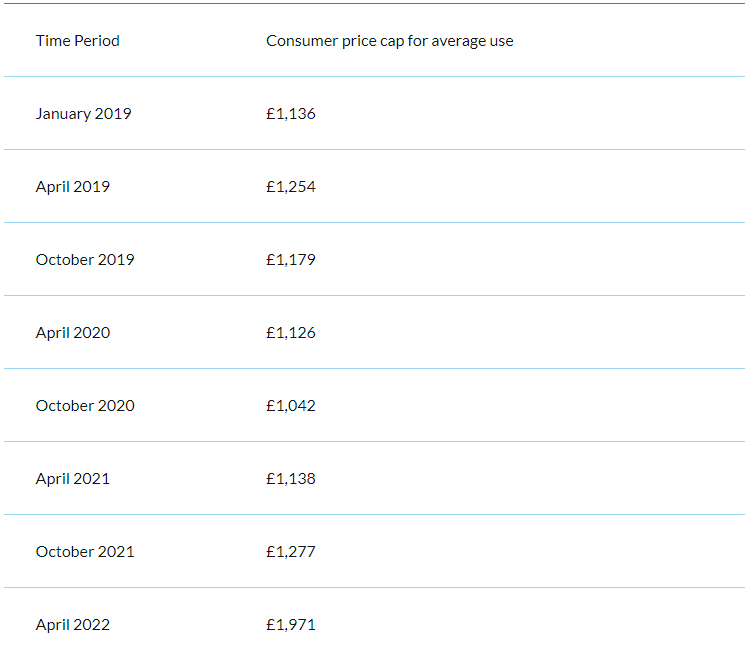

This is on top of the painful 54 per cent hike in household energy bills this month, with the consumer price cap spiralling from £1,277 per year to £1,971 per year.

Energy specialists Cornwall Insight have predicted the price cap could rise to £2,600 per year in October, with the regulator set to review prices this summer.

However, Bulb was considered too large to use the mechanism – with Interpath Advisory and Teneo overseeing the sale process of Bulb and its parent company Simple Energy.

Supplier’s fall from grace energises calls for price cap reforms

Following its collapse, Bulb attributed its demise to soaring wholesale costs and the constraints of the price cap.

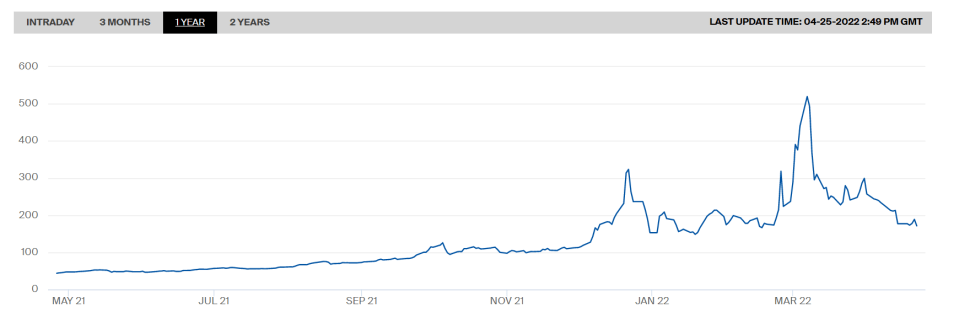

It argued that gas prices had reached £4 per therm, but that the price cap prevented it from charging customers more than 70p per therm, and was forced to offer energy at a loss.

Natural gas prices have since peaked at record levels of over £8 per therm last month, following the targeting of Russian energy supplies from the UK and US last month.

Prices remain historically high at £1.71 per therm, well below the record total but significantly above conventional market prices.

For context prices were 44p per therm this time last year.

Bulb is not the only supplier to attribute blame to the price cap , with Scottish Power chief executive Keith Anderson also calling for the price cap to be reformed.

He made his case to the Business, Energy and Industrial Strategy (BEIS) Committee last week, suggesting a £1,000 deficit fund for vulnerable households.

However, there are also questions over Bulb’s performance prior to and during the energy crisis.

Despite generating sales of £1.5bn, according to its latest accounts, Bulb has never made a profit in its seven-year operational history.

Instead, losses have grown over time, rising from £28m in 2018 to £129m in 2019 – narrowing to £63m in March 2020.

It has also faced criticism for failing to hedge properly in a market saturated with dozens of suppliers chasing customer growth over sound financial stewardship.

When interviewed by City A.M. earlier this year, Good Energy chief executive Nigel Pocklington argued that Bulb failed to hedge properly.

He suggested that its collapse was a “scandal that arguably has not been quite covered as one yet.”

Pocklington said: “We have an up-to-18-months-out approach to hedging. We said when we were coming into winter 2021 that we were 100 per cent hedged. That’s one of the reasons we’re still here. Now have we grown like Bulb did? No. But nor have I cost the Treasury or the bill-payer any billions of pounds to rescue me.”

Chief executive continues role despite collapse

Meanwhile, Hayden Wood has maintained his role as chief executive of Bulb – despite its drop into administration – and has confirmed he is still being paid his £250,000 per year salary, funded by the taxpayer.

City A.M. also understands around £2m in quarterly retention bonuses have been paid to employees, including the customer-facing workers.

This is to ensure the supplier can retain staff and continue to trade, and that Bulb’s most senior executives are not receiving these financial awards.

A spokesperson for the joint administrators of Simple Energy said: “The teams at Simple and Bulb have worked incredibly hard since the companies entered insolvency last November, ensuring the businesses have been able to continue to trade, and providing continuity of service for 1.5 million customers, and all against the backdrop of personal uncertainty that any administration inevitably causes.”

Since Bulb’s collapse, market regulator Ofgem has made multiple reforms to the energy market.

It has brought in temporary measures, such as requiring suppliers to compensate rival firms when taking new customers, alongside permanent new policies such as more stringent financial stress tests.

Ofgem also intends to reduce the implementation period from two months to one month to better reflect wholesale prices.