Energy giants set for scrutiny as latest results come amid cost of living crisis

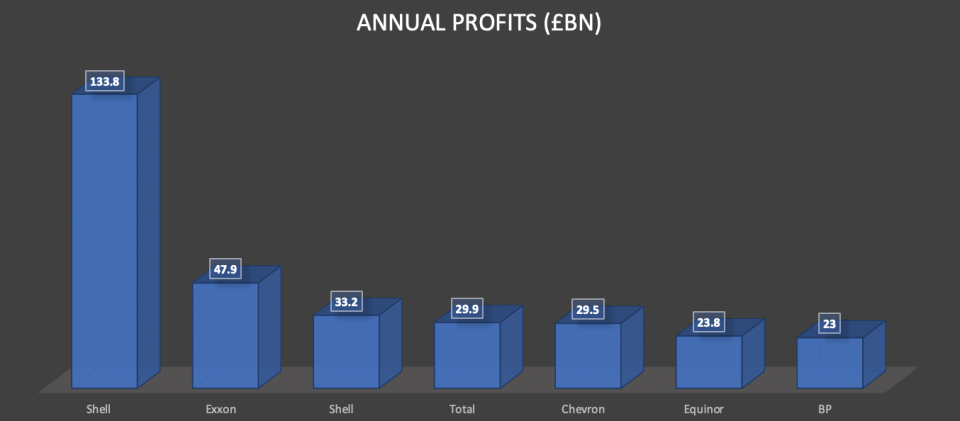

Energy giants will be under fresh scrutiny this week, as the world’s largest oil and gas producers announce their latest round of results.

With the UK economy still struggling to recover from the pandemic, fossil fuel majors will find themselves in Westminster’s crosshairs again – with the cost of living crisis and ultra-high energy bills contrasting with tens of billions of pounds in collective earnings.

This could include further calls from Labour to remove investment relief from the windfall tax, with the energy price cap still nearly double pre-conventional trading norms.

Forecaster Cornwall Insight expects prices to decline to £1,880 per year in October, but stay within £40 of that total into new year and next spring.

There is also potential for further speculation over Rosebank, the UK’s largest undeveloped oil and gas field which still awaits approval from regulators, before Equinor can begin developing the project.

The Norwegian energy giant, which is one of the UK’s biggest import partners, will be the first to unveil its second quarter figures on Wednesday, before a flurry of announcements from Centrica, Chevron and Exxon, Total and Shell later in the week.

Shell faces scrutiny over green energy goals

Shell will be under the microscope after it announced last month it would hike its dividend by 15 per cent and spend another £3.9bn ($5bn) in share buybacks during the second half of 2023, while appearing to water down its approach to net zero and climate change.

At a capital investor day, Shell ditched its modest target of a one to two per cent cut in oil production year-on-year until the end of the decade, instead sustaining output and ensuring investors cash in on black gold’s chunky returns.

The FTSE 100 firm argued it has already reached its goal – largely through hefty divestments – and remains publicly committed to its climate agenda, but any further adjustments will be open to scrutiny.

The company has since confirmed it is planning to invest £7.8bn to £11.7bn ($10bn-15bn) between 2023 and 2025 to support the low-carbon assets including biofuels, hydrogen, electric vehicles and carbon capture storage .

However, new chief executive Wael Sawan has pushed back against boosting renewables at the expense of shareholders or the company’s bottom line.

In a strategy update, he argued that Shell needs to “create profitable business models that can be scaled at pace to truly impact the decarbonisation of the global energy system.”

“We will invest in the models that work – those with the highest returns that play to our strengths,” he said.

Shell also revealed it expects a weaker second quarter as slashed demand and lower prices impact its operations, while indicating its chemicals division is likely to make a loss during the quarter.

Oil and gas prices remain elevated, but have eased this year, suggesting that there could be a slight downturn from the robust profits unveiled three months ago across companies in Europe, North America and the Middle East across the energy sector.

Shell posted bullish first quarter earnings of £7.5bn ($9.6bn) in February earlier this year, with integrated gas contributing £3.8bn ($4.9bn) to the overall profit – exposing its contribution to the company’s hefty bottom line.

Rival BP will unveil its own second quarter results the following week, with the world’s most profitable company Saudi Aramco to announce its latest trading update in August.

Report cards: Energy giants’ upcoming results

- Equinor – July 26

- Total – July 27

- Shell – July 27

- Chevron – July 28

- Exxon – July 28

- BP – August 1

- Saudi Aramco – August 7