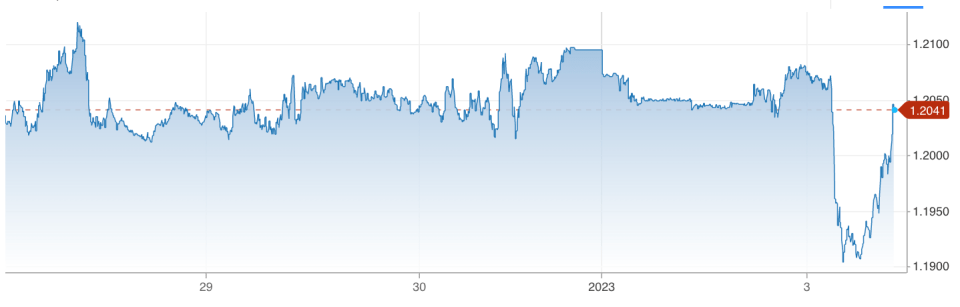

Euro on course for worst day since September in poor start to 2023

The euro has kicked off 2023 poorly, with investors ditching the common currency and flooding back into the US dollar.

The currency used by the now 20 countries that make up the eurozone after Croatia joined the union earlier this month was on track for its steepest drop against the greenback since September last year during late afternoon trading.

The euro shed as much as 1.3 per cent against the dollar to stumble to $1.05, its lowest level since mid-December, but has since recovered and is now down around 0.7 per cent.

Traders are bracing for the European Central Bank (ECB) to keep raising interest rates aggressively this year after its chief, Christine Lagarde, and other members of the governing council at the tail end of 2022 signalled it was not yet close to the end of its tightening cycle.

Last year, the ECB signed off its first rate bump in more than a decade, breaking free from years of ultra loose policy.

Rates on the continent had been negative for several years before 2022’s policy pivot.

However, fresh German inflation data out today revealed the rate of price increases fell much sharper than market expectations to 9.6 per cent last month, prompting investors to reassess how forcefully the ECB will have to tweak borrowing costs.

“The regional German December CPI prints out this morning were far weaker than expected ahead of the national number this afternoon – adding to the ‘peak inflation’ narrative that will soon have the market second guessing the ECB’s relative hawkishness if that development deepens,” John Hardy, head of FX strategy Saxo Bank, said.

The dollar raced ahead of the world’s major currencies last year, driven by the US Federal Reserve hoisting rates much faster than its peers, including four back-to-back 75 point rises.

The world’s most important central bank then slowed the pace of hiking campaign to 50 points, but is expected to continue at that clip in the first few months of this year.

Higher interest rates tend to strengthen a country’s currency by making assets denominated in said currency relatively more attractive.

The greenback rally lost some steam at the end of the year, but the first trading day on most of the world’s top markets this year indicates the currency’s rise may yet have some legs to run this year.

The Wall Street Journal’s dollar index, which compares the greenback against a basket of major currencies such as the euro and pound, climbed nearly one per cent today.

Pound sterling tumbled nearly one per cent against the dollar during early exchanges, but has since recovered.

Pound/USD exchange rate