ETFs are out of focus for most traders

Investors, avert your eyes. This is for the traders amongst us.

For years, if you wanted to trade an opinion on a particular industry, sector, or geography, your vehicle of choice was exchange-traded funds, or ETFs. They are transparent, relatively cheap, and allow high-level opinions to be traded in a single product.

But, they’re not for trading. Let me explain.

ETFs are funds, which generally means there are large numbers of instruments within the instrument. Funds seek diversification, which smooths out returns. As a trader, are you looking for smoothed out returns or short-term jolts in the market?

If you are a trader, you want focus – not smoothed out returns due to diversification.

Let’s go through an example.

Say you want to try to profit from a rising ecommerce sector in China.

You begin your search with China-focused ETFs. You peruse ETF websites, sift through “screeners”, read up on proprietary ETF rating systems to settle on a handful of options. Then you have to learn about weightings. Will this product actually move in correlation to my opinion?

You found your ETF: the Global X MSCI China Consumer Discretionary ETF, or ticker CHIQ. It’s one of the world’s largest China-focused consumer discretionary ETFs. It has 60+ components. Since you are a trader – you want volatility. Does it move?

Let’s take a look at the March to August 2020 volatility-related figures of CHIQ.

| Average (Mean) Daily Range | 2.02% |

| Median Daily Range | 1.79% |

| Minimum Daily Range | 0.60% |

Now, as a smart shopper, you consider alternatives. Enter: FXCM’s Stock Baskets.

FXCM has 6 proprietary stock baskets focused on China Ecommerce, China Tech, Esports and Gaming, US Big Tech Firms (“FAANG”), Biotech, and Cannabis.

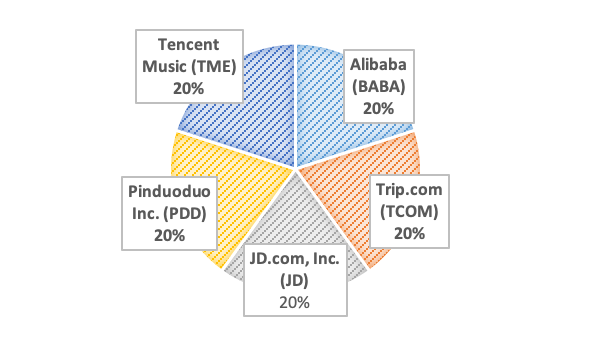

Since you are interested in Chinese Ecommerce, we focus on that stock basket. The basket has a straight-forward equally-weighted structure of only 5 components.

March to August 2020 volatility-related figures of FXCM’s China Ecommerce Stock Basket (CHN.ECOMM)

| Average (Mean) Daily Range | 3.72% |

| Median Daily Range | 3.59% |

| Minimum Daily Range | 1.05% |

Compare these volatility figures to the first table.

So, as a trader, there are some obvious conclusions about volatility. The FXCM stock basket, CHN.ECOMM, was 84 per cent more volatile on average in 2020 than its ETF counterpart, CHIQ. Why? The stock basket counts on 5 of the largest stocks instead of 60+. The greater the stocks in the product, the less volatility generally.

Then you ask about costs.

Surely stock baskets are more expense given the economies of scale and size of the ETF market?

Wrong.

Let’s take the obvious cost of paying the spread – the difference in the bid/ask price when opening a trade. Here is a comparison of their spreads.

| Spread (in %) | Cost (per £5000 traded) | |

| CHIQ ETF | 0.44% | £22.19 |

| CHN.ECOMM Stock Basket | 0.11% | £5.48 |

In our view, trading stock baskets through a global broker like FXCM offers significant advantages. Not only do they provide a straightforward concept to begin trading, but the right product with the right weighting can potentially result in better trading opportunities than comparable ETFs.

Disclaimer

Data was calculated using the March 1st to August 31st daily OHLC rates from NYSE Arca and the FXCM Trading Station

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

75.38 per cent of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

To learn more about FXCM, visit www.fxcm.com/uk

FXCM is a leading provider of online foreign exchange (FX) trading, CFD trading, and related services. Founded in 1999, the company’s mission is to provide global traders with access to the world’s largest and most liquid market by offering innovative trading tools, hiring excellent trading educators, meeting strict financial standards and striving for the best online trading experience in the market. Clients have the advantage of mobile trading, one-click order execution and trading from real-time charts. In addition, FXCM offers educational courses on FX trading and provides trading tools, proprietary data and premium resources. FXCM Pro provides retail brokers, small hedge funds and emerging market banks access to wholesale execution and liquidity, while providing high and medium frequency funds access to prime brokerage services via FXCM Prime. FXCM is a Leucadia Company.

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you. The products are intended for retail, professional and eligible counterparty clients. Retail clients who maintain account(s) with Forex Capital Markets Limited (“FXCM LTD”) could sustain a total loss of deposited funds but are not subject to subsequent payment obligations beyond the deposited funds but professional clients and eligible counterparty clients could sustain losses in excess of deposits. Clients who maintain account(s) with FXCM Australia Pty. Limited (“FXCM AU”), FXCM South Africa (PTY) Ltd (“FXCM ZA”) or FXCM Markets Limited (“FXCM Markets”) could sustain losses in excess of deposits. Prior to trading any products offered by FXCM LTD, inclusive of all EU branches, FXCM AU, FXCM ZA, any affiliates of aforementioned firms, or other firms within the FXCM group of companies [collectively the “FXCM Group”], carefully consider your financial situation and experience level. If you decide to trade products offered by FXCM AU (AFSL 309763), you must read and understand the Financial Services Guide, Product Disclosure Statement, and Terms of Business. Our FX and CFD prices are set by us, are not made on an Exchange and are not governed under the Financial Advisory and Intermediary Services Act. The FXCM Group may provide general commentary, which is not intended as investment advice and must not be construed as such. Seek advice from a separate financial advisor. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. Read and understand the Terms and Conditions on the FXCM Group’s websites prior to taking further action.