Ethereum – the emerald isle in a sea of red

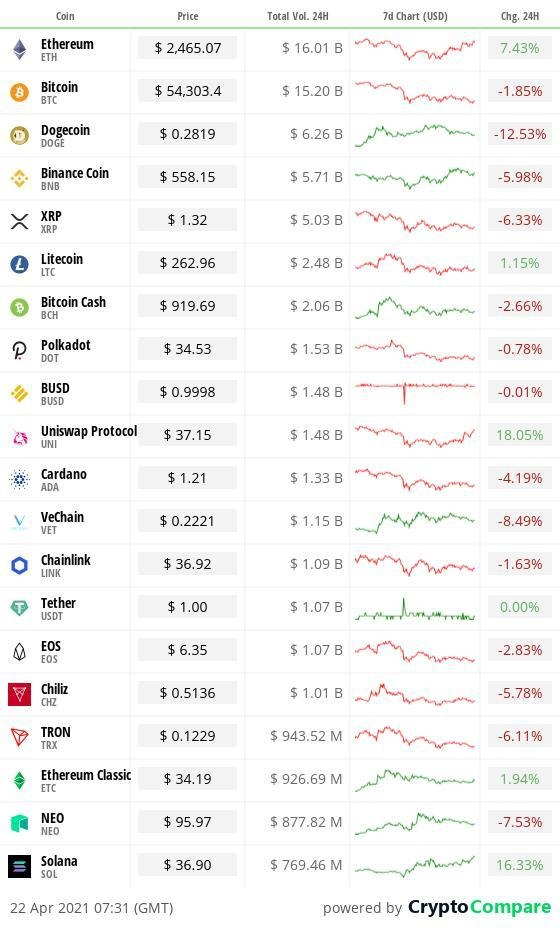

Crypto at a glance

It’s Ethereum’s time to shine today, up more than six per cent in the last 24 hours and currently trading just shy of $2,500.

The second-largest cryptocurrency currently has a market cap of just below $285 billion, putting it above the likes of Intel, Verizon and Coca-Cola. This is the same level Bitcoin was not even six months ago.

More excitingly for Ethereum, for the first time in a while, it doesn’t feel like the second-largest cryptocurrency is simply coasting in Bitcoin’s shadow or riding a wider alt wave. Ethereum is out on its own, a green oasis in a sea of red. Is it now ready to push on even further?

Ethereum’s joy comes as the Bitcoin price continues to drift. The leading cryptocurrency is currently changing hands at $54,000, which is roughly 2.5 per cent on this time yesterday. It’s now been trading in that channel between $53,000 and $57,000 since the start of the week – a range that’s become very familiar over the last couple of months. Can it break resoundingly out of this pattern?

Bitcoin’s market dominance is also down again today, currently sitting at 51 per cent. At the beginning of 2021, that figure was more than 70 per cent. Unlike yesterday, though, today’s swing towards the alt markets seems to be driven primarily by Ethereum. Of the top 30 coins by market cap, only UniSwap and Solana have gained ground in the last day.

Less bullish Bitcoin action after the rush of interest amidst Coinbase’s direct listing won’t necessarily be a surprise, and traders were always likely to look for opportunities elsewhere after the recent all-time high. That’s not to say the pendulum won’t swing back the other way anytime soon though.

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the markets

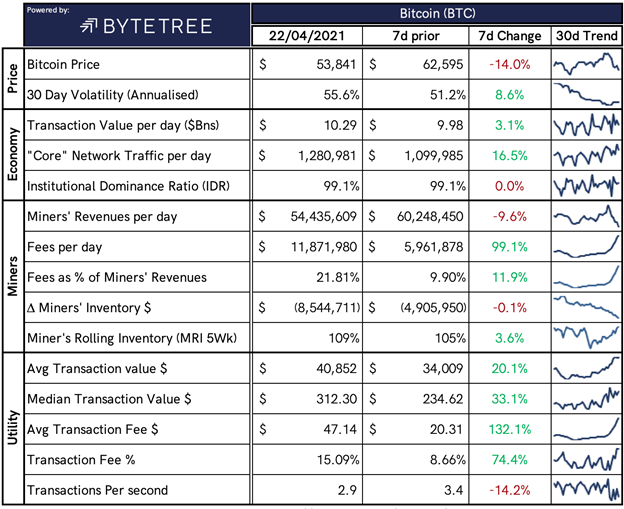

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $2,018,845,657,456, up from $2,052,482,711,141 yesterday.

What Bitcoin did yesterday

We closed yesterday, April 21 2021, at a price of $53,906.09 – down from $56,473.03the day before. The daily high yesterday was $56,757.97 and the daily low was $53,695.47.

This time last year, the price of Bitcoin closed the day at $6,880.32. In 2019, it closed at $5,314.53.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $1.014 trillion, down from $1.037 trillion at this time yesterday. To put that into context, the market cap of gold is $11.385 trillion and Alphabet (Google) is $1.541 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $60,417,126,215, down from $62,908,429,664 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 45.12%.

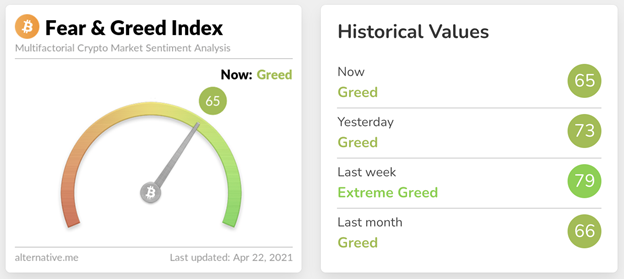

Fear and Greed Index

Market sentiment remains in Greed, though it’s down from 73 to 65 today.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 51.28, downfrom 51.71 yesterday. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 39.55, down from 41.42yesterday. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Bitcoin mining presents an opportunity to accelerate the global energy transition to renewables by serving as a complementary technology for clean energy production and storage.”

– Bitcoin Clean Energy Initiative Memorandum

What they said yesterday

Energy myth disproved yet?

Saylor goes hard…

Jackson vs Miami for City of Crypto title…

Ethereum…

Crypto AM Editor writes

Bitcoin could pull back to $20,000 claims global investment boss

Bitcoin gets seal of approval as Baillie Gifford ploughs $100m into London crypto firm

API3 and Open Bank Project team up for decade-long blockchain venture

Intelligence dossier finds Bitcoin is outperforming gold but Ethereum is outshining Bitcoin

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part One of Two – April 2021

Five Part Series – March 2021

Part five…

Part four…

Part three…

Part two…

Part one…

Crypto AM: Recommended Events

AIBC World

May 25 to 26 2021 – Dubai

https://aibc.world/events/uae/general-info/

Crypto AM City of London Roundtable

Crypto AM DeFi & Digital Inclusion Summit

&

Crypto AM Awards 2021 (announcement soon)

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.