Euro plummets as Mario Draghi opens the door for more easing in March

Eurozone monetary policy could be loosened further in March, European Central Bank (ECB) chief Mario Draghi has suggested.

The euro immediately dropped 0.6 per cent against the dollar. European stocks shot up, with the German Dax rising over one per cent, building on earlier gains. The French Cac 40 also jumped an extra one per cent after a positive start to the day.

"Yet, as we start the new year, downside risks have increased again amid heightened uncertainty about emerging market economies’ growth prospects, volatility in financial and commodity markets, and geopolitical risks," he told journalists after the ECB decided to leave its interest rates unchanged. He said:

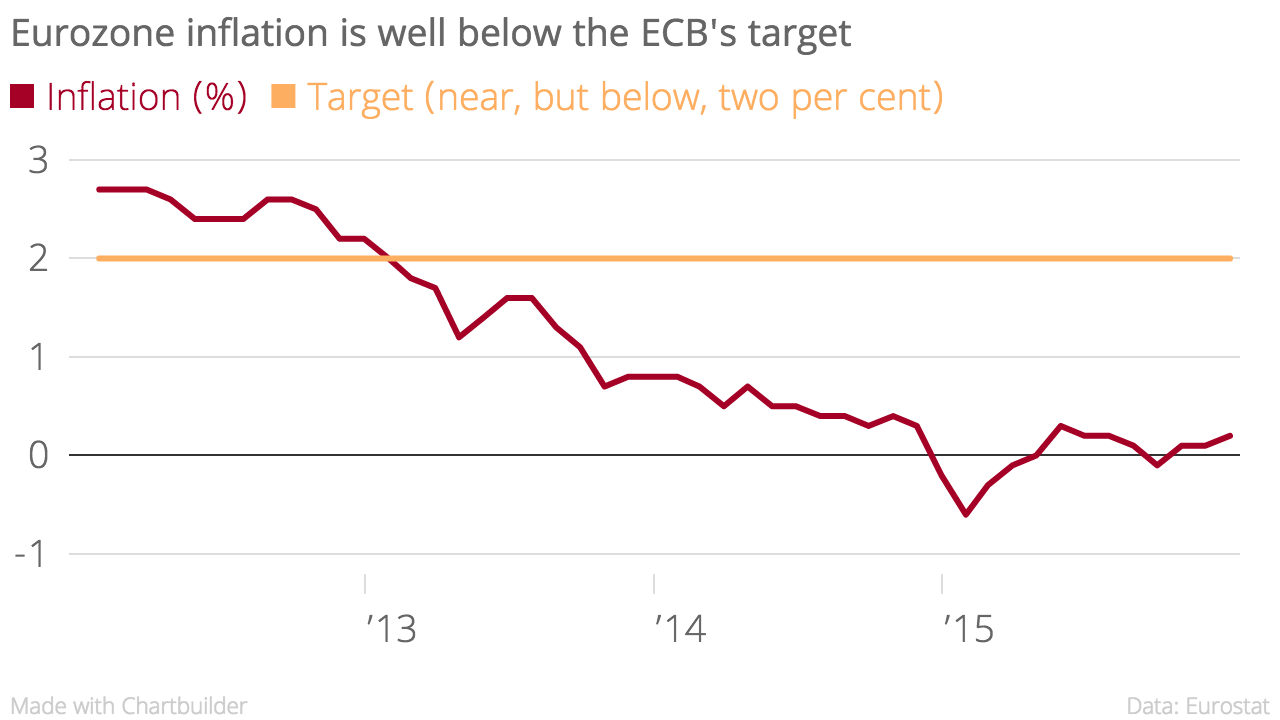

In this environment, euro area inflation dynamics also continue to be weaker than expected. It will therefore be necessary to review and possibly reconsider our monetary policy stance at our next meeting in early March, when the new staff macroeconomic projections become available which will also cover the year 2018.

He added that the decision to extend asset purchases to March 2017 were fully appropriate and will result in a significant addition in liquidity to the banking system.

"In short, there is some wriggle room for March's policy decision," said economist Ken Wattret from BNP Paribas.

"The sensitivity to low inflation and downside risks is evidently very high and the signalling from today's press conference has been very dovish accordingly."

Holger Schmieding, chief economist at Berenberg Bank, said:

In December, the ECB council did not grant Draghi all the easing that he had apparently asked for. In March, Draghi wants to try again. With new downside risks to economic growth and a significant drop in oil prices depressing the near-term outlook for inflation, chances have risen that the council may then agree to an additional stimulus.

Some economists are now betting on a rate cut in March and boost to the asset purchase programme.

"He [Draghi] went further than we expected and we now believe that the new package that we predicted for June could be presented in March, including another depo rate cut and an adjustment of QE, but it will likely depend on developments between now and March," said Philippe Gudin from Barclays.

"We had previously expected further easing from the ECB in June. But in light of today’s dovish rhetoric from Mr Draghi we have pulled forward the timing of that forecast for further easing to March," said economists Andrew Cates and Waylon Sittampalam from RBS.

"The ECB will naturally keep a close eye on the incoming economic data in the period ahead in deciding whether or not to act again in March. We suspect that the data for both growth and inflation will undershoot consensus expectations in the coming weeks."

They added that they believe the deposit rate will be cut to minus 0.4 or 0.45 per cent in March with the rate of asset purchases lifted by €10bn a month.