Euro at two-year low after hint of early Xmas present

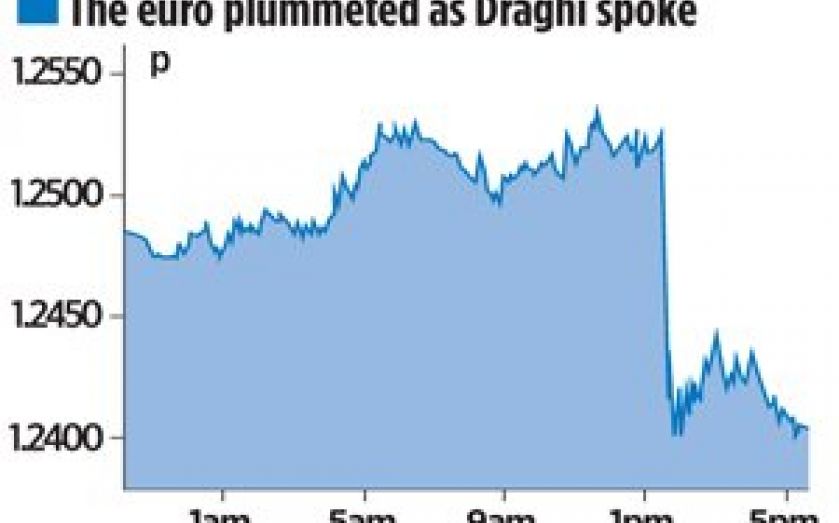

THE EURO fell to a two-year low and stocks were buoyed yesterday after European Central Bank (ECB) chief Mario Draghi signalled that quantitative easing could soon become a reality.

“The Governing Council has tasked ECB staff and the relevant committees with ensuring the timely preparation of further measures to be implemented,” Draghi said during his press conference.

Draghi was speaking after the governing council – the group that decides on ECB action – kept interest rates at record lows.

The euro dipped to just below $1.24, its lowest value for two years, having been as high as $1.252 just minutes earlier. The German Dax and French Cac stock indices made day gains of 0.66 and 0.46 per cent respectively.

Draghi struck further dovish tones (doves support looser policy) when he maintained that the ECB’s balance sheet size should reach that which was seen at the beginning of 2012. The target implies that Draghi is planning approximately €1 trillion of asset purchases.

Two weeks ago, the ECB began purchasing covered bonds – bonds backed typically by pools of mortgages – in order to inject liquidity into the banking system.

Soon the ECB will begin purchasing asset-backed securities – groups of mortgages packaged together. Full QE is considered to be the purchase of only government bonds.

Draghi also attempted to quell fears of dissent among ECB policy makers. “The governing council is unanimous in its commitment to using additional unconventional instruments within its mandate,” he said.