Exclusive: London consumer spending soars during cheap meal scheme

The Eat Out to Help Out scheme gave London restaurants a huge boost in August, with spending jumping to just 10 per cent below its 2019 level, according to the latest data provided exclusively to City A.M.

Food and beverage spending in London in July was a whopping 39.1 per cent lower than a year earlier, showed figures from Fable Data, which tracks card payments and bank transactions.

But chancellor Rishi Sunak’s cheap meal scheme helped push up spending in the sector to only 9.8 per cent below its 2019 level last month.

In London overall, total consumer spending was 10.6 per cent higher in August than a year earlier. It had been 27.2 per cent lower in July.

“The scheme was undoubtedly a widespread success for those businesses that were open and chose to take advantage of it,” said Kate Nicholls, chief executive of industry group UK Hospitality.

Yet the jump in spending in August raised the prospect of another fall in September. Londoners will no longer be enticed to the high street by cheap food. And rising coronavirus cases could encourage people to stay at home.

The data provided to City A.M. by Fable gives a snapshot of the health of the London economy.

Londoners splash out on new wardrobe

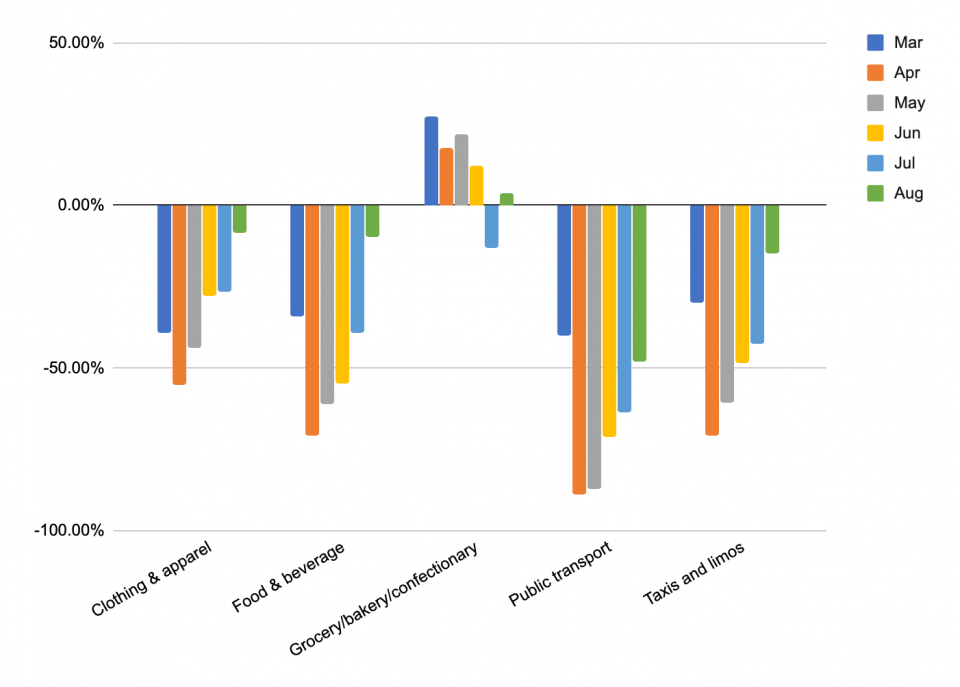

Londoners regained an appetite for clothes shopping in August, as well as eating out. Clothing and apparel spending was only 8.4 per cent below its 2019 level in August, whereas it was down 26.6 per cent in July.

Laura Campbell, data analyst at Fable, suggested people working from home were after “a slightly different wardrobe from what you would have worn to the office”.

Much of the spending will have been online. Nick Stamenkovic, senior economist at Natwest, said: “The big structural shift we’ve seen… accelerated by Covid-19 is the shift away from traditional bricks and mortar towards online spending.”

Consumer spending in London compared to a year earlier

Londoners stayed firmly away from public transport, however. Spending on the Tube and buses was down 48.1 per cent in August, although it was better than the 63.7 per cent deficit of July.

People turned to taxis and limos instead. Spending in this category was down only 14.6 per cent compared to a year earlier. That was a big improvement from the 42.5 per cent gap a month earlier.

Campbell said the Eat Out to Help Out scheme may have led people to catch a cab into the city centre.

“If you’re fretting about the pandemic, a taxi’s going to seem safer,” she said. Yet she cautioned that any analysis at this stage is “speculative”.

The Eat Out to Help Out scheme encouraged people to visit restaurants by giving them 50 per cent off meals worth up to £10 in August. The government made up the short-fall.

Diners ate 100m cut-price meals using the scheme, which ran from Mondays to Wednesdays. It cost the government £522m, according to the Treasury.

Southwark and Islington boosted by scheme

Fable’s data suggests the scheme boosted certain boroughs more than others. Southwark saw overall consumer spending jump in August to 34.4 per cent higher than a year earlier. Spending by people in Islington was 32.7 per cent above 2019 levels.

Hackney, Hammersmith and Fulham and Westminster also saw a big rise in consumer spending. The relative wealth of these areas compared to some others could explain the rise in spending in August, as could their thriving local restaurant scenes.

Stamenkovic warned that the spending could fall in the autumn, however. He said the London economy still faced strong headwinds.

“As [the scheme] has now ended, and the challenges and uncertainty facing consumers going forward, I doubt that trend will be sustained in the coming months.”

UK Hospitality’s Nicholls said: “There will certainly be a need for further support to avoid more business failures.”

“The biggest threat to many businesses in the short-term is rent,” she said. “And the falling away of the furlough support at the end of October will force some uncomfortable decisions on many businesses if employment support disappears altogether.”

A Treasury spokesperson said: “The scheme complements a wider package of hospitality support that goes beyond August.”

They said that includes “cutting VAT to 5 per cent, paying the wages of furloughed staff, business rates relief and billions in tax deferrals and loans”.