Election 2024: What will a Labour government mean for inflation, interest rates and mortgages

Mortgage holders do not have to worry about a Labour government sparking a new upsurge in inflation, economists said after the party’s landslide election victory.

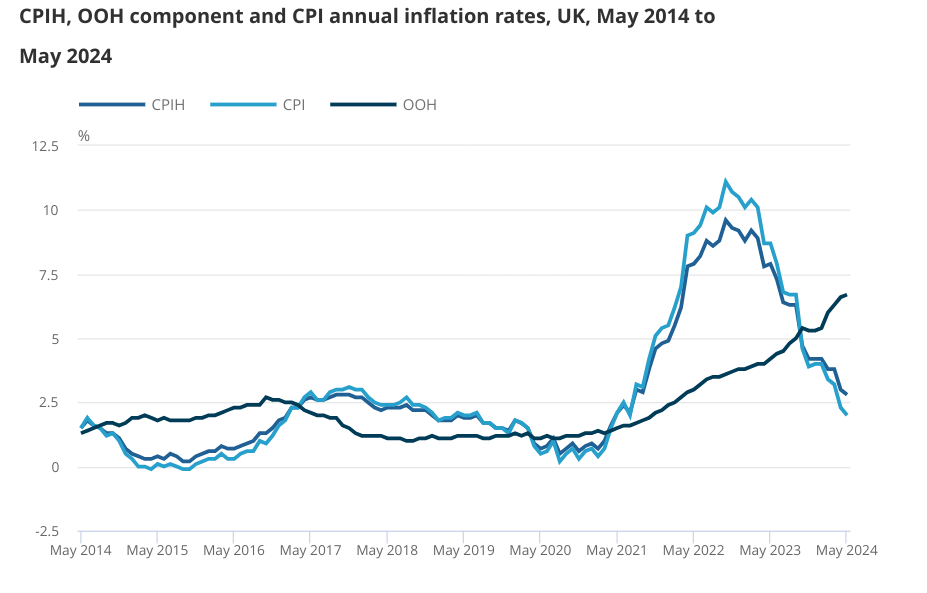

Inflation has fallen fairly rapidly over the last few months, hitting two per cent in June. As a result markets expect the Bank of England to start cutting interest rates in the next couple of months, either in August or September.

Minutes from June’s meeting showed that it was a “finely balanced” decision, suggesting that the Monetary Policy Committee (MPC) is readying a cut.

With traders pricing in two rate reductions over the remainder of the year, mortgage rates have moved lower. Figures out last week showed that the effective interest rate on newly drawn mortgages was 4.79 per cent in May, down from 5.19 per cent at the beginning of the year.

Oli Creasey, property research analyst at Quilter Cheviot: “If interest rates come down, buyers will be able to borrow more based on the same income, improving volumes and/or prices.”

Although Labour is likely to have a slightly more expansionary fiscal policy than the Conservatives, most economists argued that it would not be enough to change the calculation for the Bank.

Public spending is likely to be £9.5bn higher in 2028/29 than under current plans, while taxes will also rise by a similar amount over the course of the parliament.

Analysts at Goldman Sachs said Labour’s fiscal policy would provide a “modest boost” to demand growth in the near-term.

“Firmer demand is likely to result in marginally higher wage growth and inflation, but the magnitudes involved suggest that the implications for the BoE are likely to be limited,” they wrote.

Paul Dales, chief UK economist at Capital Economics, suggested that there would be some upside risks to inflation, but said this was only “at the margin”.

Peder Beck-Friis, an economist at PIMCO, thought the Bank might even cut interest rates by more than markets expect.

“We expect the new government under Keir Starmer to maintain tight fiscal policies. This should facilitate a gradual decline in inflation and enable the Bank of England (BoE) to begin cutting interest rates soon – and potentially cut more than markets expect next year,” Beck-Friis said.