Exclusive: Business tax reliefs jump to record £94bn as number of available reliefs grows to 57

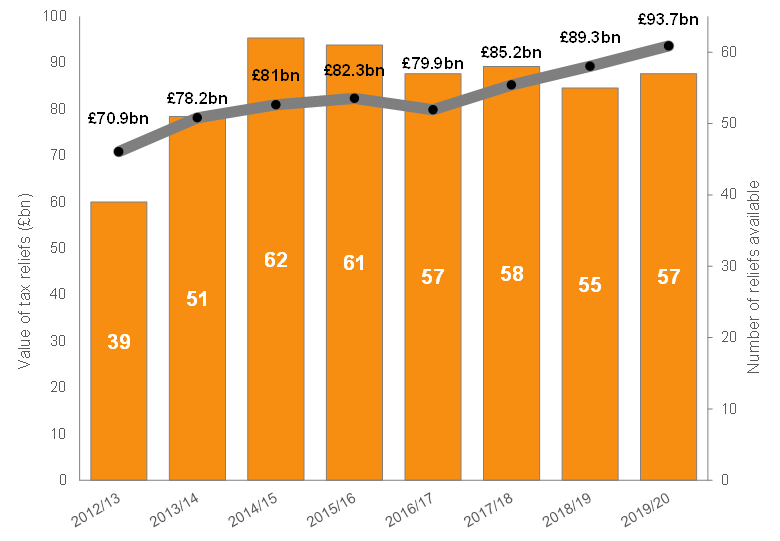

The value of tax reliefs claimed by UK businesses reached a record £93.7bn last year, up another 5 per cent from the £89.3bn claimed the year before, according to new data shared exclusively with City A.M. today.

The growth in the value of business tax reliefs claimed has been driven by the rise in the number of reliefs available.

There are now 57 different tax reliefs available to businesses in the UK that HMRC deems significant enough to report on, while several hundred more go unreported due to their low level of use, showed research by Thomson Reuters.

Many are so small that it is assumed they are worth negligible amounts to the business community.

The number and value of business tax reliefs in use has risen sharply over the past decade. Only 39 reliefs were on offer to businesses in 2012/13, with a total value of £70.9b.

Jas Sandhu Dade, Head of Corporates Europe at Thomson Reuters, said that while tax reliefs play a vital role in encouraging business growth, the tax system has become enormously complex for businesses, with the number and value of reliefs available changing each year.

Sandhu Dade added that while there has been some discussion on whether there are too many tax reliefs, many recognise that reducing the number of available reliefs might disadvantage the businesses who rely on the smaller reliefs.

Many businesses also worry that reducing the number of tax reliefs will simply result in them paying more tax.

“Initiatives like “levelling up” and decarbonising the economy are inevitably going to lead to additional, targeted tax incentives for businesses,” said Sandhu Dade.

“The challenge is not just which tax incentives to add, but also which incentives they should now remove to simplify the tax system,” she added.

“Removing tax breaks can be incredibly hard as it is going to attract fierce criticism from those businesses that benefited from those tax incentives. Few politicians would want to scrap a tax incentive if it made a sector less competitive internationally or cost jobs.”

“At the current rate at which tax breaks are removed, it is unlikely that the Government will be able to make a serious dent in the number of tax reliefs, or stop the steady increase in the number of tax breaks,” she explained.

Calls to simplify

The economic bounceback following the Covid-19 pandemic has given new impetus to calls to simplify the tax system. Reducing the bureaucracy, time and cost of taxation would allow greater resource to be allocated to increasing the rate of economic growth.

“Tax reliefs are a very important part of making our economy work more efficiently. However, if the system becomes too complex, too many businesses may not be able to claim the reliefs they need to thrive,” said Sandhu Dade .

“The tax reliefs system for businesses continues to become more complex each year, with new reliefs added and existing reliefs changed. While simplifying the system may seem a good idea in theory, it risks missing out on reliefs they have come to rely on,” she continued.

Tax reliefs available for businesses in the UK currently include the Annual Investment Allowance, which allows businesses to reduce their Corporation Tax liabilities by investing in plant and machinery, VAT zero-rating on construction of new homes, the Reduced rate of Climate Change Levy for participants in climate change agreements as well as Relief on employers’ National Insurance Contributions for employer-supported childcare, such as workplace nurseries.