Ethereum products grow ahead of major network upgrade as spot Bitcoin ETF suffers delay

Data from CryptoCompare shows that the price of Bitcoin started last week around the $19,800 mark and was rather volatile over the following days, ranging from $20,500 to $19,600 as bulls seemingly try to retake the $20,000 mark.

Ethereum’s Ether, the second-largest cryptocurrency by market cap, started the week at $1,400 and quickly surged to nearly $1,600 before enduring a small correction to its current level near $1,570.

Headlines in the cryptocurrency space this week focused on a series of developments associated with Ethereum and its upcoming Merge upgrade. The Merge is the network’s current mainnet merging with the Beacon Chain’s Proof-of-Stake system, setting the stage for future scaling upgrades, including sharding. The move is expected to reduce Ethereum’s energy consumption by 99.95%.

The upgrade represents a move away from Ethereum’s energy-intensive proof-of-work system and will make the network cheaper, faster, and more environmentally friendly over the long run.

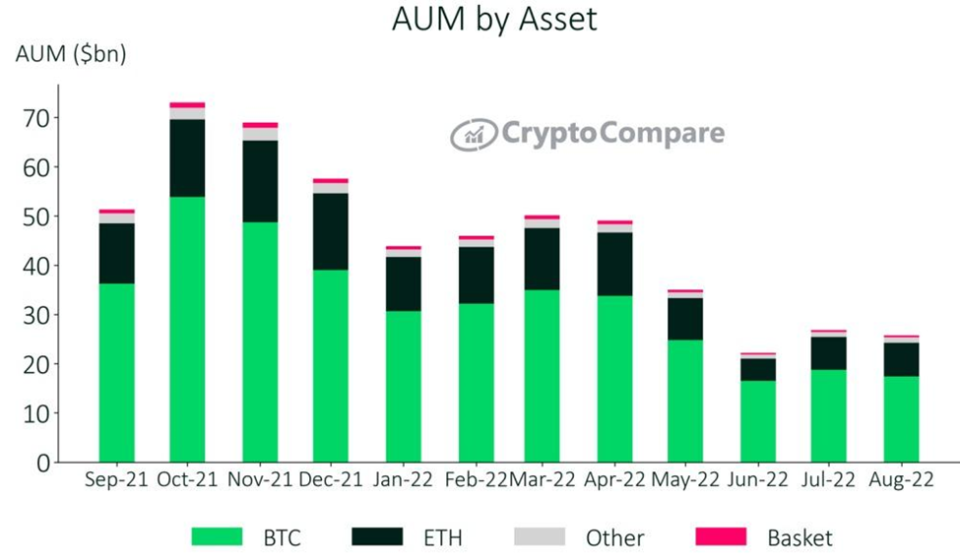

According to the August 2022 issue of CryptoCompare’s Digital Asset Management Review report, Ethereum investment products outpaced Bitcoin products last month, with Ether-based products increasing by 2.36% to $6.81 billion AUM in August, whilst Bitcoin products declined 7.16% to $17.4 billion AUM.

In August, Ether-based products also outpaced Bitcoin in terms of weekly flows, with the second largest digital asset by market capitalisation recording the largest average weekly inflows with $6.4 million, while Bitcoin products averaged outflows of $14.9 million.

The Merge upgrade may lead to a potential chain split, and cryptocurrency exchanges and other service providers have already started announcing whether they’ll support opposing networks or not. OpenSea, a popular non-fungible token (NFT) marketplace, has made it clear it plans to exclusively support the proof-of-stake version of Ethereum after the upgrade.

Over the week, the Chicago Mercantile Exchange Group (CME Group) launched contracts for euro-denominated Bitcoin and Ether futures sized at 5 BTC and 50 ETH per contract. The two contracts are listed on the CME and are cash-settled based on the CME CF Bitcoin-Euro Reference Rate and CME CF Ether-Euro Reference Rate, respectively.

Credit Suisse held ‘digital assets’ for clients last quarter

Credit Suisse held CHF31 million ($32 million) in “digital assets” for its clients at the end of the second quarter of the year, regulatory filings show. The revelation shows traditional financial institutions are moving toward crypto custody.

The Swiss financial giant reported holding around $32 million of what it described as “digital asset safeguarding assets”. The megabank did not report those holdings over the previous two quarters.

Traditional financial institutions aren’t the only ones boosting their exposure to digital assets. Social media behemoth Meta Platforms announced last week that users are now able to link their digital asset wallets to Facebook and begin sharing their NFTs. The feature was previously only available on Instagram.

Initially, Meta will support Ethereum-based NFTs, as well as those from Polygon (MATIC) and Flow (FLOW), the network which supports NBA Top Shot.

Meanwhile, bankrupt cryptocurrency lender Celsius Network has filed to return users $50 million worth of cryptocurrency that was on its platform in custody accounts, designed to store assets rather than to generate returns.

The company has asked a US bankruptcy judge’s permission to release the funds, with a full hearing on the request now set for October 6, according to court documents. The move highlights a difference among the thousands of users affected by the company’s bankruptcy.~

Another major development was the District of Columbia suing MicroStrategy and its Executive Chairman Michael Saylor for allegedly never paying any income taxes in the district in the more than 10 years he has lived there, Attorney General Karl Racine announced.

Racine added that the District of Columbia is also suing MicroStrategy for “conspiring to help him evade taxes he legally owes on hundreds of millions of dollars he’s earned while living” in Washington.

DeFi platform Kyber Network suffers $265,000 exploit

Security issues also plagued the space over the past week, with multi-chain DeFi platform Kyber Network discovering a vulnerability to its website code that allowed attackers to exploit it for approximately $265,000. Kyber Network said it plans to reimburse affected addresses for their losses.

Leading cryptocurrency exchange Binance has announced it found two suspects associated with the incident and is coordinating with law enforcement to track them down.

Another DeFi platform, Compound, suffered a critical failure after a bug was discovered in the code that caused transactions for both suppliers and borrowers of Ethereum’s native token, Ether, to revert. This bug has effectively halted the trading of Compound Ether (cETH)

The Compound team said that the code in the proposal, which was attempting to update the price feed, was audited by three separate teams before it was implemented. A fix will be rolled out in the next code proposal. Because of the protocol’s decentralized nature, it takes a week to roll out.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been

published in numerous reputable industry publications. Francisco holds various cryptocurrencies.