European inflation falls quicker than expected but recession fears will weigh on likely ECB rate hikes

Inflation in Europe is falling faster than expected, but there are signs the worldwide price surge that is set to bring on a global recession may not be finished just yet, official figures out today reveal.

A flash estimate by stats agency Eurostat for the rate of price increases in the eurozone came in at 9.2 per cent in December, lower than market expectations of 9.5 per cent.

The rate is down from just over 10 per cent.

The new numbers add to the growing body of evidence indicating the strong inflation rise over the last 12 months is in the early stages of unwinding.

Across the Atlantic, inflation in the US has been steadily falling from a peak of 9.1 per cent in June and is now running at just over seven per cent.

But, there were signs within Eurostat’s figures that underlying inflationary pressures are sticking around.

Core prices – seen as a more accurate measure of true inflation – climbed to 5.2 per cent in December, the highest since records began.

That hotter than expected number is likely to embolden the European Central Bank (ECB) to commit to its pre-Christmas promise that it will keep raising interest rates aggressively this year.

“Core inflation will probably fall more gradually due to the resilience of demand, shortage of components and equipment, and rising nominal wages,” Andrew Kenningham, chief Europe economist at Capital Economics, said.

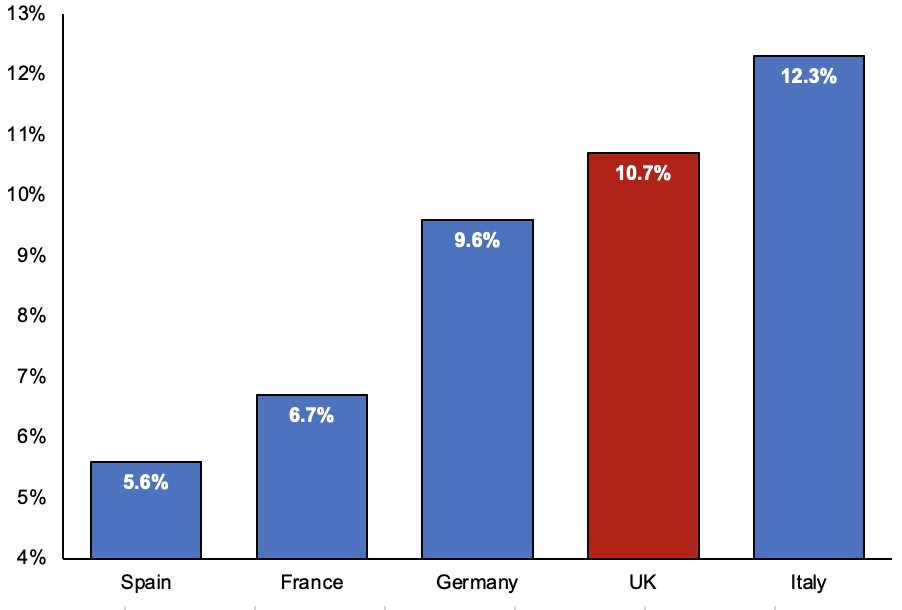

Italy is ahead of UK in European inflation league table

Its chief, Christine Lagarde, told investors to expect the central bank of the 20 countries using the euro further 50 basis point increases.

The ECB last year signed off its first rate rise in more than a decade and took rates firmly into positive territory to tame a record inflation problem. They had been negative for several years.

The ECB will announce its next decision on rates on 22 February.

Soaring energy prices caused by Russia’s invasion of Ukraine has led economists to predict Europe is headed for a recession. The bloc has relied on cheap energy from Putin for decades to power its economy.

Oil and gas prices have dropped sharply in recent weeks, driven by mild winter in Europe and countries replacing Moscow energy supplies with imports of liquified natural gas.

However, because firms buy energy supplies in advance of deliveries, they are still likely to have been hit by the price surge.

The euro was broadly flat against the US dollar on the news, as was the pan-European Stoxx 600 index.