Eurozone growth stabilises hitting June 2011 highs

Eurozone data shows that services and manufacturing sectors are both still in expansion in September. Markit's composite purchasing managers' index is up from 51.5 to 52.1. Analysts had been expecting a rise to 51.9.

By sector, there's a jump for services from 50.7 to 52.1 (51.1 expected) and a fall for manufacturing from 51.4 to 51.1 (51.8 expected).

- German manufacturing and services sectors both see growth in September

- French service sector returns to growth in September

Commenting on the flash PMI data, Chris Williamson, chief economist at Markit said:

An upturn in the Eurozone PMI in September rounds off the best quarter for over two years, and adds to growing signs that the region is recovering from the longest recession in its history.

It is particularly encouraging to see the business situation improved across the region. Although the upturn continued to be led by Germany, France saw the first increase in business since early-2012 and elsewhere growth was the strongest since early-2011.

Employment continued to fall, though it is reassuring that the rate of job losses eased to only a very modest pace, suggesting that employment could start rising again soon.

James Howat, European economist, Capital Economics:

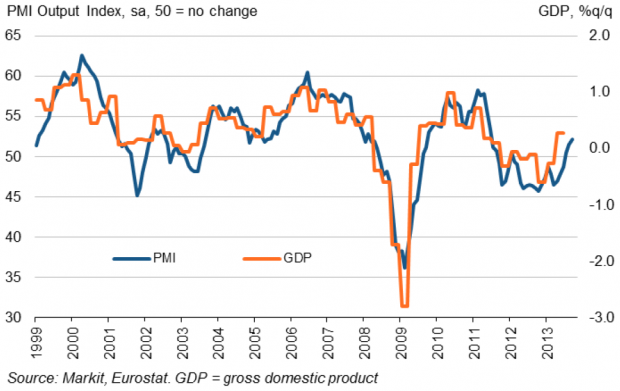

September’s rise in the euro-zone’s composite PMI suggests that the bloc’s recovery may have gathered pace in Q3. On the face of it, the index now points to quarterly growth in euro-zone GDP of around 0.4%, after Q2’s 0.3% rise.

While the PMIs point to an acceleration in GDP growth, there is a chance they may overdo it in Q3 given that they overstated growth in Q2. Indeed, disappointing recent harder data such as a renewed contraction in industrial production in July suggest that the euro-zone’s recovery still rests on fragile foundations.