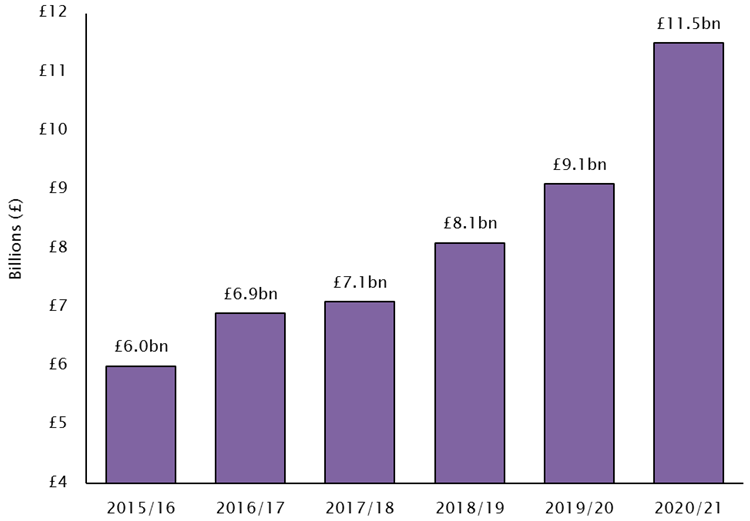

Exclusive: Businesses overpaying corporation tax up by 26 per cent to record £11.5bn

Businesses claimed back a record £11.5bn in overpaid corporation tax from HMRC last year, a jump of 26 per cent from £9.1bn the year before, according to data by accountancy firm UHY Hacker Young, shared with City A.M. this afternoon.

The firm stressed it is “extremely likely” that these refunds are merely “the tip of the iceberg” as many of them only reflect losses suffered by businesses in the early part of the pandemic.

Businesses pay corporation tax based on forecast profits for the following year, making it easy to overpay tax if profits fall below their expectations, which will have been the case for most companies during the pandemic.

‘Loss relief’ rules

In the March Budget, the government introduced a temporary extension to ‘loss relief’ rules, allowing businesses to reclaim losses made during Covid from corporation tax they have paid in the last three years, rather than the usual one year.

By doing so, more businesses should be able to claim a refund.

If a business does not spot that it has overpaid corporation tax, HMRC will hold onto their money, UHY Hacker Young stressed.

A lot of businesses have not filed their tax returns covering the full lockdown period yet and with many businesses unable to trade over the past year, it’s likely some will be facing big losses, the firm added.

As a result, far more businesses than usual will have overpaid corporation tax, meaning refunds are expected to rise even further in the coming months.

Amount of corporation tax overpaid by businesses: up 26 per cent in the last year

“Businesses are already overpaying billions in corporation tax under HMRC’s current collection system. Accounting for Covid-related losses on top of this will only see refunds jump even further,” explained Nikhil Oza, corporate tax director at UHY Hacker Young.

“Unfortunately, it will be down to the business to spot any corporation tax it has overpaid HMRC and to instigate the refund process. Failure to do so means HMRC will keep the money it’s not actually owed,” he concluded.