ESG: Understanding Investors

Investors are one of the key reasons why AIM firms are increasing the level of focus on their sustainability strategies. As highlighted in the recent QCA report, investor expectations on Small and Medium Cap firms is increasing and will likely continue to rise.

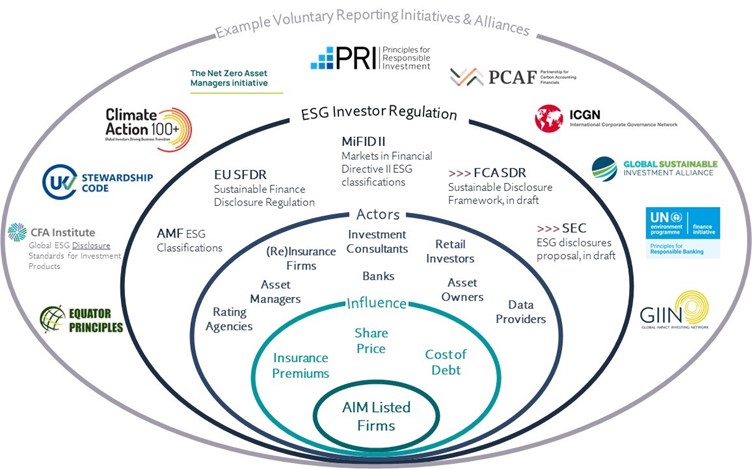

An investor can take different forms and there are different influences at play which create these indirect pressures on AIM firms. In this article, we introduce the key actors and the different influences arising from three core investors: shareholders, creditors and insurance providers; and what this means to AIM listed firms.

1.Shareholders and market cap

When we think of the term investor, it is shareholders that will naturally come to mind for most, although there are several different types of shareholders that individually, and combined, can influence an AIM firm.

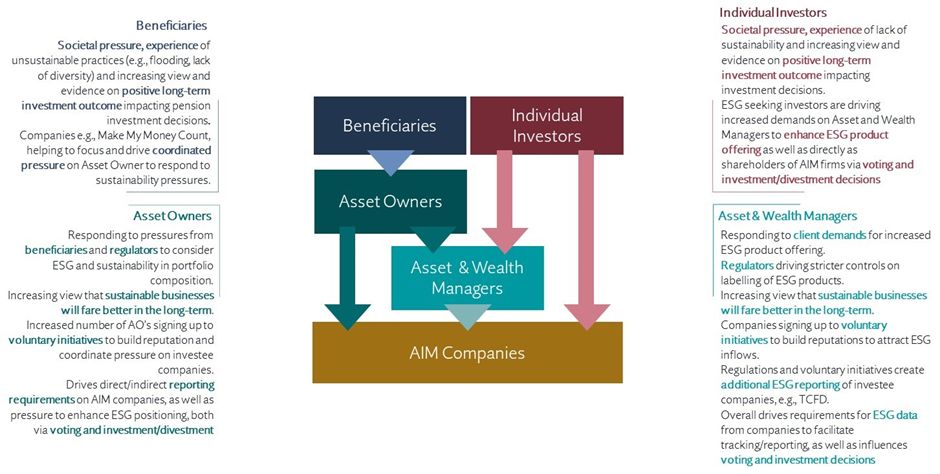

The picture below summarises ESG pressures, considering four of the key actors within the shareholder sphere.

2. Creditors and the cost of debt

Depending on where a company is sourcing its debt, the picture of creditors can look very similar to the shareholder one. As explained by Alice Ross in her excellent book Investing to Save the Planet, the debt market is arguably where sustainable-driven investors can have a greater influence on a company’s ESG strategy. Apart from at IPO, shareholders are investing in the secondary market, whereas in the primary bond market, investors can take more affirmative action on companies and impose ESG specific restrictions or covenants as part of their investment.

For most AIM firms, banks will also play an important role when it comes to re-structuring debt, who are also responding to increasing regulatory burden and pressure from customers to create sustainable products. There will be greater complexities, but to simplify it to a key principle – companies who have better ESG will be less likely to default as they are better prepared to mitigate risks over the longer term.

3. Insurance providers and the price of premiums

Perhaps the least likely to jump to mind when one considers investment, the cost of insurance can also be impacted by a company’s sustainability performance and strategy.

In addition to responding to corporate ESG pressures from employees, customers and regulators, insurance firms are continually aligning their underwriting to the evolving world, which includes responding to increasing ESG related risks that are fast expanding beyond the cost of climate events.

A company which has a detailed environment policy may have lower travel mileage; a company which has a robust ESG strategy is less likely to be at risk of ESG related litigation due to greenwashing or unfair dismissal claims for example, or to suffer from state intervention and fines for non-compliance to a regulation.

How does the ESG investor pressure materialise in an AIM firm?

There are opportunities and challenges that can result from investor’s increasing focus on the ESG performance of AIM listed companies, including:

- Increased data demands, so an asset manager, for example, can monitor and report to its investors in alignment with regulation on the ESG progress and status of its portfolio.

- Increased engagement from shareholders, taking up leadership time.

- Voting behaviour at a company’s AGM, e.g., executive remuneration, reappointment of board member.

- Decisions to invest or divest (partial or full).

- Constraints on debt financing usage.

- Increasing or decreasing cost of debt and insurance premiums.

What should companies be doing?

Companies that can help their investors meet their ESG goals will create investment opportunities and reduce costs. Investors, especially shareholders, can also provide great aides in helping to improve an ESG strategy.

But investors should not the only voice. And investors, who are influenced by ratings agencies, have poor and patchy data on AIM listed companies, requiring increasing demands on data and leadership time of AIM investee companies if strategies are unclear.

Investors want companies to set ESG strategies that underpin the wider business strategy and can be supported by metrics and data. Investors should be engaged as part of defining and ongoing refinement of an ESG strategy, but companies need to have ESG priorities understood before they engage, to ensure the right outcome is reached and that the resulting strategy is right-sized to the company’s resource profile and available investment.

Proactive, open, and two-way communication with investors is key to maximising the benefits from helping these important stakeholders with their ESG objectives, but not at the detriment to the company’s wider ESG goals.