Ethereum’s Merge Approaches as Crypto Adoption Surges in Brazil

Data from CryptoCompare shows that the price of Bitcoin initially moved down at the start of last week, dropping from $22,000 to $21,000. BTC then quickly surged to retest the $25,000 resistance, and has since corrected to $23,200.

Ethereum’s ether, the second-largest cryptocurrency by market capitalization, started the week at $1,500 and after an initial drop to $1,300 it quickly rose to $1,700. ETH is, at the time of writing, still hovering around that mark.

Over the past week, new developments were made associated with Ethereum’s long-awaited Merge upgrade, which describes the network’s current mainnet merging with the Beacon Chain’s PoS system, setting the stage for future scaling upgrades including sharding. The move is expected to reduce Ethereum’s energy consumption by 99.95%

A number of testnet – essentially testing environments – have been undergoing merge upgrades before the main Ethereum network scales to a PoS system. Tim Beiko, an Ethereum protocol support engineer at the Ethereum Foundation, made a projection the mainnet merge could occur in September at a PoS Implementers Call. Beiko has noted that the Merge timeline is very likely to change over time.

Ethereum’s final testnet merge has been scheduled to occur in early August. The new testnet comes shortly after the Sepolia testnet successfully activated its Proof-of-Stake (PoS) consensus mechanism and will precede the mainnet Merge.

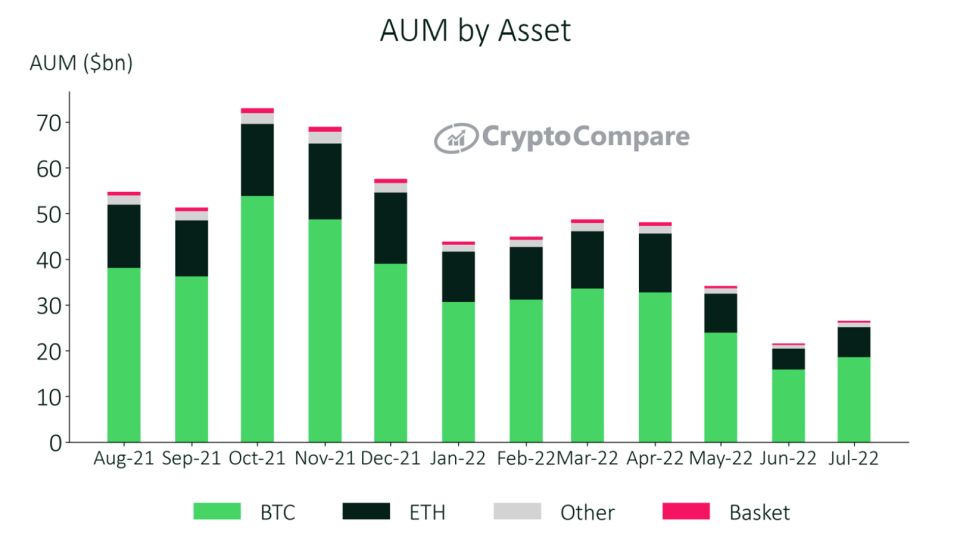

Ethereum’s performance last month has seen Ethereum-based cryptocurrency investment products lead a bounce-back in the assets under management of digital asset investment products, with Ethereum-based products seeing their AUM rise 44.6% to $6.57 billion, according to CryptoCompare’s Digital Asset Management Review.

Ethereum’s rival smart contract network Solana is set to have its own retail store in New York City called Solana Spaces, thanks to the organization behind the network, the Solana Foundation. The move comes shortly after Solana announced plans to create and launch its own Android smartphone.

Crypto Adoption Grows in Brazil

Several headlines coming out of Brazil made it clear cryptocurrency adoption is growing exponentially in the country. For one, Brazil’s largest digital bank by market value, Nubank, has reached 1 million users on its cryptocurrency trading platform merely a month after launching it in June. The company hoped to reach the milestone within a year of launching the platform, Nucripto.

Nucripto quickly became available to Nubank’s 46.5 million users in June, allowing them to buy and sell bitcoin and ether through a crypto-trading and custody service provided by Paxos’ blockchain infrastructure.

Last month, Brazil’s largest private bank, Itaú Unibanco, said it plans to launch an asset tokenization platform that transforms traditional finance products into tokens. In December Mercado Libre, Latin America’s largest e-commerce company started allowing users in Brazil to buy, sell, and hold cryptocurrencies.

Seemingly in response to Itaú Unibcanco, Santander Brazil is looking to offer cryptocurrency trading to clients in the coming months. The bank plans to launch crypto-related services and provide further news on the initiative in its next earnings release.

Meanwhile, in the United States, Nasdaq-listed cryptocurrency exchange Coinbase is facing a probe from the Securities and Exchange Commission (SEC) into whether it improperly let its users trade digital assets that should have been registered as securities.

The regulator has been investigating some of the tokens listed on the exchange and recently alleged that seven cryptocurrencies listed on it were securities, in an unrelated insider trading case brought against a former product manager at the exchange.

Notably, Coinbase’s new derivatives unit is seeing retail traders pour into its “nano” bitcoin futures product (BIT), which recently saw volumes hit record highs for three straight. Each BIT contract represents 1/100th of a bitcoin and is available on a number of different retail brokers, including NinjaTrader, EdgeClear, Wedbush, Ironbeam, and Tradovate.

Moreover, a new bipartisan bill is looking to change how cryptocurrency transactions are taxed in a bid to exempt digital asset transactions of $50 or less from capital gains taxes. The bill is being sponsored by Senators Pat Toomey, R-PA., and Kyrsten Sinema, D-Ariz.

The bill is called the Virtual Currency Tax Fairness Act and would prevent the IRS from collecting taxes from retail traders when the asset in question appreciates less than $50.

Tether Cut Commercial Paper Reserves by 88%

Leading stablecoin issuer Tether has said it holds no Chinese commercial paper and detailed that it reduced its commercial paper exposure by $4.7 billion since the start of this month, meaning it now holds 88% less than the $30 billion it had in July 2021.

According to a statement Tether put out, it currently holds $3.7 billion worth of commercial paper, with no Chinese commercial paper holdings. Commercial paper is a form of short-term unsecured debt.

While business in the cryptocurrency space slowed down over the recent market downturn Vidente, the owner of the South Korean cryptocurrency exchange Bithumb, has said it held discussions about a possible sale of its stake to Sam Bankman-Fried’s crypto trading platform FTX.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.