EU finalises compromise deal to cut gas usage ahead of winter

European Union (EU) member states have settled on a diluted emergency plan to curb gas demand this winter, amid shortages in supplies from Russia and escalating fears that Gazprom turns off the taps.

The continent is already braced for a painful gas squeeze from tomorrow, when Kremlin-backed energy giant Gazprom plans to reduce flows through the Nord Stream 1 pipeline to Germany to just 20 per cent of capacity.

Prior to ten days of maintenance, flows were only at 40 per cent of expected capacity.

It has also cut flows into 12 EU member states – and demanded that overseas ‘unfriendly’ companies pay for gas in roubles.

Gazprom has blamed its latest reduction on needing to halt the operation of a turbine – a claim dismissed by EU energy chief Kadri Simson, who called the move “politically motivated”.

The deal follows weeks of negotiations and an initially hostile response from EU member states opposed to potentially binding cuts on gas during the coldest months of the year.

This includes Spain, which does not rely on Russian gas, and has argued that cutting its own demand would not help other countries since it lacks infrastructure capacity to share spare fuel.

Greece end Poland were also among the most vocal countries to oppose mandatory gas cuts – with both voicing disagreement with the idea of industrial gas curbs to help members facing shortages.

Measures compromised by bevy of opt-outs

Energy ministers have now approved plans for all EU countries to voluntarily cut gas usage 15 per cent from August to March, however there are a bevy of reductions and opt outs for member states.

This includes Ireland and Malta, which are not connected to other EU countries’ gas networks.

Meanwhile, member states that meet an EU target for filling gas storage up to 80 per cent by August could face weaker targets – softening the cuts for roughly a dozen states, including Germany and Italy, based on current storage levels.

Countries can also exempt the gas they use in critical industries, such as energy-intensive steelmaking, from the target.

In addition, nations with a limited ability to export gas to other EU countries can request a lower target, provided they export what they can.

Despite the compromises, the deal was backed by European Commission President Ursula von der Leyen, who described the plans as “decisive step” against Russian aggression.

Germany’s Economy Minister Robert Habeck believed the agreement would show Russian President Vladimir Putin that Europe remained united in the face of Moscow’s latest gas cuts.

“You will not split us,” he said.

However, Ireland has raised doubts over whether the plans are sufficiently radical in the face on Russian disruption.

“Fifteen percent will probably not be enough, given what the Russians have just announced,” said Irish Environment Minister Eamon Ryan said.

Russian disruption causes gas prices to spike

This is not the first example of sanctions being watered down by the EU after negotiations, with the long-awaited oil ban finalised last month only including seaborne shipments.

While multiple nations including Germany – Europe’s biggest gas user – have upped their energy saving measures, the EU has only have reduced its combined gas use five per cent, despite months of soaring prices and dwindling Russian supplies.

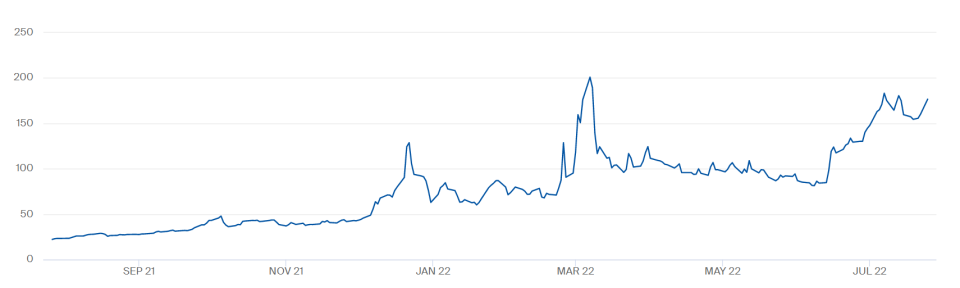

Russia’s latest move to reduce gas flows into Europe has caused prices to spike 13 per cent on the Dutch TTF Futures benchmark, adding to the cost to fill storage ahead of the cold winter months.

Earlier this month, the International Energy Agency warned Europe would need to top up its supplies to at least 90 per cent to avoid blackouts and supply shortages if Russia cuts off supplies entirely.

Currently, supplies are at around 66 per cent of storage across the bloc.

The bloc is also increasingly reliant on the US, which has provided a whopping 15bn cubic meters of LNG since March, according to data from Refinitiv, which was originally the White House’s pledge for the whole year.