Europe will struggle to cut Russia out of energy plans warn experts

Experts have warned the continent will struggle to wean itself off Russian gas, and the European Union (EU) will be deeply vulnerable to rocketing gas prices if it completely cuts off access to Kremlin-backed fossil fuels.

Natural gas prices have soared to record levels across both the UK and Dutch benchmarks following Russia’s invasion of Ukraine, amid escalating fears of supply shortages and disruption.

The EU still relies on Russia for around 40 percent of its natural gas supplies.

While heavy Western sanctions have so far avoided energy-specific measures – the possibility of escalation, Russian retaliation and conflict driven disruption continue to influence market behaviour.

Earlier this week, the International Energy Agency (IEA) unveiled a ten point plan last week to mitigate the EU’s reliance on Russian gas.

Its list included calls for heavily ramping up renewable investment, no more deals with Gazprom, and minimum storage obligations.

However, Chris Wheaton, energy analyst at investment bank Stifel, raised doubts over whether the suggestions would be effective in the short term.

Commenting specifically on IEA calls for further renewable investment, he argued it would take too long for its plans to reduce Europe’s reliance on Russia.

Speaking to City A.M., he explained: “There is limited additional manufacturing capacity for renewables or solar, and the lead times of projects make it hard to accelerate developments within the next 12-18 months. The IEA just put out as 10 point plan for reducing reliance on Russian gas. One of the points in the report was a call for additional subsidies. For rooftop solar: which is the quickest and cheapest solar to install, you could offset 0.5 per cent of Europe’s gas consumption for €3bn. This is unattractive economics.”

The analyst further cautioned that oil prices could spike to a record $200 per barrel if the West cuts off Russian production entirely.

Alongside the urgency of the situation in Ukraine, Gazprom flows have dwindled to decade lows within EU storage over the past six months, with the state-supported gas giant seemingly missing its output targets to the bloc last year.

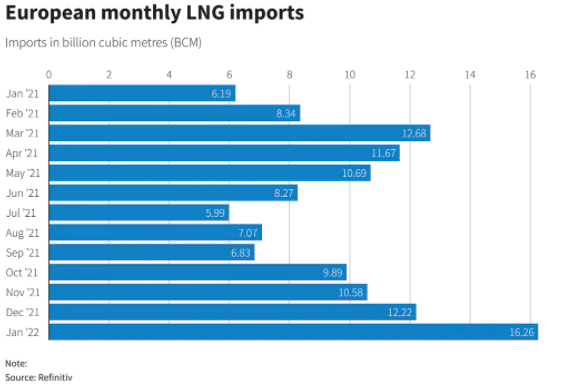

The EU staved off blackouts and energy shortages over the winter chiefly through a fortunate combination of warm winter weather and top-ups in liquefied natural gas (LNG) from the US.

Following Russia’s invasion of Ukraine last month, the West has imposed heavy economic sanctions on Russia, but have so far avoided energy-specific measures – wary of the bloc’s reliance on Russian supplies.

European think tank Bruegel has previously warned the EU would struggle to deal with more than a short-term supply shock from Russian gas flows, while prior to the conflict in Ukraine, EU Commission President Ursula von der Leyen has only suggested the bloc could deal with partial disruption from Kremlin-supported supplies.

Europe scrambles for more supplies amid escalating crisis

UK industries are already bracing for rising energy costs, with Squeaky revealing to City A.M. last month that the retail sector is especially threatened, as it is more difficult for such businesses to mitigate the issue by raising their prices.

Meanwhile, Dr Richard Connolly, a Russian economy expert at the Royal United Services Institute, told The Telegraph large swathes of energy-intensive industry in Europe are “only competitive if it has access to cheap natural gas”.

Commenting on the consequences of potential shortages in Russian supplies, Connolly said: “This has the threat of undermining the entire industrial model in the heart of Europe and that’s why they’ve been reluctant to do anything in the past.”

The EU has been working with the US in recent months to diversify its supplies through deals with other countries.

Alongside gaining LNG boosts from the US and commitments from Japan, it has has dropped regulatory action against Qatar Petroleum as it seeks deals new gas arrangements.

However, it has so far failed to make new agreements, with Asian economies sealing long-term LNG agreements to meet rebounding post-pandemic demand ahead of European buyers.

Ole Hansen, head of commodities at Saxo Bank, City A.M. argued that while Europe seems to have overcome issues this winter, there are still question marks over how it will ready itself for more difficulties later this year.

He said: “Europe at this point without gas from Russia will be a major challenge, but luckily spring and lower heating demand is just around the corner, and that could see the region scrape through but it still leaves a big question mark over next winter, and how to rebuild storage to a comfortable level.”

Hansen noted that Germany has opened up the possibility of using more coal, slowing down moves to phase out the energy source, while Chancellor Olaf Scholz has recently made commitments to building new LNG terminals and maintaining storage at much higher capacity levels ahead of next winter.

Greg Jackson, chief executive at Octopus Energy praised Germany’s response, and suggested it could reduce fears of continued elevations in energy prices.

He told City A.M. “Germany made a major intervention, decreeing that its gas storage needs to be 90 per cent full going into next winter. In the short term that will put further upward pressure on prices, because there’s going to be a requirement to find that gas against German storage. But of course, the impact of that will be that you could see lower prices in winter because German storage was way below 90 per cent going into the winter we just had.”