Eurozone money supply and lending pick up in January

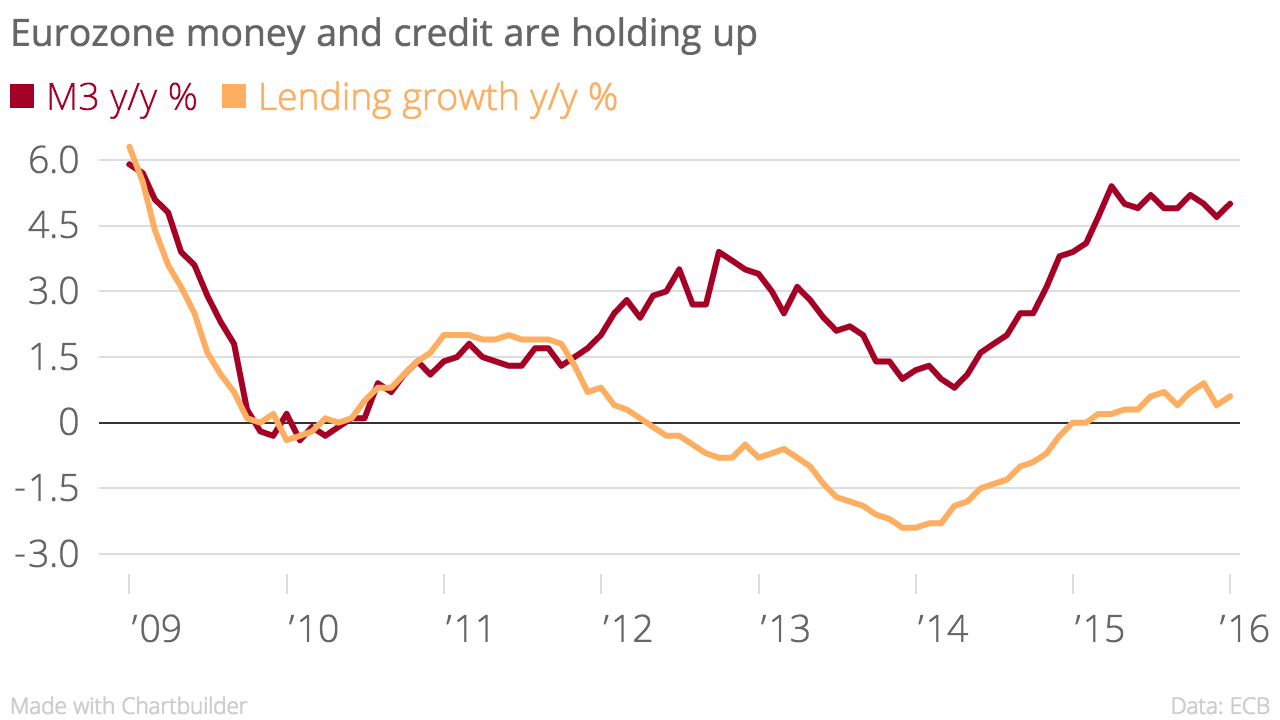

Lending and money supply growth in the Eurozone picked up in January, according to figures published by the European Central Bank this morning.

Borrowing by households climbed 1.4 per cent compared with the same month last year, the same rate as in December. However, lending to non-financial corporations bounced back to 0.6 per cent growth from 0.1 per cent in December.

The M3 money supply, which counts the notes and coins in circulation as well as electronic money in the bank accounts of Eurozone households and businesses, rose five per cent on the year. There are now €10.9 trillion (£8.6 trillion) sloshing around the Eurozone economy.

"A rebound in Eurozone bank lending to businesses after December’s sharp drop and a pick-up in money supply growth will come as some relief to the ECB [European Central Bank] after in January," said economist Howard Archer from analysts IHS.

"Nevertheless, the annual growth rate in bank lending to businesses remains low so January’s rebound is unlikely to deter the ECB from enacting further stimulus at its March meeting – especially given its concerns over prolonged negligible Eurozone inflation, low inflation expectations and stuttering Eurozone growth amid global economic concerns and financial market weakness. Furthermore, the weakness in oil and commodity prices has increased the risk that Eurozone consumer price will stay lower for longer."