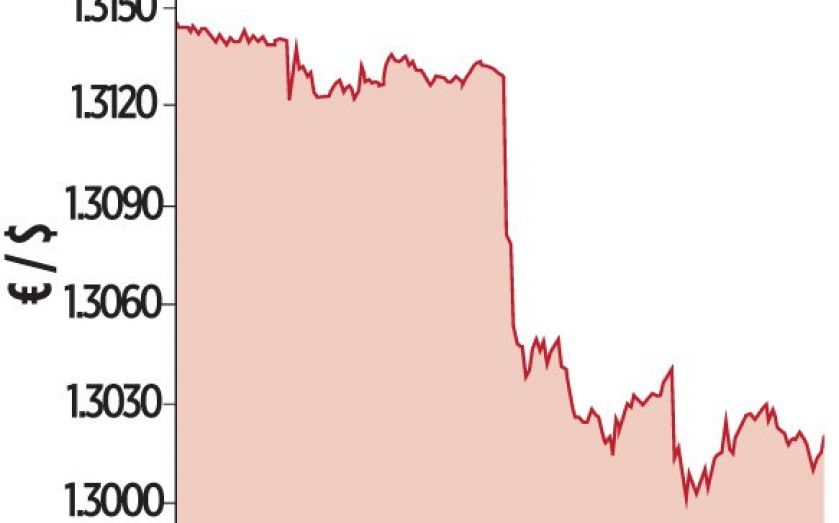

Euro tanks after Draghi unveils surprise stimulus

THE EURO took a nosedive yesterday after central bank chief Mario Draghi surprised markets with a new wave of dovish policies designed to help save the ailing single currency area.

Interest rates were cut to fresh record lows, while Draghi’s European Central Bank (ECB) will also try to boost credit conditions further by snapping up asset-backed securities and covered bonds.

Around €500bn (£396bn) could be pumped into markets over three years, with details to be unveiled officially next month.

Draghi again stopped short of launching a programme of sovereign bond purchases, yet traders were nonetheless caught out by the unexpected level of stimulus set out.

The euro collapsed against the US dollar, sinking below $1.30 for the first time in 14 months. The single currency, used by 18 European states, also dived against sterling, falling to around 79.3p last night.

Economists were divided on whether Draghi’s actions were the start of more easing to come, or merely his latest attempt to avoid sovereign bond purchases. “A wall of money is heading the way of financial markets, courtesy of Frankfurt, and probably over the objections of Berlin,” said Fathom Consulting. “This is not the end but the beginning of the process of quantitative easing (QE) – more is coming.”

Draghi revealed that senior members of the ECB were split over the action. “Some of our governing council members were in favour of doing more than I’ve just presented, and some were in favour of doing less. So our proposal strikes the mid-road.”