European factory ‘summer slump’ continues through August

European factory activity stagnated further in August, as a gloomy spell for companies was extended by a continued fall in demand.

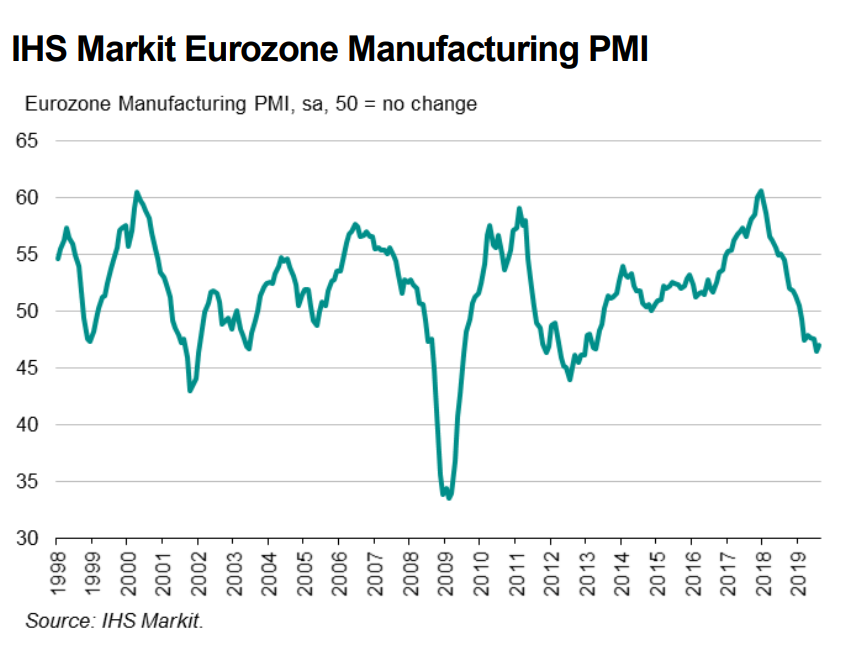

Manufacturing output fell for the seventh month in a row, according to IHS Markit’s Purchasing Managers’ Index (PMI), a closely-followed measure of sector activity. Economists recorded a PMI score of 47, where anything below 50 indicates a contraction.

Read more: Car industry investment grinds to a halt as Brexit uncertainty cripples sector

The results makes it more likely that the European Central Bank (ECB) goes ahead with monetary easing next week.

The ECB all but promised to ease policy further at their July meeting, as the bloc’s growth outlook gets worse. A further escalation in the US- China trade war yesterday has increased fears of a global economic slowdown, which would hit Europe’s already embattled manufacturers hard.

“Eurozone producers are suffering as the summer slump in factory production persisted into August. A marked deterioration in optimism about the year ahead suggests companies are expecting worse to come,” noted IHS Markit chief business economist Chris Williamson.

New orders fell for an eleventh month, and firms continued turning to completing backlogs of work to stay active.

German economy still ‘facing headwinds’

Germany, Europe’s biggest economy, suffered the steepest decline, as the weakening demand pushed companies to scale back production and cut jobs.

This too improved slightly, rising slightly to 43.5, after a seven-year low in July.

Germany’s manufacturing sector drives its export-led economy, accounting for roughly one-fifth of it.

Trade credit insurance firm Euler Hermes senior economist Katharina Utermoehl said: “The latest PMI reading is more evidence of the headwinds facing the German economy.

Read more: Eurozone manufacturing output sinks to lowest level since 2012

“We expect to see the manufacturing sector continue to be held back by the ongoing weakness in exports – in particular to the UK – and the persistent problems in the German car industry.

“Moreover it is worrying that the industrial weakness is increasingly weighing on domestic demand, with private consumption and construction investment largely responsible for keeping the German economy afloat up until now. Due to the weak start to the third quarter, the risk of recession now looms large.”

(Main image: Getty)