Eurozone inflation plummets back below zero after renewed fall in energy prices

The Eurozone is back in deflation after only four months of positive price growth.

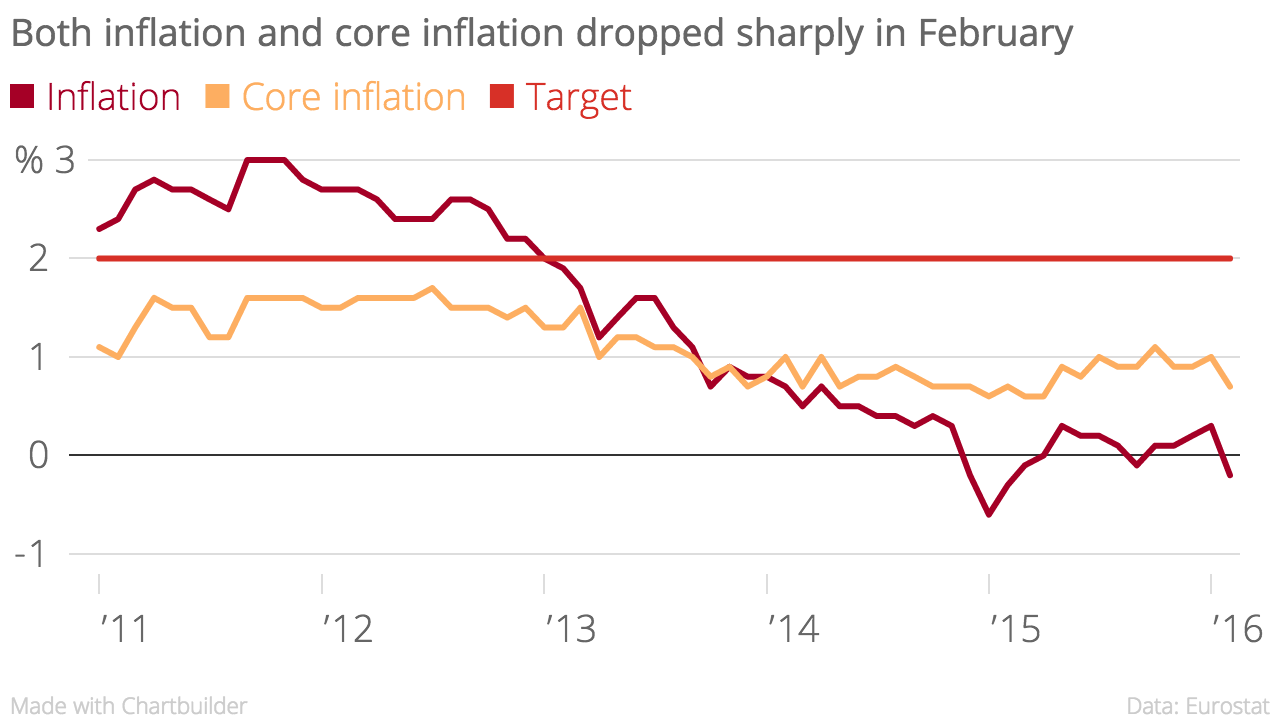

Annual inflation in the currency-bloc fell to 0.2 per cent in February, according to an early flash estimate from Eurostat released this morning. It marks a sharp drop from January's 0.3 per cent.

Core inflation, which strips out energy, food, alcohol and tobacco dropped to 0.7 per cent from one per cent in January.

The drop in inflation was down to renewed falls in energy prices. Energy price inflation was minus eight per cent in February, a sharper fall than January's minus 5.4 per cent.

The prices of services, unprocessed food and non-energy industrial goods all rose at slower rates year-on-year in February, which also dragged on the headline figure.

European Central Bank (ECB) boss Mario Draghi said the bank's policy would be reconsidered in March when ECB staff produce their latest forecasts. It was taken at the time as a big hint that the interest rate on deposits at the ECB could be cut further into negative territory and monthly asset purchases could be ramped up from €60bn (€47.2bn) a month.

"The ECB staff forecasts (due for publication next week) are likely to reveal a significant downward revision to the inflation forecast this year from December’s 1.0 per cent to closer to 0.5 per cent," said economist Jennifer McKeown from Capital Economics

"This, together with low and falling inflation expectations, should give the doves on the Governing Council plenty of ammunition. We still see the Bank announcing another cut to the deposit rate, perhaps of 20bps, and an increase in the pace of monthly asset purchases from €60bn to €80bn or so."