European Central Bank could be forced into 75 basis point hike to tame record inflation

The European Central Bank could be forced to hike interest rates by a historic 75 basis points next week to tame the largest inflation surge on record, economists bet today.

The monetary authority governing the 19 countries using the euro may have to respond strongly or risk elevated prices being embedded into the bloc’s economy over the long run, according to experts.

Inflation surged to 9.1 per cent this month, the highest level since the creation of the single currency in 1999, higher than analysts’ expectations and up from 8.9 per cent, new figures published today by Eurostat reveal.

A firming in price pressures across the single currency area “will add to the pressure on the European Central Bank to step up the pace of tightening,” Jack Allen-Reynolds, senior Europe economist at Capital Economics, said.

“The balance of probabilities is shifting towards a 75 basis hike next week,” he added.

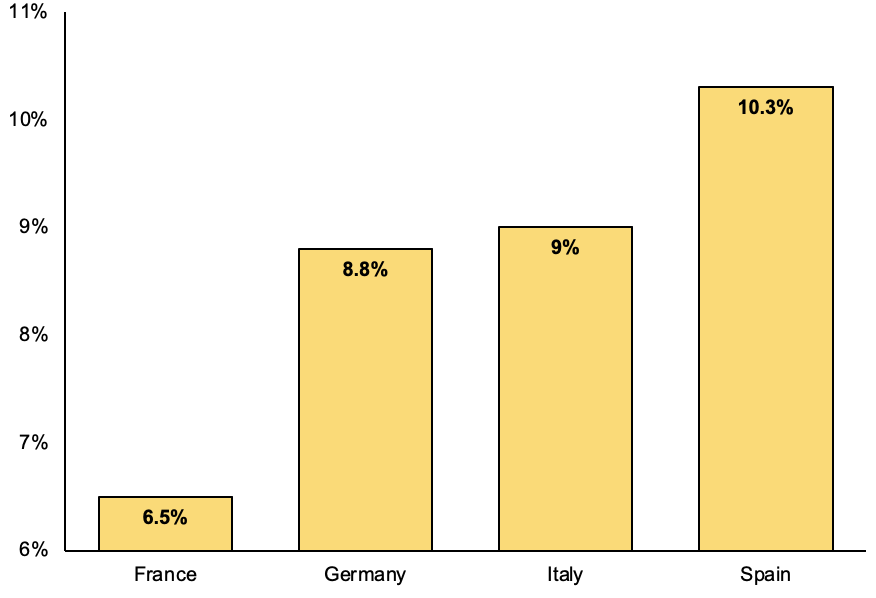

Major eurozone economies’ August annual inflation

Europe is facing the daunting prospect of high inflation sticking around for months due to its decades-long heavy reliance on Russia for cheap gas crashing to an end.

President Putin has squeezed gas flows to the Continent in response to Western sanctions over Russia’s invasion of Ukraine.

Energy prices have climbed to new highs, driven by traders fretting over European countries jacking up gas prices by scrambling to other providers to fill lost Russian inventories.

Moscow shut down the gas pipeline Nord Stream I today to conduct maintenance work, it insists. Traders think the Kremling will keep the pipeline closed.

Gas prices dipped from their peaks yesterday after Germany reportedly received bigger inflows, pushing the country close to its storage targets.

The ECB is trailing its central banking counterparts, the Bank of England and Federal Reserve, in lifting rates to a more appropriate plane.

President Christine Lagarde and co shocked markets last month after they marked their first rate rise in over a decade with a 50 basis point increase, taking borrowing costs to zero per cent.

Before that move, eurozone rates had been negative since 2014.

The Bank of England has hoisted rates six times in a row to 1.75 per cent, the highest since 2009, including a 50 basis point rise earlier this month, the biggest in over a quarter of a century.

Across the pond, Fed chair Jerome Powell and the rest of the federal open market committee have hiked rates 225 basis points since March, the fastest tightening cycle since the early 1980s.

Wall Street analysts think the Fed will lift rates 75 basis points for the third time in a row at its next meeting in the middle of September.