Energy prices will not return to normal this decade, warns Cornwall Insight

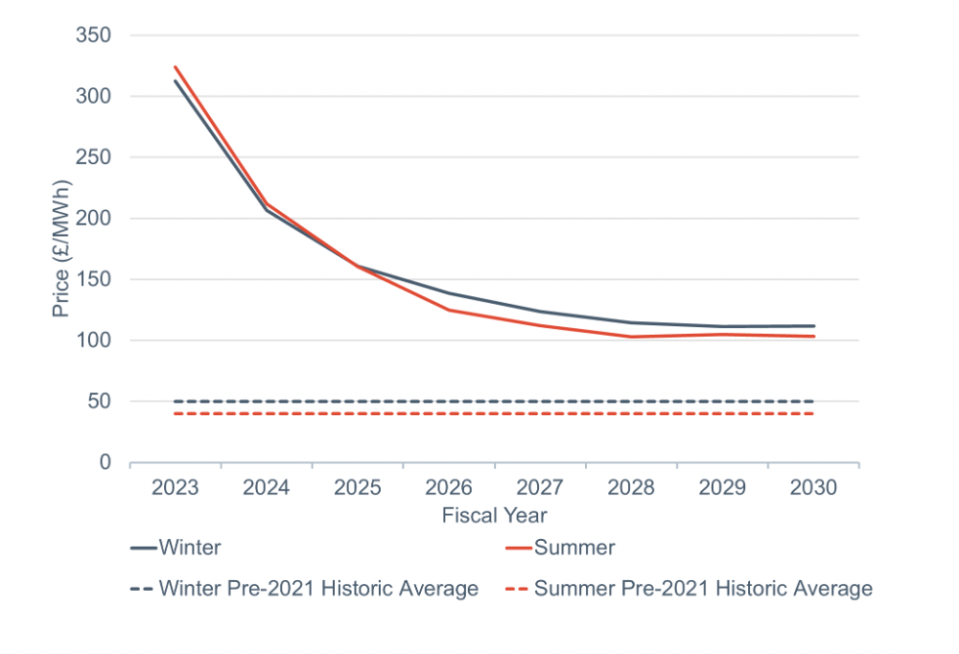

Energy prices will not return to pre-crisis levels by the end of the decade, according to the latest data from Cornwall Insight.

The data specialist does predict a drop in prices from late next year, as gas prices fall from current peaks,

However, it still forecasts that gas prices will remain historically elevated for years to come, ratcheting up pressure on households hoping to pay their bills and Governments looking to ease the pressure on vulnerable energy users during the coldest months of the year.

This, combined with the costs involved in vastly ramping up renewable capacity on the grid and electrifying the economy, means that despite expectations the crisis will ease, forecast prices will not revert to historic norms.

Cornwall Insight further argues that recent announcements from the Government, such as capping the revenues earned by renewable generators, have unsettled the market.

The energy group is also concerned investment may well decrease as investors take stock of their options, potentially slowing the drop in and levelling out of energy prices.

Tom Edwards, senior modeller at Cornwall Insight said: “While increasing offshore wind, amongst other changes to the energy mix, have led to lower forecasts, it is important to recognise that prices could remain well above pre-pandemic levels until 2030 and beyond.

“Higher demand for renewables as gas becomes more difficult to procure, and the intensifying move towards electrification, will ultimately lead to prices stabilising at higher levels than previously predicted.”

Energy crisis looms for households

As for this winter’s crisis: sustained Russian gas supply uncertainly in the EU, persistent outages of French nuclear capacity and low rainfall levels affecting Norwegian hydro, are continuing to add significant risk premiums to gas’ forward curve.

This has increased gas prices, making periods of low renewable availability increasingly expensive.

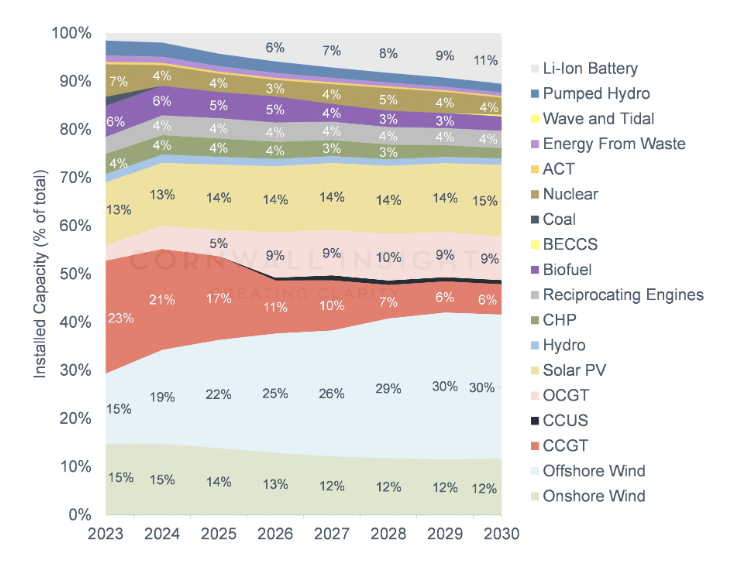

Later in the decade, it expects that renewables play a key role in the levelling out of prices despite increased demand from electrification.

This will be helped by an increase in battery storage capacity, meaning renewable energy can be stored more effectively for use during periods of low wind and solar generation, lowering prices during these times.

To aid in the UK net zero strategy, the government has invested heavily in renewables, setting itself a target of 50GW of offshore wind by the end of the decade.

Offshore wind power is now expected to double as a percentage of the UK electricity capacity by 2030, going from 15 per cent to 30 per cent.

Edwards concluded: “We must not let perfection become the enemy of the good, pre-pandemic prices may not be within our grasp, but a lower cost and a stabilised energy market is achievable if we continue to invest in a low-carbon energy future.”