Exclusive: Brits turn to buy-now pay-later to fund spending amid cost of living crisis

Brits are turning to buy-now pay-later products to fund online spending amid a cost of living squeeze that is eroding their disposable income rapidly, exclusive research shared with City A.M. reveals.

Nearly £1 in every £8 spent online last month was sourced from buy-now pay-later providers, according to research by Adobe Analytics.

The proportion is up slightly from just over 10 per cent in the same month last year, signalling shoppers are responding to their spending power being eaten up by inflation by using firms like Klarna and Zilch to keep splashing the cash.

Buy-now pay-later (BNPL) is a type of interest-free credit that allows customers to buy products by borrowing against their future income. Like credit cards, however, there is a risk people can get tangled up in serious debt trouble if they fail to repay their debts.

Adobe attributed the rise in demand for BNPL services to Brits trying to “spread the cost of January purchases to ease the financial pressure caused by continued high levels of inflation and the cost-of-living crisis”.

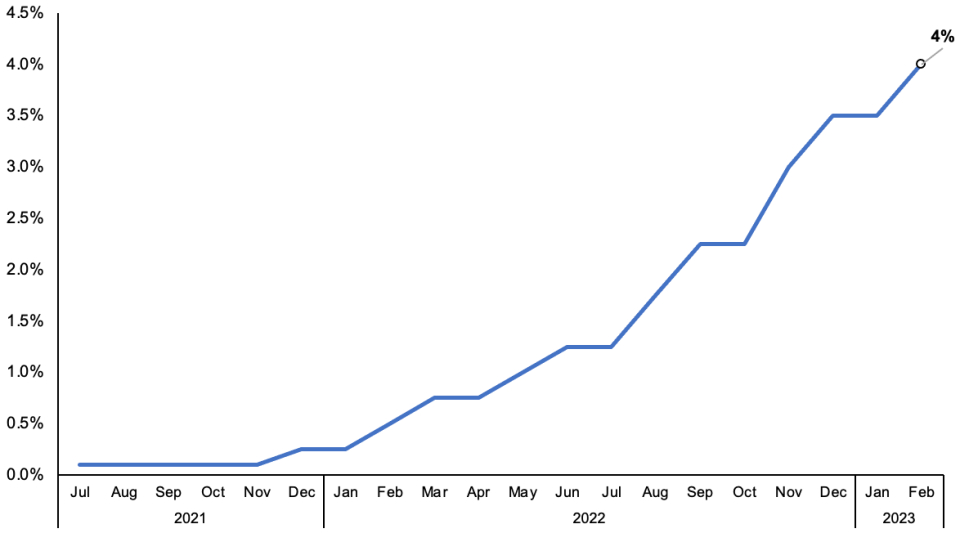

The rate of price increases surged to a 41 year high of 11.1 per cent in October. In response, interest rates have also shot up 10 times in a row to 15 year high of four per cent as the Bank of England scrambles to tame inflation.

As a result, shoppers are considering a wider variety of credit providers to fund their purchases.

“It’s no surprise that more and more people are turning to interest-free BNPL providers like Klarna as banks hike-up credit card interest to their highest ever rates,” a spokesperson for Klarna, the darling of the buy-now-pay later sector, told City A.M.

Shoppers do not pay any interest on cash borrowed from Klarna unless they miss a payment deadline, which can vary from 30 days to spreading payments over several months. Using them can impact a consumers’ ability to borrow in the future.

Philip Belamant, chief executive of Zilch, told City A.M. that the firm “reports to all major [credit rating agencies], protecting customers from over-borrowing elsewhere, and has recently begun working with StepChange, the UK’s leading debt charity, to help those who fall behind, for free”.

Interest rates have climbed sharply

“The increased use of buy-now-pay-later services to spread the cost of January purchases, shows that consumers are still keeping a close eye on their finances in the short term,” Suzanne Steele, vice president and managing director for Adobe in the UK, said.

Overall, Brits spent just 1.4 per cent less online in January compared to last year at £8bn. The figures are not adjusted for inflation, so the fall is likely to be deeper.

The UK is forecast to tumble into a long but shallow recession by the Bank of England, mainly driven by households cutting spending in response to their real incomes being eroded by a historic inflation surge.

The Bank said the rate of price rises will more than halve by the end of the year, opening the door for a recovery in consumer spending in 2024.