Engineering giant Smiths misses profit forecast and launches ‘acceleration plan’

British engineering giant Smiths Group missed a key consensus forecast and launched an ‘acceleration plan’ to boost profitability, as it snapped up two firms in a £110m spending spree.

Smiths reported a 5.4 per cent year on year organic revenue growth to £3.1bn, but the 7.1 per cent increase in operating profit to £526m fell shy of the £532m consensus forecast, causing shares to drop seven per cent on Tuesday morning.

The FTSE 100 company announced it is launching a group-wide ‘acceleration plan’ to boost profitability and productivity, for one-off costs totalling £60m to 65m in the 2025-2026 period.

Smiths chief executive Roland Carter said: “Effective strategy execution is enhancing our performance – and we will build on, and out from, this solid foundation, enabling us to grow more profitably to make Smiths even better.

“This will be delivered through improved prioritisation of investment in R&D and innovation to power organic growth; the Group-wide Acceleration Plan, which is designed to drive productivity and profitability – bringing delivery of our medium-term margin target closer; and disciplined M&A, all of which offer the opportunity to augment overall performance,” he added.

Smiths also said on Tuesday it has bought California-based metal manufacturer Modular Metal Fabricators and Canadian electric heating solutions provider Wattco for a combined total of £110m.

Smiths, known for its airport security and detection machines, will integrate them respectively into its heating, ventilation and air conditioning (HVAC) and electrical heating arms.

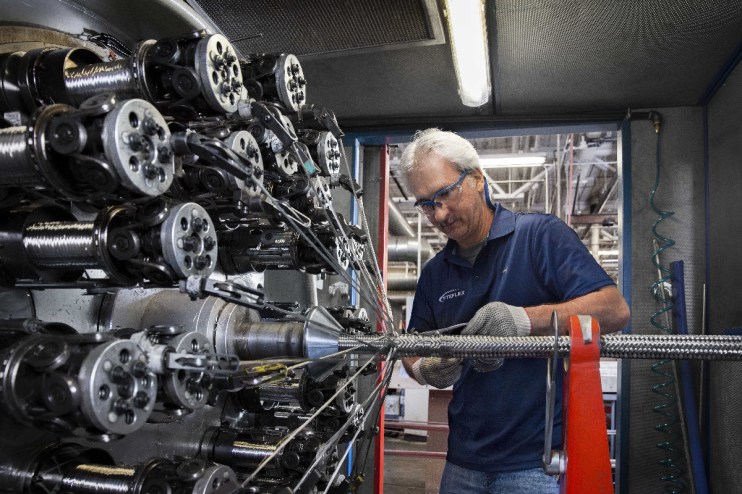

Both of these segments lie within its Flex-Tex business, which supplies engineering components for the aerospace, industrial and medical sectors.

Carter, a Smiths lifer who recently stepped up to become chief, said: “Each business brings a highly complementary customer base, product range and approach to technology, while enhancing our geographical coverage.”