European chemical companies could take a hit as valuations decline amid soaring commodity prices

Investment guidance for European chemicals companies is too optimistic, with Russia’s invasion of Ukraine likely to stretch out the current inflationary environment for raw materials, warned financial services group Morningstar.

The report, published by equity analyst Rob Hales and seen by City A.M., suggested that the valuations of European chemical stocks could plummet in the second half of the year.

In particular, no-moat companies (firms with no specific market advantage) are likely to find it difficult to pass on rising input costs to continue operations.

The chemicals sector includes products that are used across the economy from pesticides to consumer goods.

Increasingly, they are struggling to swallow higher commodity prices, which have boomed amid soaring energy costs this year.

The expectations of European Union sanctions on Russian oil has raised the prospect of further supply disruptions and uncertainty in a global market still recovering from the pandemic.

There is also the additional headwind of higher interest rates, as central banks struggle to tame inflation.

Hales argued a combination of investor liquidity and the appeal of defensive assets powered the chemical sector during the pandemic and the early stages of economic recovery.

It meant companies could offset raw materials with price increases – which buyers are now increasingly hostile to.

The analyst told City A.M. this meant the performance of chemical companies had become divorced from their fundamental performance.

He said: “It’s based on investors’ willingness to pay a higher multiple for their earnings because there’s a crisis time, and they are more attracted to defensive companies. So, they are prepared to pay higher multiples in a lower interest rate environment.”

While nearly all European chemical companies met or beat guidance in 2021, he believes the conflict in Ukraine will dim the formerly positive outlook for this sector – and that this is already being reflected in lowering stock prices.

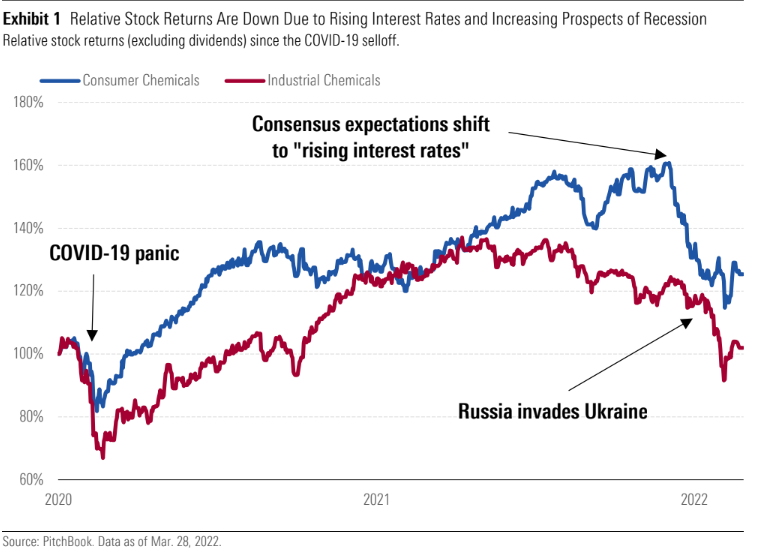

Hales noted that relative stock performance across the chemical sector had declined precipitously in 2022 for consumer and industrial companies, with prices now reverting to pre-COVID-19 levels.

He said: “With interest rates rising now, with a generally coordinated consensus among central banks around the world, we’re seeing those stock prices come down.”

As for potential stock picks Morningstar considers best placed to navigate the difficult headwinds, Hales favours biological sciences group Christian Hansen and industrial chemicals group Lanxness due to their more realistic current valuations in contrast to their competitors.