The truthiness of ESG criticism

There are two often-repeated critiques of Environmental, Social, and Governance (ESG) investing that I really can’t stand. They have the quality of truthiness about them and are what academics sometimes call “as if” arguments.

For my younger readers, the term truthiness is defined by Wikipedia as follows:

“Truthiness is the belief or assertion that a particular statement is true based on the intuition or perceptions of some individual or individuals, without regard to evidence, logic, intellectual examination, or facts.“

Source: Wikipedia

One truthiness-infused argument in investing is that the rise of index funds and exchange-traded funds (ETFs) makes markets less efficient and causes stock market bubbles. This might be true if index investors accounted for the vast majority of assets under management (AUM).

But today, index funds manage less than 30% of all assets. The index-funds-create-bubbles claim, simply ignores this fact or assumes that the active investors who account for the remaining 70% can’t form an independent opinion and blindly follow benchmark indices, which isn’t flattering either.

In ESG investing, a similarly “truthy” critique holds that portfolios managed with ESG overlays have to underperform their conventional peers.

Why? Because such overlays are “optimization with additional constraints.” So ESG investing means excluding oil and gas or similarly ESG-challenged companies from the portfolio.

Thus, modern portfolio theory dictates that the efficient frontier cannot lead to the same return as one that includes these stocks. There are two problems with this argument.

The trap of making assumptions

The first problem with modern portfolio theory it assumes that ESG investing is the same as excluding certain companies or sectors from a portfolio.

This is how many people still approach ESG investing and it is, quite frankly, the worst way to do it. Not only do exclusionary screens not work, they are counterproductive.

Luckily, serious ESG investors moved on from exclusions a long time ago. The next iteration of ESG was the best-in-class approach. ESG portfolios invested in all sectors but only in the companies with the lowest ESG risk in each sector.

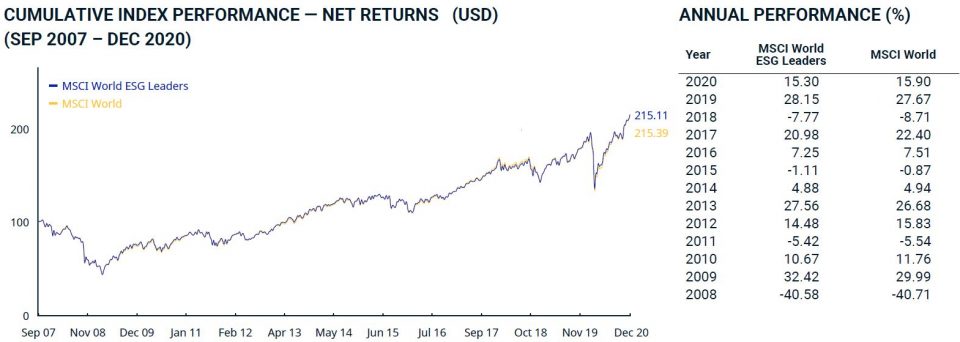

Every ESG index follows this course. To be sure, best-in-class investing has its own problems, so I’m not endorsing it. But this single modification contests the notion that ESG investing cannot possibly have the same risk-return trade-off as conventional investing. The performance of the Morgan Stanley Capital International Index (MSCI World Index) and the MSCI World ESG Index demonstrates this.

The two indices are virtually identical. Technically, the ESG index has an annualized return of 5.35% since its 2007 inception compared to 5.32% for the conventional index. The same exercise with regional and country indices yields – the same results. The performance of ESG indices has more or less mirrored that of conventional indices over the last decade or more.

That, by the way, shouldn’t come as a surprise. The best-in-class approach mimics conventional strategies as closely as possible. Which is exactly what most ESG indices were set up to do.

Most active fund managers do not outperform conventional market indices and since ESG indices have virtually the same performance as conventional indices, this also means that the majority of active fund managers do not outperform ESG indices either.

Which brings me to the second flawed critique of ESG investing.

ESG investing has to underperform its conventional counterpart myth

ESG investing has to underperform its conventional counterpart because its optimization with additional restrictions is, in fact, a theoretical argument: it may be true in an ideal world, but it isn’t true at all in practice.

Modern portfolio theory assumes that we can forecast future returns, volatilities, and correlations between assets with extreme precision. But in reality, every forecast has estimation errors. The recent presidential election in the United States demonstrates this. Those who were surprised by the closeness of the outcome either don’t understand estimation errors or haven’t paid attention. The same is true for portfolio optimization.

In the end, the uncertainties around our forecasts are so much bigger than any constraints that modern ESG investing may put on our portfolios. To conclude that fully integrated ESG investing is constrained optimization, is itself an argument constrained by truthiness. And that’s the word.

For finding out more about ESG and The Future of Sustainable Investing click here

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

By Joachim Klement, CFA, he is a trustee of the CFA Institute Research Foundation and offers regular commentary at Klement on Investing.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: @ Getty Images / ipopba