Europe’s LNG terminals near full-capacity amid deepening tensions between Russia and the West

Most of Europe’s liquefied natural gas (LNG) terminals have been topped up to full capacity again, following an influx of supplies from the US.

At least half of US LNG supplies shipped in February have gone to Europe, according to the latest data from Refinitiv.

This means the continent is poised to remain the top destination for American shipments for the third month in a row.

The developments reflect a sharp turnaround from escalating supply problems during the winter, and are a welcome boost for Europe amid growing fears Russia could invade Ukraine.

Russia has denied that it plans to invade the country, but there is continued confusion over whether it is withdrawing troops from positions near Ukraine’s border or if it is in fact ramping up military activities in the region.

The US previously came to the continent’s rescue over Christmas, when prices soared to over £4 per therm amid exacerbating worries of winter blackouts.

Prices have since dipped, but remain historically significant.

LNG imports to Europe from external partners reached a record high in January, at more than 16bn cubic metres.

So far in February, it has imported a further 6.9bn cubic metres.

The US has also been holding talks with Qatar over increasing Europe’s supplies, while Japan has announced it will provide extra resources.

Brimming LNG supplies has fuelled European confidence, and EU Commission President Ursula von der Leyen was particularly defiant earlier this week, stating that the trading bloc could cope with partial disruption in Russian supplies.

Double edged sword: Unbalanced supplies restricts European flexibility as Russia continues to play games

While the LNG boost should benefit Europe, it is unclear whether the continent can processing supplies in line with the pace of fresh arrivals of emergency supplies.

LNG terminals now have limited available capacity if Russia invades Ukraine and causes further supply disruption through conflict in the region and sanctions.

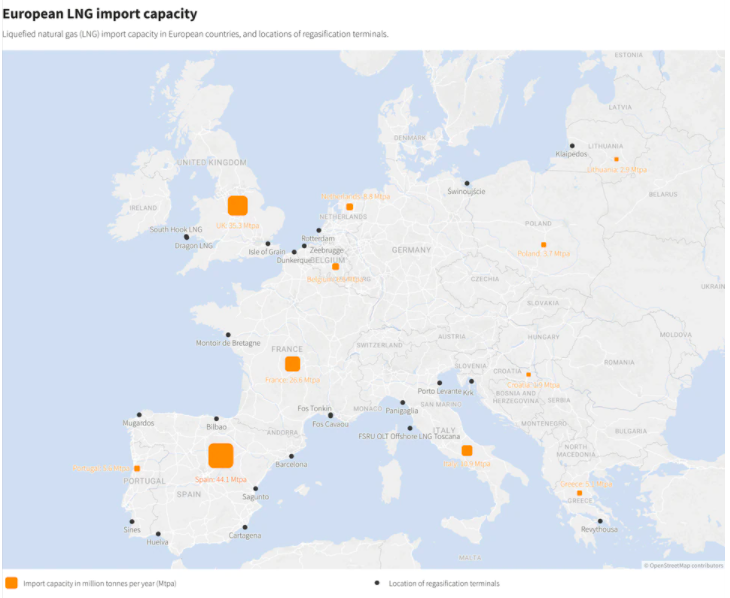

Turning LNG into usable energy is a complicated, onerous procedure, as the source needs to be regasified by transforming it from its freezing condition back into gas.

It is then transported through pipes – either directly for burning or to generation plants to make electricity.

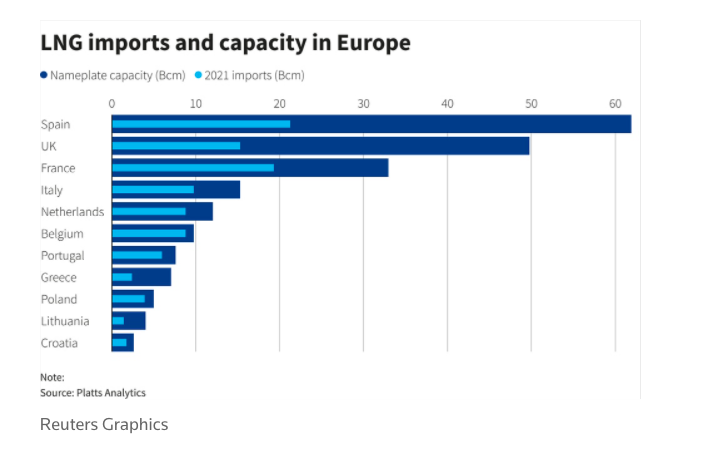

Another factor that is complicating matters is that Spain has the continent’s biggest overall LNG capacity, with six terminals.

However, the utilisation rate for the its processors was just 45 per cent in January, according to data and analytics firm Kpler.

The top-ups in LNG also reflect the unbalanced nature of its gas supplies.

Europe’s natural gas flows remain strained amid reduced exports from Gazprom and eastward movements on the Yamal-Europe pipeline.

Russia’s Finance Minister has further warned that if the country faces sanctions – it would be prepared to re-route more flows away from Europe to other partners such as China.

The country’s options to shift pipeline gas away from Europe are limited, and the EU’s reliance on Russia for 40 per cent of its natural gas is a double-edged sword for the Kremlin.

On the one hand, reports from think tank Bruegel and investment bank Stifel suggest Europe would struggle to maintain supplies in line with rebounding demand over the medium term without Russia’s supplies.

However, the EU also remains a vital customer for Gazprom – and the gas giant would struggle to make up lost income from the continent.

Russia is also continuing to play games to divide Europe, as President Vladimir Putin has invited Italian Prime Minister Mario Draghi to visit Moscow.

According to Russia’s ambassador to the country, Sergey Razov, Russia is ready to boost supplies to Italy if it needs more energy.

Razov told reporters today that Russia appreciated what he called Italy’s ‘moderate position’ regarding the crisis over Ukraine.

Italian Foreign Minister Luigi Di Maio has praised the invitation.

Europe does have its own cards to play against Russia, such as the approval process for Nord Stream 2.

The £8.4bn pipeline still awaits certification from both EU and German regulators, and would highly benefit Gazprom as it would double exports of natural gas from Russia to Germany.

If the pipeline was rejected, it would be a huge blow for the Kremlin-backed company, and deeply humiliating for Putin.