High interest rates and the election dampened London prime property market

It was a slow June for London prime property, with transactions down 17 per cent compared to the same month last year.

Analysts have blamed the general election for the dip in demand, as buyers waited for certainty and stability before investing in property.

“A lot of buyers postponed plans due to a combination of high interest rates and political uncertainty, which will have resulted in a degree of pent-up demand… I suspect this will help to maintain market stability [during the usual summer slowdown],” Mark Pollack, Co-Founding Director of Aston Chase, said.

High interest rates have also taken their toll on the market – London property owners are paying 48 per cent more than what they paid three years ago for a mortgage, with the average bill for payments coming in at £23,000.

Some 3.5m households in England and Wales have remortgaged their homes in the last year, amounting to a staggering £8.8bn in loan payments.

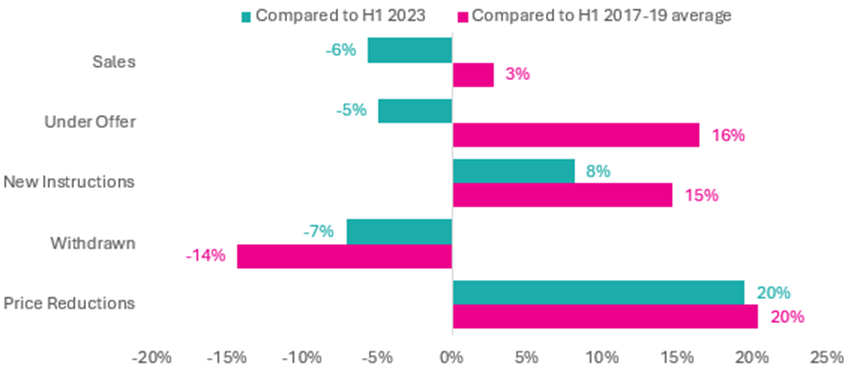

Stock in the market continued to rise, with 12.7 per cent more properties on the market across prime Lonodn at the end of June than a year earlier.

“June was a quiet month for the prime London sales market, with activity down on all our main metrics,” Nick Gregori, Head of Research at LonRes, said. “We know many buyers and sellers are playing a waiting game – mainly hoping for better economic news and political stability – and the General Election campaign is likely to have added to this sense of caution.”

Interest rates are unlikely to fall in the short term, even though inflation has started to come down.

“Now the election is done, the stability point is dealt with… if the financial markets’ response is anything to go by, the certainty offered by a new government with a large majority could increase confidence, overriding any worries about taxes and regulation,” Gregori said.

“People [who refraiend from buying before the election] will now re-enter the homebuying market after the new government is formed… they know what the new administration intends to do regarding taxation and other policy announcements,” Jeremy Gee, Managing Director of Beauchamp Estates, agreed.

In the long term, a labour government is likely to keep inflation down and lead to lower interest rates – but that won’t be for a while.

Super-prime property faltering?

The £5m+ market has suffered an acute change in dynamics: sales fell by over 20 per cent year on year, while new instructions rose by 25 per cent.

Changes to non-dom tax rules have encouraged foreign high-earners to relocate to outside the UK, and to hesitate before moving to London.

A leading wealth adviser warned last week that changes to the non-dom policy mean London could miss out on welcoming the non-doms leaving France and the US due to political instability.