ESG: A dealbreaker but not a board priority in the UK in 2022

Environmental, social and governance (ESG) issues aren’t expected to be prioritised by boards in 2022, even though half of M&A deals in 2021 didn’t progress due to ESG concerns, according to a survey of 200 UK dealmakers by Datasite.

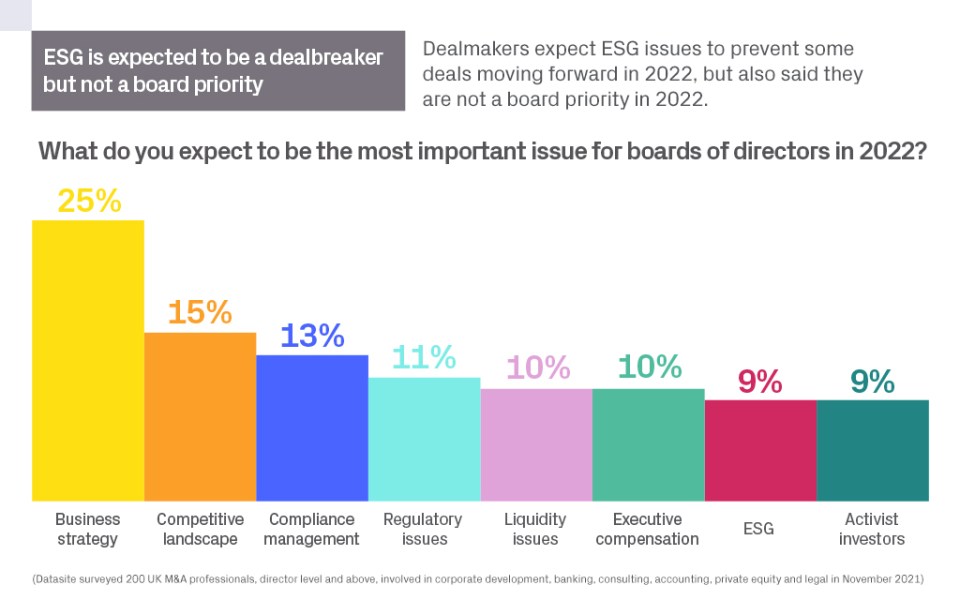

According to the results, over half (52%) of UK dealmakers said ESG credential concerns impacted M&A deals on which they worked in 2021. Despite this, just 9% of UK dealmakers ranked ESG as a board priority in 2022, while 25% of UK dealmakers said they expect business strategy to be the top board concern in 2022, followed by compliance management (13%), liquidity issues (10%), and executive compensation (10%).

Merlin Piscitelli, Chief Revenue Officer for Datasite in Europe, the Middle East and Africa said: “2021 continued to reveal the many pandemic-related challenges dealmakers continue to face, not the least of which for many was how businesses can continue to grow and be competitive. And while this will continue to be an issue in 2022, ESG must also become priority for boards, too, especially if they seek to grow and remain competitive via an acquisition.”

In fact, 17% of dealmakers expect ESG issues to be a top deal blocker in 2022. Almost one in five dealmakers (19%) said supply chain issues would be the top risk to sink a deal in 2022, followed by labour shortages (17%). Additionally, 31% UK dealmakers expect the timing and cost of ESG compliance to have the biggest impact on dealmaking in the next three to five years. With regards to the most helpful technologies for completing ESG M&A due diligence, 32% of UK dealmakers cited secure file sharing with external stakeholders, followed by integrated ESG checklists (26%).

Piscitelli added: “To meet the challenges in 2022, dealmakers will need to closely evaluate how they conduct their due diligence. Here, technology can help. While there are no standard operating procedures to follow when assessing climate-change diligence risks, there are tools within diligence data rooms that include robust optical character recognition (OCR) search functionality to help dealmakers and advisers hunt for key words, such as ESG. And with search alerts, they need search only once for a term and set an alert for when any new documents with that term are added to the data room. This way, no ESG-related documents or assets can be missed.”

Download the global infographic for more survey results.