Energy sanctions on Russia could leave Europe exposed warn analysts

Europe will struggle to make up the shortfall in Russian gas supplies if it rolls out energy sanctions on the country, warn industry commentators.

This follows US Secretary of State Anthony Blinken raising the possibility of oil sanctions on Russian supplies, alongside UK dock workers refusing to unload Russian supplies from cargo ships and vessels.

Craig Erlam, senior market analyst at OANDA suggested any move to cut off Russian supplies would be extremely painful for Europe, with the continent lacking a sustainable alternative to Kremlin-backed fossil fuels

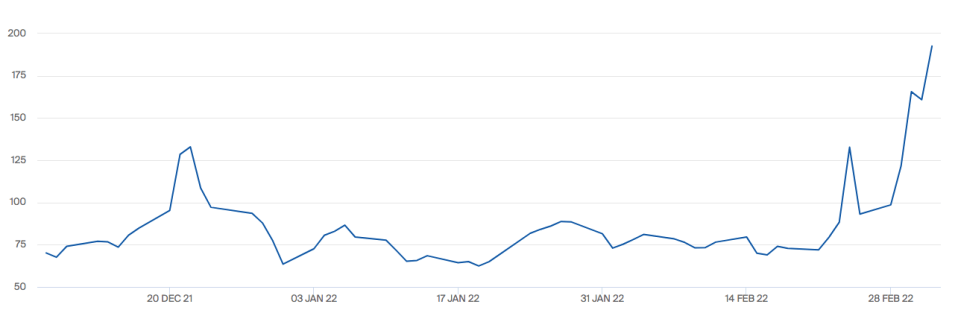

This has driven historic rallies in oil and gas markets, with investors fearing supply shortages in already tight markets.

He told City A.M. “The spike we’ve seen in oil and gas prices is linked to reports that the EU could follow the US and ban imports of Russian oil. It seems a drastic move by the EU regardless of how damaging it would be for Russia, which it obviously would be. But the two are mutually dependent and Europe simply doesn’t have an alternative in the short-term. Never say never, but any move of this kind would be the biggest yet.”

The continent currently relies on Russia for around 40 per cent of its natural gas supplies.

The European Union (EU) resisted supply shortages last year chiefly through liquefied natural gas (LNG) top-ups from the US, with Gazprom reportedly failing to hit its output targets to the region.

UBS director of equity research, Henry Patricot, warned the EU could only replace around 20 per cent of Russia’s gas flows with non-Russian supplies or liquefied natural gas (LNG) – meaning vast changes to consumer demand would be required to offset shortfalls.

He said: “We estimate if the EU can max out spare capacity in ex-Russian pipelines and LNG terminals, Europe could replace nearly 40bn cubic metres for the rest of the year. But still: a 120bn cubic metre adjustment would be required on the demand side in the short-term.”

Ronald Smith, senior oil and gas analyst at BCS Global Markets, noted that Europe had been fortunate with warmer than anticipated weather over recent months – cutting down demand as pandemic restrictions ease.

However, temperatures have dropped in recent weeks, pushing up demand across the continent alongside pandemic restrictions coming to a close.

This could leave Europe facing difficulties if it engages in drastic sanctions on Russian energy supplies.

Speaking to City A.M., he said: “That ‘weather luck’ experienced by Europe to start 2022 help improve gas storage from historically low to merely very low, but Europe is not out of winter yet, and the system is still very vulnerable to changes in supply and demand.”

Smith also suggest Europe could be hesitant to ramp up sanctions as Russian flows have remained stable in recent weeks despite “extremely high geopolitical tension.”

He explained: “Exports via Ukraine are back up to full contract levels, while even the Yamal-Europe line is now running at high levels at certain times of the day for every day in March as European customers raise their requests for deliveries under contract conditions.”

Politicians play down possibility of energy sanctions

Last week, the International Energy Agency outlined a ten point plan for Europe to wean itself off Russian fossil fuels, targeting a 50bn cubic metre reduction of Russian imports and minimum gas storage obligations.

However, European leaders including Prime Minister Boris Johnson and Dutch premier Mark Rutte have played down the prospect of sanctions yesterday, due to the continent’s dependence on Kremlin-backed gas flows.

Johnson said: “So far the success of the West has been in the unity we’ve shown and I think we’re all increasingly united in the mood that we’ve got to move away from Russian hydrocarbons, we’ve got to make sure that we have substitutes and substitute supply and that’s what we’re working on as well.”

Rutte added: “The painful reality is that we’re much too dependent on Russian gas and Russian oil. We have to dramatically reduce our dependency on gas and oil from Russia – that will take time.”

EU President Ursula von der Leyen revealed last month that Russian gas supplies are at 10-year lows in European storage, and UBS has since revealed current storage levels sit at only 29 per cent.

Earlier this year, European think tank Bruegel also warned the trading bloc would struggle with more than a short-term supply shock.