Energy bills set to RISE next year as volatility spooks oil and gas markets

Household energy bills will not ease any time soon, with forecasters warning that the energy price cap is now set to rise again, fuelled by rebounding gas prices and fresh market volatility.

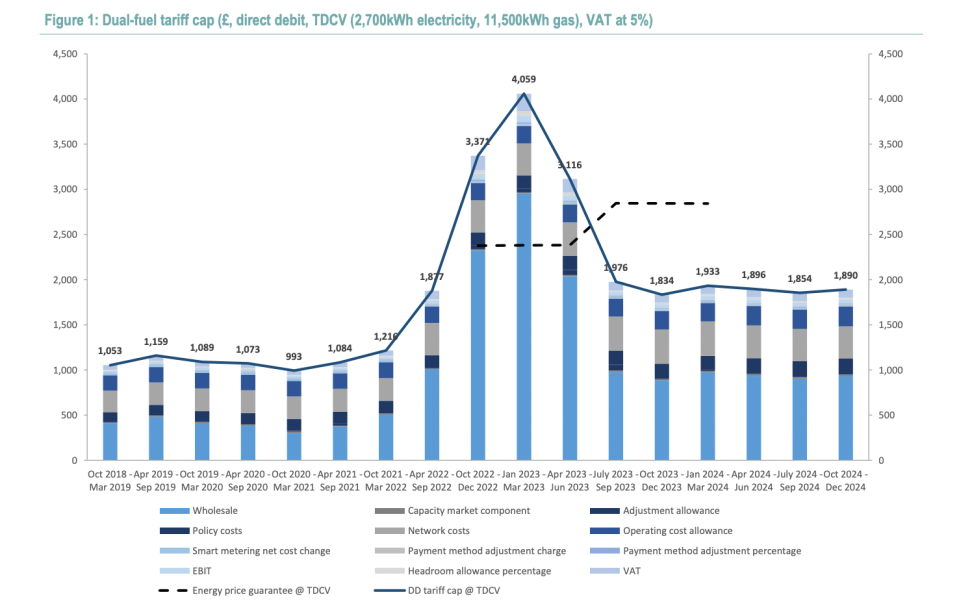

This contrasts with expectations earlier this autumn that the price cap would gradually decline, although remain well above the levels established before the domestic energy crisis which caused 30 suppliers to collapse, and Russia’s invasion of Ukraine.

Both Cornwall Insight and Investec are now predicting the energy price cap – currently set at the current £1,834 for average use – will increase for the rest of 2024 rather than easing.

Cornwall Insight argued that recent disruptions to the Finnish Balticconnector and the Israel-Hamas conflict have left their mark on energy markets.

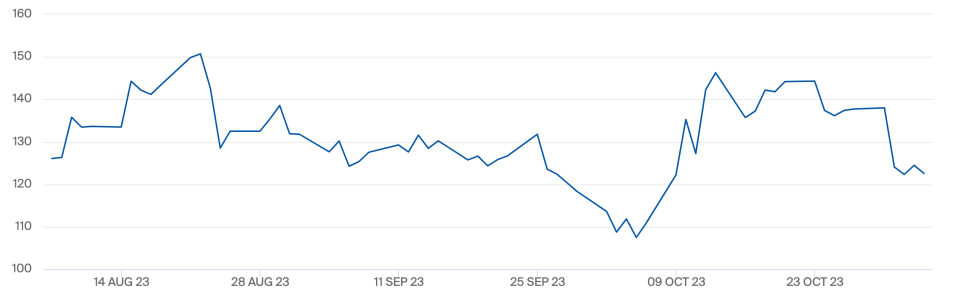

While supply has not yet been directly affected, it has raised market fears over shortages – with the UK Natural Gas Futures benchmark currently trading at £1.22 per therm, still nearly treble conventional trading levels of 40-45p per therm.

This has caused price cap predictions for April, July and October next year to jump five to six per cent since September.

Gas prices remain high and have rebounded over the past month – Source: UK Natural Gas Futures

Dr Craig Lowrey, principal consultant at Cornwall Insight said: “The jump in price cap predictions since September has once again highlighted the vulnerability of UK energy prices – and customer bills – to geopolitical events. The Russian invasion of Ukraine demonstrated there is a delicate balance in the global energy market which can easily be disrupted by unexpected events, it looks as though the current situation is repeating that pattern.”

The energy forecaster also warned the UK’s increasing reliance on liquefied natural gas (LNG) risks raising the price cap – with supplies facing pressure from industrial action at gas production facilities in Australia.

It now predicts the energy price cap will rise from £1,834 per year to £1,923 per year next January.

It will then uptick slightly to £1,929 per year in April 2024, before sliding to £1,880 three months later and then rising again to £1,917 per year for next winter.

This will put Brits under sustained pressure this winter, as while the price cap is well below the £4,279 per year peak in January 2023, the government has concluded last winter’s hefty support packages.

Household energy bills will not return to pre-crisis levels any time soon – Investec warns

Now, households will have to depend on pre-existing benefits such as the Warm Home Discount and universal credit – meaning millions of people will be financially squeezed over the coldest months of the year when demand for heating is at its peak.

Investec has published a similarly gloomy outlook on energy bills, with the banking group unconvinced recent measures from Ofgem such as removing the market stabilisation charge – which penalised supplier and, through them, households – would be enough to mitigate the rising bills.

It predicts comparable rises for next January (£1,933), April (£1,896), July (£1,854), and October (£1,890).

Martin Young, senior investment analyst, said: “We maintain our view that we will not see a deluge of cut-price deals, and a belief that switching will be driven by customer service and innovative products. As we have stressed on many occasions, if this plays out, uptake of such tariffs will depend on personal preference and exit charges”

Industry watchdog Ofgem is currently consulting on the possibility of a social tariff to reduce the burden vulnerable households face.

Cornwall Insight has previously predicted energy bills will not decline to pre-crisis levels this decade, amid the transition to low carbon alternatives such as renewables.

It argues boosting domestic green energy is essential for reducing the UK’s reliance on volatile global gas markets and overseas suppliers, and will help stabilises prices households have to pay.

Lowrey said: “The government needs to take steps to proactively limit the impact that such situations have on the UK’s energy market, and already stretched households, rather than reacting to events as they occur. Stop-gap measures such as social tariffs and one-off payments are helpful, but they are not a long-term solution.