Energy crisis: Can someone shine a light on the Bulb takeover deal?

Bulb Energy’s collapse from a highly-vaunted challenger to a de-facto nationalised husk on government life-support – propped up by transfusions of taxpayer cash – has largely been overshadowed by Russia’s invasion of Ukraine.

The Kremlin is seemingly taking all the blame for the energy crisis, yet Russia’s imperialist warmongering only exacerbated soaring gas prices, with energy firms already collapsing across the UK’s domestic market amid rebounding post-pandemic demand in the summer of 2021.

Rather than Russia’s supply squeeze, it is Bulb’s ‘hero to zero’ tale that truly encapsulates everything wrong with the retail energy sector.

Bulb was the centrepiece of a reformed energy market prior to the industry crisis – a new challenger firm defining a resurgent energy sector lively with competition.

During this period of time, it scooped up multiple awards and became the fastest growing energy firm in the UK.

The sector eventually peaked with 70 firms competing for customers in 2018, offering cheaper than ever deals while reducing the stranglehold of the former Big Six.

But this vision was built on sand, and highly-dependent on customers switching firms, with company growth plans powered only by gullible investor sentiment, and no meaningful oversight of hedging or the competency of owners.

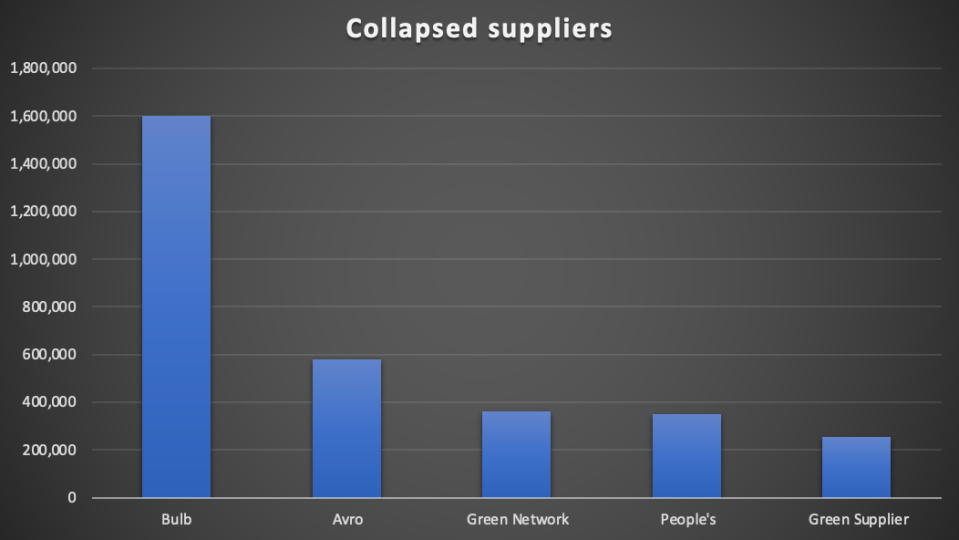

This led to a perfect storm of incompetency and ill-preparedness when wholesale costs climbed, and Bulb was one of 30 energy firms to collapse amid this historic market volatility – three months before Russia invaded Ukraine.

It was also the only one to be passed through a special administration process.

As the UK’s seventh biggest supplier with 1.6m customers, it was deemed too large for the supplier of last resort process – which ferried customers from other fallen firms to surviving suppliers in a bidding process overseen by Ofgem.

With the industry eager to recover from the crisis and restore the confidence of consumers now grappling with record energy bills – it would have been a refreshing statement of intent from the government, Ofgem and bidders for any deal to rescue Bulb to be as transparent as possible.

Bulb deal still lacks real transparency

Unfortunately, the terms of Bulb’s future role in the energy market remain shrouded in ambiguity.

Bulb spent over a year in public hands before finally being sold to Octopus Energy following a protracted and heated bidding process last October.

One supposed certainty from the saga was the cost of nationalising Bulb and offloading it to Octopus was in the many billions, including a £6.5bn prediction from the Office for Budget Responsibility (OBR), making Bulb the biggest state bailout since RBS in the 2008 financial crisis.

Octopus, however, has revealed it has calculated the cost to taxpayers at £260m – a factor of 25 less than the OBR forecast.

Martin Young, senior analyst at Investec, told City A.M. that this was a “plausible estimate at this junction”.

While the news is highly welcome, the vast gulf in estimates exposes the general uncertainty around the terms of the Bulb deal.

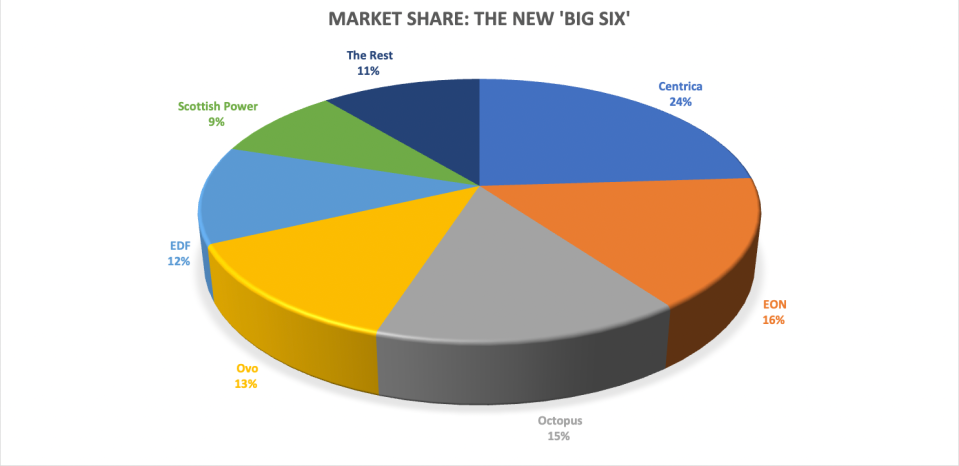

There is no doubt Octopus has been one of Britain’s few great business success stories in recent years, and with the Bulb takeover it has become the third largest supplier in the UK, overtaking established players like Ovo and EDF in terms of size and scale.

However, with the terms still not in the open for scrutiny, despite the involvement of taxpayer cash, it would seem premature to lavish praise on the takeover – no matter how preferable it may be to Bulb spluttering on in public hands.

City A.M. understands the takeover of Bulb includes a nine-figure lump sum, a hedging loan provided by the government, alongside a profit-share deal and ringfencing of Bulb’s former customers until the support is repaid.

Nevertheless, there is still a lack of information around the percentages involved in the profit-share deal and the size of the sum make it difficult to evaluate the deal for taxpayers.

British Gas owner Centrica is hoping to test the deal further in court later this month at a judicial review on 27 February.

The rival energy firm, which pulled out of a bid for Bulb last summer, has raised concerns over the deal’s transparency – particularly regarding government support – alongside Scottish Power and EON.

Yet, it isn’t clear what either the outcome of the case will be or what Centrica hopes to meaningfully achieve, with Octopus’ takeover deal being greenlit in December.

As Ofgem looks to clean up the energy market, imposing standards on transparency would not go amiss – as the British taxpayer has a right to know the terms of this deal, rather than allowing it to be engulfed in an industry row.