Ethereum upgrade incoming, but crypto markets continue sideways

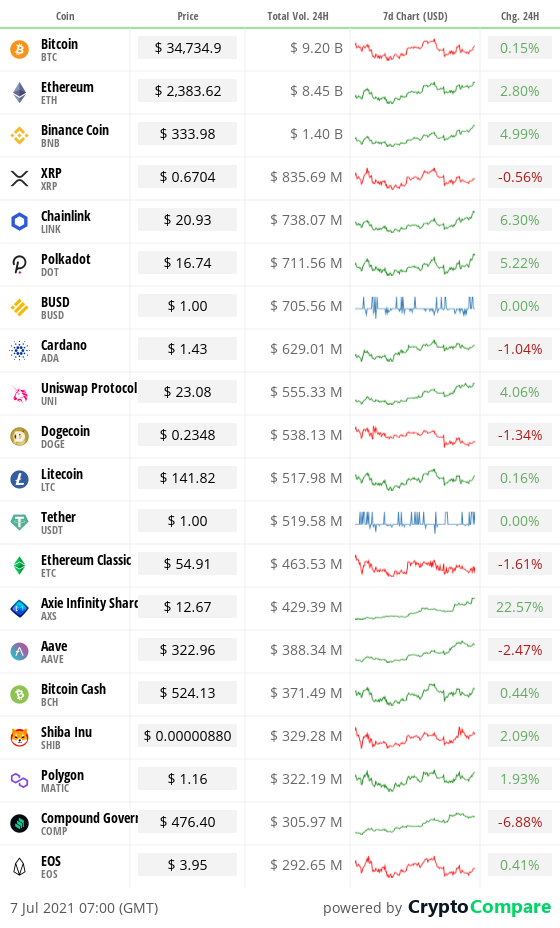

Crypto at a glance

The crypto markets continued to drift sideways yesterday, with Bitcoin again failing to break past $35k but holding strong at $33k. The short-term volatility is now down to a two-month low and is approaching the lows of 2021, according to an Arcane Research report released yesterday.

The report also notes that it was a similar story last July. Are we setting up for another sideways summer month? Or is this the calm before the storm?

It’s a similar pattern everywhere this morning, with swings of just one or two per cent in either direction for the likes of Ethereum and Cardano too. The big news yesterday was that Ethereum’s long-awaited London hard fork is likely to launch on August 4.

The upgrade has been long awaited by the Ethereum community, and is expected to have a number of changes to the way the network operates. This includes the introduction of a “base fee” structure in order to control the rapid surge in ETH gas fees.

The upgrade will also see the introduction of EIP-1559, which will see a portion of the fee collected from Ethereum users burned to control supply. This is something institutional investors seem particularly bullish on, as it will increase its credentials as a store-of-value. Saxo Bank’s cryptocurrency analyst Mads Eberhardt said in a note on Monday that “The London update also puts pressure on the store-of-value narrative in regards to Bitcoin, as the Ethereum inflation will likely fall to the level of Bitcoin, while the Ethereum network is having a higher demand for transactions.”

Will they be proved correct?

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

Yesterday’s Crypto AM Daily in association with Luno…

In the markets

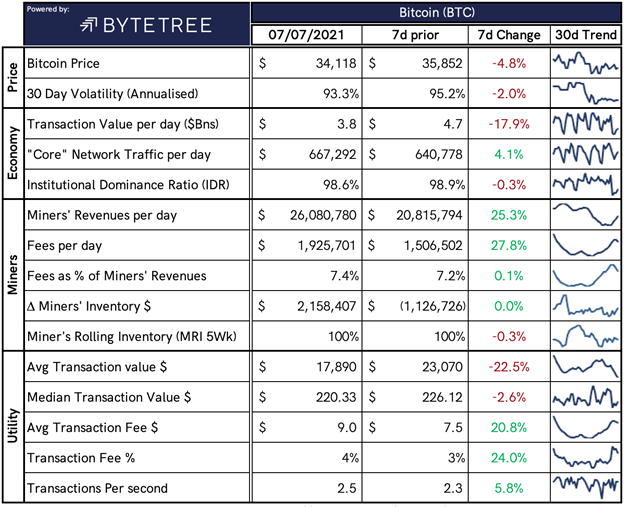

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1,476,329,521,324.

What Bitcoin did yesterday

We closed yesterday, July 6 2021, at a price of $34,235.19, up from $33,746.00, the day before.

The daily high yesterday was $35,038.54 and the daily low was $33,599.92.

This time last year, the price of Bitcoin closed the day at $9,758.85. In 2019, it closed at $11,450.85.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $650.96 billion. To put it into context, the market cap of gold is $11.454 trillion and Facebook is $1 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $28,279,616,821 up from $25,883,375,435 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 80.25%.

Fear and Greed Index

Market sentiment today is 28.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 44.83, Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 48.80. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Volatility is the price you pay for Bitcoin to beat the S&P Index by 10x over a decade.”

– Michael Saylor, MicroStrategy CEO

What they said yesterday

Businesses buying again?

Agenda?

Next Ethereum upgrade incoming…

Crypto AM editor’s picks

Coinbase gets green light from German regulators

Nukkleus acquires London based Match Financial

Binance given the boot by UK financial watchdog

Ripple outpacing Bitcoin among UK crypto investors

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part one of two – April 2021

Part two of two – April 2021

Five Part Series – March 2021

Part one…

Part two…

Part three…

Part four…

Part five…

Crypto AM Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit – you can now watch the event in two parts via YouTube…

Part one:

Part two:

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST