Egdon positive despite decline in oil revenues

UK OIL and gas firm Egdon Resources reported a loss of £460,000 for the year ended July 2014, compared with a loss of £720,000 in 2013.

Oil and gas revenues dipped to £2.96m from £3.34m, despite production increasing.

Mark Abbott, managing director at Egdon, said this was primarily down to declining oil prices.

However, he added that because Egdon was more focused on onshore production, and had several interests in shale drilling projects, the company was “buffered from the worst effects of lower gas prices”.

Abbott described the past year as being “transformational for the company”.

He added: “We have made significant strides in delivering in our strategy.”

Part of this strategy was to grow in the “UK unconventional resources space”.

Egdon acquired Alkane Energy during the 2014 financial year, and entered into agreements with French oil firm Total and with Scottish Power. The group also raised £10m through two equity fundraisings.

Another part of the firm’s strategy, according to Abbott, was to increase production. He highlighted that the company had reported daily production of 238 barrels of oil equivalent per day (boepd), compared with a target of 200 boepd.

In terms of the firm’s outlook, Abbott was upbeat and said that while the timeline for shale gas production to begin was “uncertain”, he expected to see drilling begin in Egdon’s Gainsborough wells, in Lincolnshire, by the third quarter of next year.

He continued: “We are looking at another programme of exploration in the Midlands, and we also have a gas project off the Yorkshire coast. It’s going to be a pretty active year going forward.”

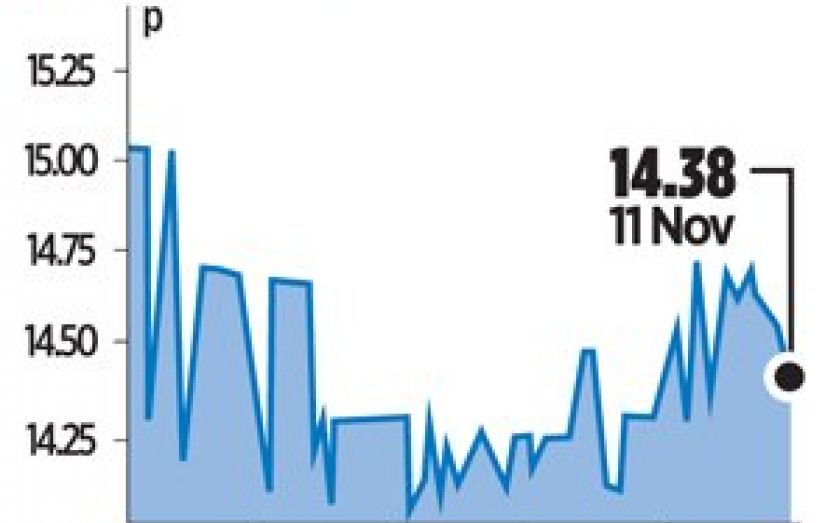

Sam Wahab, analyst at Cantor Fitzgerald, agreed that 2014 had been a “transformational year” for Egdon, and said the firm had evolved into a “leading UK unconventional business”. Shares in Egdon increased by 0.88 per cent yesterday.